Bank stops money, warns of fraudulent accounts

A customer recently shared a story, when a person pretending to be a delivery person texted that the item had been delivered to her house and asked to transfer payment for the item. Because she often orders online, she did not suspect anything and clicked to transfer money to the account number sent by the person.

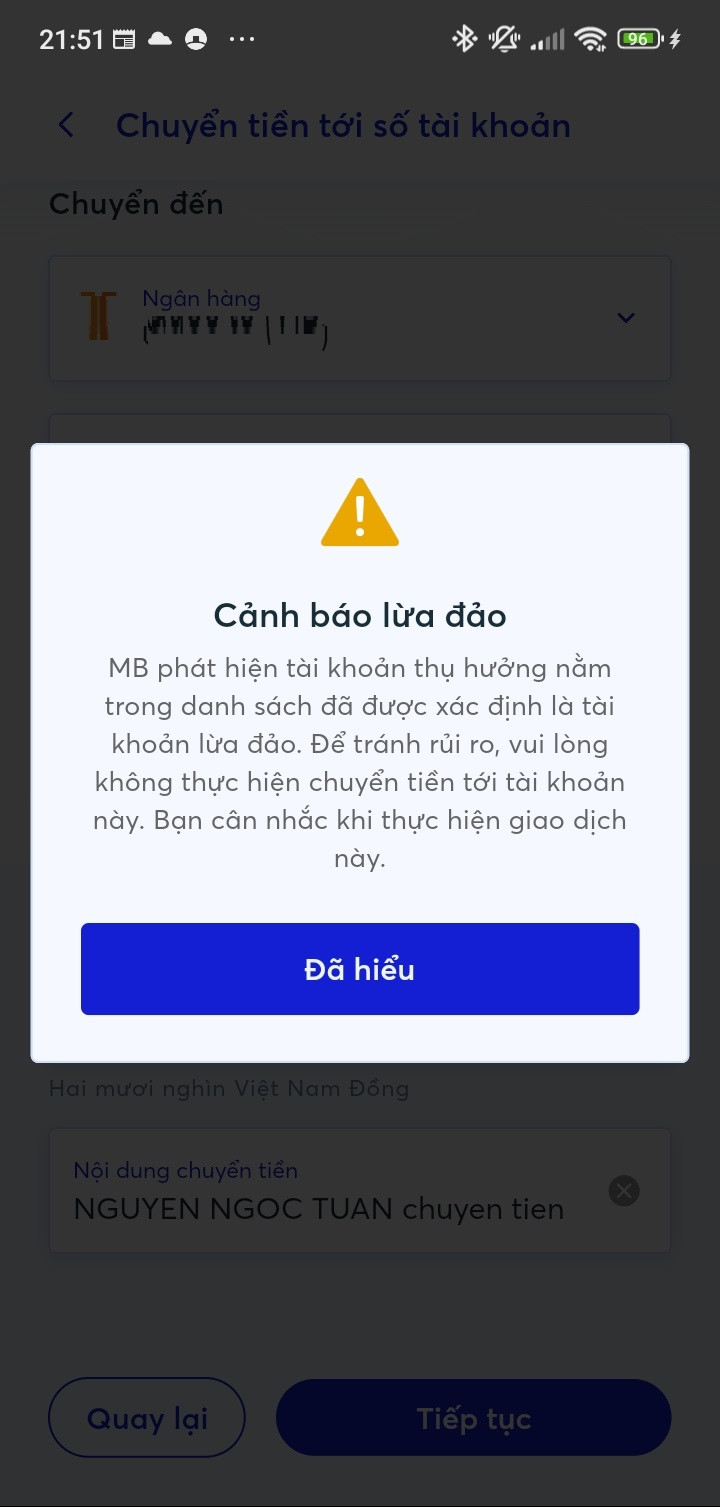

When a customer made an online money transfer on the MB app, even if it was only a few hundred thousand dong, she received a warning message about a fraudulent account. She stopped in time and shared her story on social media, thanking the bank for warning and preventing the customer from stopping in time to keep the money.

This allows customers to feel secure when making transactions with strangers or suspicious accounts, protecting the safety of their accounts and assets.

MB is the first bank to deploy a feature to identify fraudulent account information.

