According to the latest statistics from the State Bank, by the end of August, people had deposited nearly 7 million billion VND in banks. The amount of savings deposited in banks has increased continuously for the past 2 years.

According to data released by the State Bank today, November 12, the amount of money savings of the population reached 6,924,889.15 billion VND, an increase of 6% compared to the end of 2023.

Compared to the end of July, the amount of savings deposits of the population increased by 86,475 billion VND. This is a large increase. If calculated on a daily average, each day in August, 2,882 billion VND was deposited in the bank.

As for businesses and economic organizations, the amount of savings deposits in the banking system of this group as of the end of August reached VND 6,838,341.69 billion, a slight decrease compared to the end of 2023.

However, in the 3 months from June to August, deposits of enterprises and economic organizations are tending to return. banking system

As of the end of July, the amount of money that businesses and economic organizations deposited in banks was 69,586 billion VND.

Calculating the total amount of deposits from both residents and businesses and economic organizations at the time of August, the total amount of savings deposits in commercial banks reached a record level ever with more than 13,763,230 billion VND.

Explaining why savings deposits continue to flow into banks, financial experts say that it is because investors are still cautious with other investment channels such as stocks, real estate, etc.

Especially the price of gold fluctuates. too big. Since the beginning of the year, the international gold price has increased by more than 50%. If you invest, it is extremely risky. As for storing gold, people usually only buy when the price of this commodity is stable.

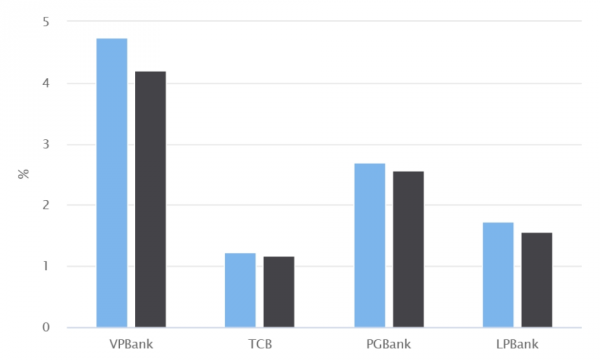

On the other hand, deposit interest rates have also increased since April. Currently, the deposit interest rates of some listed private joint stock commercial banks are commonly at 5 - 5.8%/year for a 12-month term. For a 6 - 9 month term, the listed deposit interest rate is 4.5 - 4.8%/year.

Source

![[Photo] President Luong Cuong attends special political-artistic television show "Golden Opportunity"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/44ca13c28fa7476796f9aa3618ff74c4)

Comment (0)