The stock market has attracted a large amount of money from investors in recent months. Since the end of the second quarter of 2025, the strong cash flow into the stock market has pushed the VN-Index up by more than 14.3%, surpassing the old peak and getting closer to the 1,600-point mark.

The average trading value per session in July reached VND32,800 billion, a sharp increase of 75% compared to the previous month, reflecting the strong new cash flow and high expectations from investors. To date, there have been two sessions with liquidity of over USD3 billion. Of which, July recorded the first trading session with a trading value of over VND70,000 billion. Bottom-fishing demand actively bought when the VN-Index fell more than 4%. Then, on the session of August 5, a new liquidity record was set in the trading session. The VN-Index suddenly fell more than 60 points in less than 30 minutes, although it still ended the session in the green.

On the Ho Chi Minh City Stock Exchange alone, at the end of the last trading session of July 2025, the VN-Index reached 1,502.52 points. In just the first week of August, new milestones were conquered with the peak of 1,584.98 points set in the session of August 6.

According to HoSE statistics, stock market liquidity in July reached more than 1,422 million shares/day with an average trading value of more than VND 34,993 billion/day; correspondingly increasing 63.20% in volume and 66.98% in value compared to June 2025.

Regarding covered warrants (CW), the average trading volume reached over 70.35 million CW/day with an average trading value of VND104.23 billion/day; an increase of 52.57% in volume and 105.33% in value compared to the previous month. Foreign investors actively traded on the HoSE with the value for the whole month of July 2025 reaching over VND176,199 billion, accounting for 10.95% of the total trading value of the entire market. With overwhelming buying power, foreign investors made net purchases during the month with a value of over VND7,778 billion.

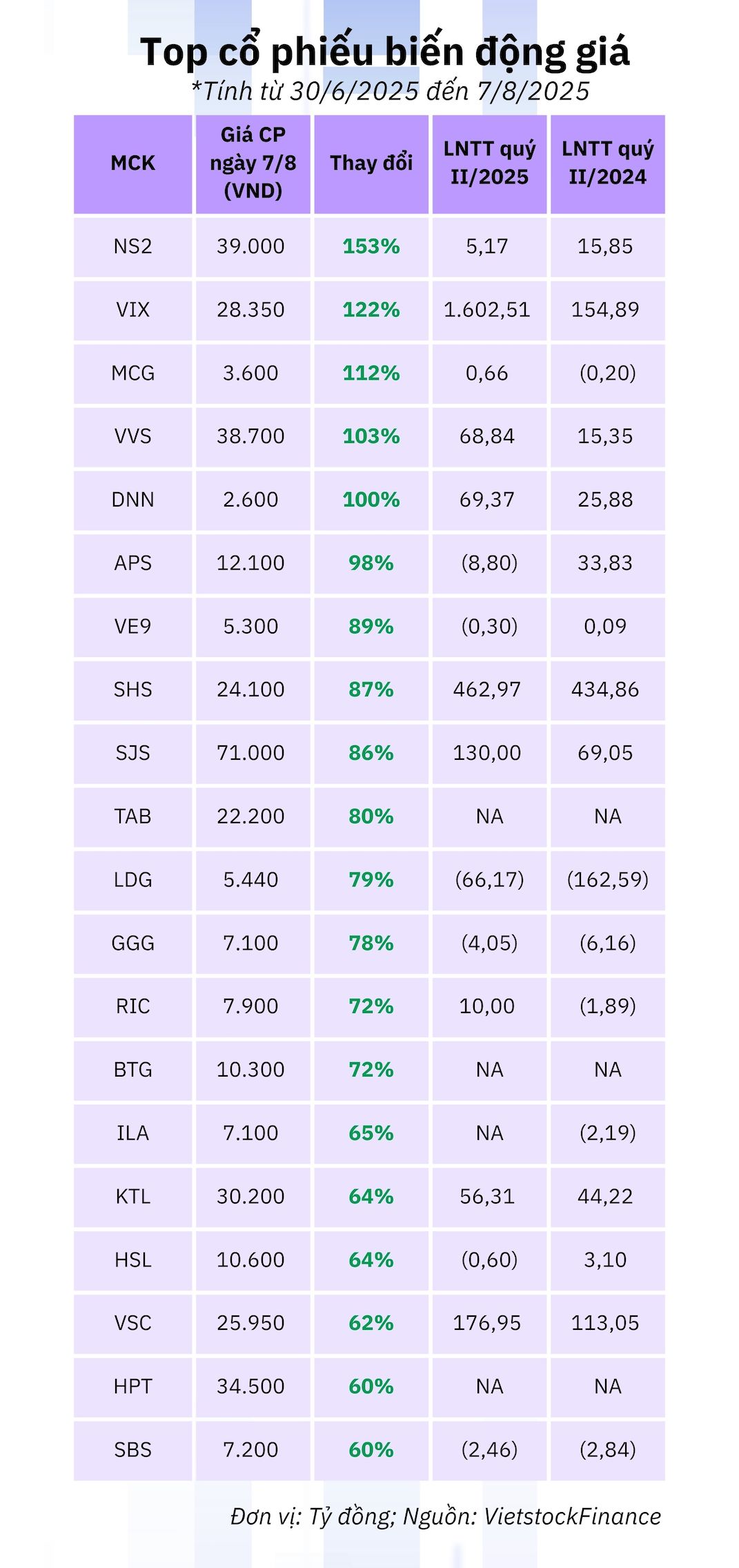

More than 40 stocks recorded a price increase of over 50% (based on adjusted prices). Many stocks even recorded a price increase of "the same number of times". Leading the price increase was NS2 stock of Hanoi Clean Water Joint Stock Company No. 2 on UPCoM. The increase in July brought NS2 stock price to a new peak even though the business results in the second quarter of 2025 did not record outstanding results, even decreasing quite sharply compared to the same period.