Mr. Mai Huy Phuong, Deputy Director of Digital Banking (MB Bank), said that when customers transact online on MB, they need multi-factor authentication. In addition to OTP authentication and facial authentication requirements, customers will be warned about fraudulent accounts.

MB is currently the only bank that has deployed this feature. Some large banks with a "huge" number of customers - strong investment in technology - such as Big4, Techcombank , VPBank,... have not yet deployed it. However, some banks have made a list of accounts suspected of being used as a means of fraud and cheating.

Mr. Vu Ngoc Son, security expert, National Cyber Security Association, said that the association is preparing to launch "Anti-fraud" software, helping users detect fraudulent account numbers, phone numbers, links and applications before making transactions or before installing them on their phones.

This is a type of application (app) that is installed on the phone. However, this app is not yet available on the app store because it is waiting for approval from Google and Apple, expected in July.

“In addition to the feature of detecting and warning about scammers’ accounts, the “Anti-Fraud” app can also identify the scammer’s phone number. Then, the person receiving the call will see a warning displayed on the phone screen. This software also detects and warns about scam apps when users install them,” said Mr. Vu Ngoc Son.

However, Mr. Son noted that if users ignore the warnings, continue to transfer money or continue to install malware, the warnings will be ineffective.

According to Mr. Son, the application of Decision 2345 of the State Bank (requiring biometric authentication for money transfers over 10 million VND) has been "successful" so far, demonstrating the efforts of banks.

According to Mr. Pranav Seth - Director of Digital Banking Transformation, Techcombank - to enhance transaction safety for customers, since December 2023, this bank has established a project team of 60 experts from many fields to provide an infrastructure that can be simplified but still ensures safety for customers.

“We conducted research with more than 200 different mobile phone models, with different NFC connectivity locations, to be able to inform customers in multiple forms,” said Pranav Seth.

In addition, this bank also provides information security training to 5,000 employees directly serving customers.

Thanks to that, Techcombank is the bank with the largest number of customers registering for biometrics in the system, with more than 2.1 million customers as of July 3, of which only 150,000 customers registered for authentication at the counter.

At Vietcombank , on the first day of implementing biometric authentication, the bank also signed a contract to use electronic authentication services with the Ministry of Public Security.

With this agreement, Vietcombank customers can update biometric information online through an app-to-app connection solution between the VCB Digibank application and the VneID application.

Customers of bank A are also customers of bank B.

The Vietnam Banking Association has also recently held a meeting with its members to discuss the development of a coordinated process to support the handling of accounts and cards related to suspicions of fraud and scams.

Mr. Nguyen Quoc Hung, General Secretary of the Banking Association, assessed that banks have built a very complete customer protection process, which can ensure the safety of their own customers. However, in the fight against fraud, in order to increase the safety of users, there needs to be coordination between credit institutions and payment intermediaries.

“Our customers transact through accounts of other banks, so we need to have a process in the spirit that customers of bank A are also customers of bank B; the “god” of one bank is also the “god” of all banks,” said Mr. Nguyen Quoc Hung.

Sharing the above viewpoint, Mr. Pranav Seth said that this is also the right time for all parties to work together to build a communication method, so that customers can better understand that fraud is becoming more and more complicated, and customers need to raise awareness.

Meanwhile, Ms. Doan Hong Nhung, Director of Retail (Vietcombank), commented that through the implementation of biometric authentication for customers, it can be seen that banks alone cannot do anything in protecting customer behavior on digital channels, but need the consensus of the Ministry of Public Security and the State Bank.

Source: https://vietnamnet.vn/khach-chuyen-khoan-di-tien-bi-phanh-lai-ngan-hang-gui-tin-nhan-sung-so-2299810.html

![[Photo] Prime Minister Pham Minh Chinh chairs the conference to review the 2024-2025 school year and deploy tasks for the 2025-2026 school year.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2ca5ed79ce6a46a1ac7706a42cefafae)

![[Photo] President Luong Cuong attends special political-artistic television show "Golden Opportunity"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/44ca13c28fa7476796f9aa3618ff74c4)

![[Photo] President Luong Cuong receives delegation of the Youth Committee of the Liberal Democratic Party of Japan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2632d7f5cf4f4a8e90ce5f5e1989194a)

Comment (0)