The Tax Department said that individual taxpayers can easily make automatic personal income tax settlement and refund on the Etax Mobile application - Photo: NAM TRAN

In case of tax refund, taxpayers can submit documents on eTax Mobile and receive refund after 3 days.

Tomorrow is the deadline to file your personal income tax return.

The Tax Department said there are cases where personal income tax must be directly settled.

Accordingly, the first case is that individuals with income from salaries and wages must self-settle personal income tax when they have two or more sources of income in 2024 and the additional tax payable. Or individuals with excess tax payments request a refund or offset in the next tax declaration period.

Subjects subject to direct settlement of personal income tax are those who have income from wages and salaries and are also subject to tax reduction due to natural disasters, fires, accidents, or serious illnesses affecting their ability to pay taxes.

The third case is that foreigners who have finished their work contract in Vietnam must directly settle their taxes before leaving the country.

The Tax Department notes that individuals with excess personal income tax payments are not required to submit tax settlement documents by the deadline of May 5, but can submit them later.

Automatic tax settlement and refund on phone

The Tax Department said that individual taxpayers can easily make automatic personal income tax settlement and refund on the Etax Mobile application. After only 2 weeks of implementing automatic personal income tax refund (April 4-16), nearly 99,000 files were identified by the system for refund with the amount of VND500 billion.

According to Mr. Mai Son - Deputy Director of the Tax Department, taxpayers can complete all procedures for requesting personal income tax refunds on mobile devices with the eTax Mobile application installed.

"Just perform very simple operations with the function "Suggested personal income tax finalization declaration", taxpayers check the information on the declaration, confirm to send to the tax authority.

The entire process of resolving personal income tax refunds at the tax authority will be done automatically and information will be transmitted to the State Treasury to refund taxpayers in the fastest time," said Mr. Mai Son.

To get an automatic personal income tax refund, the tax industry encourages taxpayers to use the eTax Mobile and iCanhan application's final declaration function to submit tax refund dossiers. Personal income tax refund dossiers must meet three conditions.

Condition 1: The taxpayer's declaration information must match the data from the paying agency declared to the tax authority. The amount of tax requested for refund does not exceed the tax paid. The taxpayer does not change the indicators on the suggested declaration. The citizen identification number is only associated with a single tax code.

Condition 2: The paying agency has paid personal income tax on behalf of the taxpayer.

Condition 3: Tax refund documents do not have any deductions due to natural disasters, fires, or serious illnesses.

If the application is valid and qualified, the system will automatically process and refund the tax within three working days.

Source: https://tuoitre.vn/nhung-luu-y-khi-truc-tiep-quyet-toan-thue-thu-nhap-ca-nhan-20250504163438982.htm

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

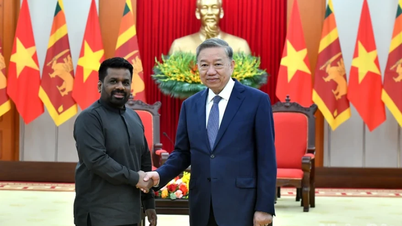

![[Photo] General Secretary To Lam receives Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/75feee4ea0c14825819a8b7ad25518d8)

![[Photo] Bus station begins to get crowded welcoming people returning to the capital after 5 days of holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/4/c3b37b336a0a450a983a0b09188c2fe6)

![[Video]. Building OCOP products based on local strengths](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)