Meanwhile, information about positive business growth contributed significantly to the increase of some stocks such as VVS stock of Vietnam Machinery Development Investment Corporation, SJS (SJ Group), RIC (Royal International Corporation) or VSC stock (Viconship).

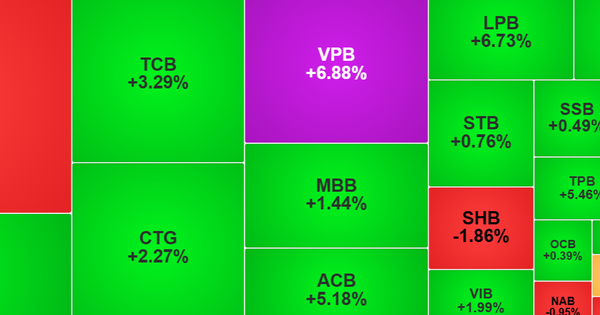

Many securities company stocks were on the list of stocks with the strongest growth in the second half of the year. VIX shares closed on August 7 at VND28,350/share, 2.2 times higher than at the end of June 2025. Compared to a year ago, the stock price has increased more than 2.8 times. With a sharp increase in charter capital, the business scale of this securities company has also expanded significantly with pre-tax profit in the second quarter of 2025 reaching over VND1,600 billion, more than 10 times higher than the same period. SHS stock price increased by 87%. Some other stocks such as APS and SBS also increased sharply despite their negative quarterly business results.

|

After 3 sessions of more than 14% decrease/session in the last 3 trading days, HPT stock price still increased by 60% in the past month. This company registered to trade shares on UPCoM and is only obliged to provide information about annual financial reports, the first half business results of HPT Information Technology Services Joint Stock Company are not announced. However, according to the explanation of the company's leaders, the continuous increase in HPT stock price, with an unusually high liquidity compared to trading history ( matching volume reached tens of thousands of shares per session), has objective and public factors that can affect positive sentiment in the market.

Through reviewing the operational situation and official communications, the Company confirms that there is no unpublished internal information that has an unusual impact on the stock price. However, HPT recognizes objective and public factors that may have an impact on positive market sentiment, including:

"The company has just held the 2025 Annual General Meeting of Shareholders on July 15, 2025, with the announcement of a report sent to shareholders on the business results of the past years and the orientation for stable and positive development. HPT is also implementing a breakthrough development strategy towards 2030 and a vision towards 2035, with these documents clearly reflecting the commitment to innovation, enhancing brand value and corporate culture, creating a foundation for sustainable development," said Ms. Nguyen Thi Hong Hai, authorized person to disclose information of HPT, in an explanatory letter sent to the State Securities Commission.

The company representative also affirmed that the increase in HPT shares, if any, can only reflect the market's expectations on the company's strength and future prospects. At the same time, the company is committed to transparent and stable operations, encouraging investors to evaluate stocks based on business results and long-term strategies, not based on unverified or emotional information.

According to analysts from Nhat Viet Securities (VFS), in August 2025, many positive information is expected to continue to support the market, such as cash flow still remaining in the market and continuously circulating through many industry groups, not really escaping despite strong correction/distribution sessions. Demand from the institutional sector is still maintained, helping the market balance during corrections. In addition, macro information on tariffs between the US and Vietnam may be announced again, which will be a lever to help the market recover and continue to increase points.

Faced with the strong increase of the stock market in the current period, the State Securities Commission has strengthened supervision, inspection, examination, and strictly handled violations in the market; at the same time, issued a directive requesting the Stock Exchanges, the Vietnam Securities Depository and Clearing Corporation (VSDC), and securities companies to strengthen supervision to ensure the safe and stable operation of the stock market.

The State Securities Commission requires the Stock Exchanges to closely monitor stock transactions with sharp increases/decreases. In case of identifying signs of unusual transactions, they must analyze, evaluate, recommend, propose solutions, and report to the State Securities Commission for handling according to regulations. The Vietnam Stock Exchange directs the Ho Chi Minh City Stock Exchange (HoSE) to coordinate with the Hanoi Stock Exchange (HNX) and VDSC to ensure safe, stable, and smooth securities trading, clearing, and payment activities.

The State Securities Commission requires securities companies to strictly comply with legal regulations in their business activities and provision of securities services. At the same time, securities companies need to strengthen management and supervision of employees and practitioners to prevent their employees and practitioners from committing acts that violate legal regulations and professional ethics, or from enticing or inviting people to participate in forums and groups to provide securities investment advice in violation of the law.

Securities companies need to closely monitor compliance with legal regulations on securities transactions of individuals and organizations that are customers of the company; actively and proactively coordinate with the Stock Exchanges , VSDC, and the State Securities Commission in monitoring, inspection, and examination activities. In case of detecting transactions with signs of violating regulations on securities transactions, report to the Stock Exchanges and the State Securities Commission for handling according to regulations.

Source: https://baodautu.vn/diem-mat-loat-co-phieu-bien-dong-manh-trong-con-song-thang-7-d352251.html

![[Photo] Prime Minister Pham Minh Chinh chairs the conference to review the 2024-2025 school year and deploy tasks for the 2025-2026 school year.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2ca5ed79ce6a46a1ac7706a42cefafae)

![[Photo] President Luong Cuong attends special political-artistic television show "Golden Opportunity"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/44ca13c28fa7476796f9aa3618ff74c4)

![[Photo] President Luong Cuong receives delegation of the Youth Committee of the Liberal Democratic Party of Japan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2632d7f5cf4f4a8e90ce5f5e1989194a)

Comment (0)