VIS Rating expects real estate developers' debt repayment capacity to begin improving from the weak level of 2023-2024.

Expectations of real estate investors' solvency to recover

VIS Rating expects real estate developers' debt repayment capacity to begin improving from the weak level of 2023-2024.

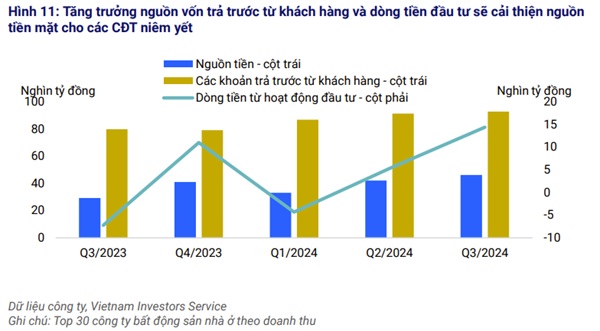

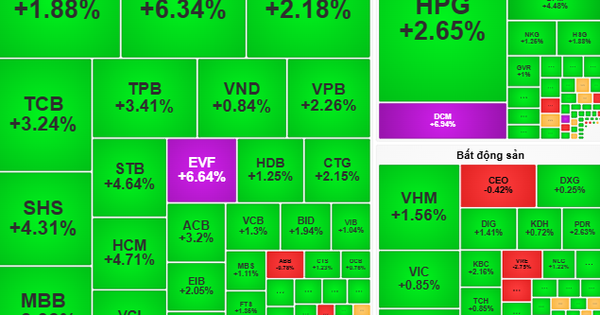

The residential real estate industry report based on data from the top 30 residential real estate companies in terms of revenue, widely announced by VIS Rating yesterday afternoon (November 28), stated that real estate sales in Hanoi and Ho Chi Minh City in the third quarter of 2024 increased by 48% compared to the previous quarter, the highest level in the past 4 quarters. Housing demand remains strong, reflected in high absorption rates and strong growth in home loans at 7% compared to the same period last year, only 1%.

Expectations of rising home prices, combined with lower down payments, will continue to drive strong demand from homebuyers. Many developers such as VHM, NLG, KDH, AGG and HDC have recorded increased sales, mainly in the high-end segments. However, the revenue and profit for 9M 2024 of the developers on the report’s watchlist decreased by 20% and 43% respectively compared to the same period last year due to lower handovers from weak sales in 2023. Therefore, it is expected that more than 60% of developers will not meet their full-year 2024 profit targets.

|

| It is expected that more than 60% of investors will not complete their profit plan for the whole year of 2024. |

Many new real estate regulations have been recently issued, which will boost the development of sales projects in 2025 and beyond. More than 20 decrees and circulars have been issued in the third quarter of 2024 to support the implementation of the revised Land Law, Housing Law and Real Estate Business Law. Investors will have clearer guidance to conduct procedures and promote the development of new projects. These aspects include land valuation, land acquisition, fees and many other factors.

In addition, the Government 's efforts to accelerate legal approvals for prominent real estate projects from early 2024 have led to an increase in newly licensed and eligible projects for sale in Q3/2024.

In 2025, VIS Rating expects developers to increase the number of new projects, helping to improve their sales and cash flows. The industry's debt service capacity will remain weak in Q3/2024, but leverage is expected to be controlled thanks to new regulations and developers ' cash flows will improve thanks to increased sales.

As of Q3 2024, more than half of the developers tracked by VIS Rating had weak leverage and debt service profiles. This was mainly due to excessive leverage for project development in 2021-2023 and the accumulation of unfinished projects and unsold inventory as market sentiment deteriorated from 2023.

|

| It is expected that the debt repayment capacity of real estate investors will start to improve from the weak level of 2023-2024. |

But as sales progress improves, VIS Rating expects real estate developers' debt servicing capacity to start improving from the weak levels of 2023-2024.

With a positive outlook for new project sales and cash flows, developers ’ debt coverage ratios will gradually improve. New regulations issued in July 2024 will limit the use of debt for new projects. Therefore, VIS Rating expects debt growth to continue to slow down from a high of 15%/year in the period of 2022-2023.

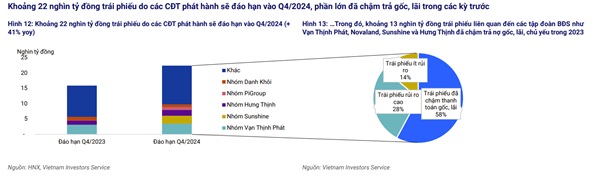

About VND22,000 billion of bonds issued by investors will mature in the fourth quarter of 2024, most of which have been late in paying principal and interest in previous periods. About VND13,000 billion of bonds maturing in the fourth quarter of 2024 have been late in paying principal and interest in 2023 and have successfully negotiated with bondholders to extend payment to the following year.

|

| About 13,000 billion VND of bonds mature in the fourth quarter of 2024. |

These bonds were issued by companies related to real estate corporations such as Van Thinh Phat, Novaland , Hung Thinh and Sunshine.

The remaining VND9,000 billion in bonds were issued by 11 companies, including 7 companies with weak credit profiles and high risks, mainly companies with no business activities related to real estate corporations, no operating revenue and very little cash resources.

On the positive side, real estate companies’ access to new capital has improved. These high-risk issuers will need to rely on liquidity support from related companies or seek bondholder approval for payment extensions to avoid delays in bond principal and interest payments.

Source: https://baodautu.vn/batdongsan/ky-vong-kha-nang-thanh-toan-cua-chu-dau-tu-bat-dong-san-phuc-hoi-d231253.html

![[Photo] President Luong Cuong receives delegation of the Youth Committee of the Liberal Democratic Party of Japan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2632d7f5cf4f4a8e90ce5f5e1989194a)

![[Photo] President Luong Cuong attends special political-artistic television show "Golden Opportunity"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/44ca13c28fa7476796f9aa3618ff74c4)

![[Photo] Prime Minister Pham Minh Chinh chairs the conference to review the 2024-2025 school year and deploy tasks for the 2025-2026 school year.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2ca5ed79ce6a46a1ac7706a42cefafae)

Comment (0)