India's Directorate General of Trade Remedies (DGTR) has issued a notification initiating a safeguard investigation on flat-rolled alloy or non-alloy steel products.

On December 30, according to the Department of Trade Remedies, Ministry of Industry and Trade , the Directorate General of Trade Remedies of India (DGTR) issued a notice initiating a safeguard investigation into non-alloy and alloy steel flat products imported into India.

Accordingly, the case was initiated based on a request from the Indian Steel Association representing many large Indian steel companies such as Arcelor Mittal Nippon Steel, AMNS Khopoli, Jindal Steel and Power, Steel Authority of India...

|

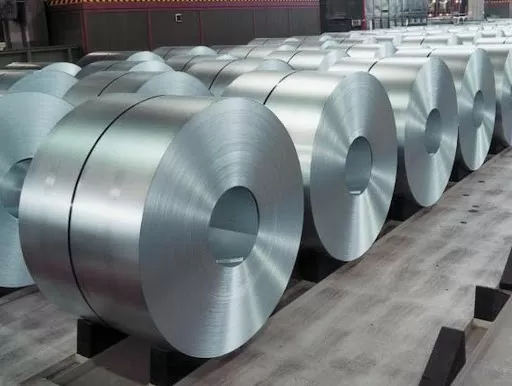

Illustration |

The investigated products are flat-rolled alloy or non-alloy steel (Non-alloy and alloy steel flat products) under HS codes: 7208, 7209, 7210, 7211, 7225, 7226...

The scope of products under investigation includes hot-rolled steel products, cold-rolled steel products, anti-corrosion metal-coated steel products (including galvanized steel, cold-galvanized steel, zinc-magnesium alloy-coated steel) and color-coated steel products.

Steel products excluded from the investigation include: cold rolled grain oriented electrical steel, cold rolled grain non-oriented electrical steel coil and sheet, coated-electro galvanized steel, tinplate, and stainless steel.

The petitioner alleged that the subject product was imported into India in large, rapid and sudden increases, causing serious injury to the domestic industry in India.

In addition, the plaintiff pointed out the unforeseen factors that caused the sudden increase in imports, including: After the United States imposed a 25% tariff on steel under Section 232 of the Trade Expansion Act, many countries successively applied trade defense measures on imported steel. Significant steel production overcapacity in China, Japan, and South Korea; China's domestic policy of shifting long steel production to flat-rolled steel for export; China's steel production investment in ASEAN countries; India's obligations under GATT 1994 and other agreements.

Investigation period: October 1, 2023 - September 30, 2024. DGTR said it will investigate data from April 1, 2021 - March 31, 2022; April 1, 2022 - March 31, 2023; April 1, 2023 - March 31, 2024 and the investigation period.

The petitioner requested the Directorate General of Trade Remedies of India to impose provisional safeguard measures in view of the existence of critical circumstances and to impose safeguard measures for a period of four years.

According to the Department of Trade Remedies, the Directorate General of Trade Remedies of India requests the relevant parties to send their comments on the case and the investigation questionnaire responses for manufacturers, exporters, importers, domestic industries, and economic interest questionnaires in the prescribed format and format to the email addresses: [email protected]; [email protected]; [email protected]; [email protected]; [email protected].

The deadline for submitting the above information is within 15 days from the date of publication of the notice of initiation (the date of initiation is 19 December 2024), and latest by 2 January 2025. In case no comments are received, the Directorate General of Trade Remedies of India will use the available facts for investigation.

The Department of Trade Remedies recommends that associations, enterprises manufacturing and exporting products proposed for investigation: Carefully study the notice of initiation, the public petition, send comments on the case (if any), send the response to the investigation questionnaire for manufacturers and exporters in the prescribed form and format to the Indian investigation agency at the above email address. Cooperate fully and comprehensively with the investigation agency to avoid being concluded as non-cooperative (which often leads to very high tax rates). Keep in touch and coordinate with the Department to receive timely support.

Source: https://congthuong.vn/an-do-dieu-tra-tu-ve-thep-can-phang-hop-kim-367015.html

![[Photo] An Phu intersection project connecting Ho Chi Minh City-Long Thanh-Dau Giay expressway behind schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/21/1ad80e9dd8944150bb72e6c49ecc7e08)

![[Photo] Politburo works with the Standing Committee of Hanoi Party Committee and Ho Chi Minh City Party Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/21/4f3460337a6045e7847d50d38704355d)

Comment (0)