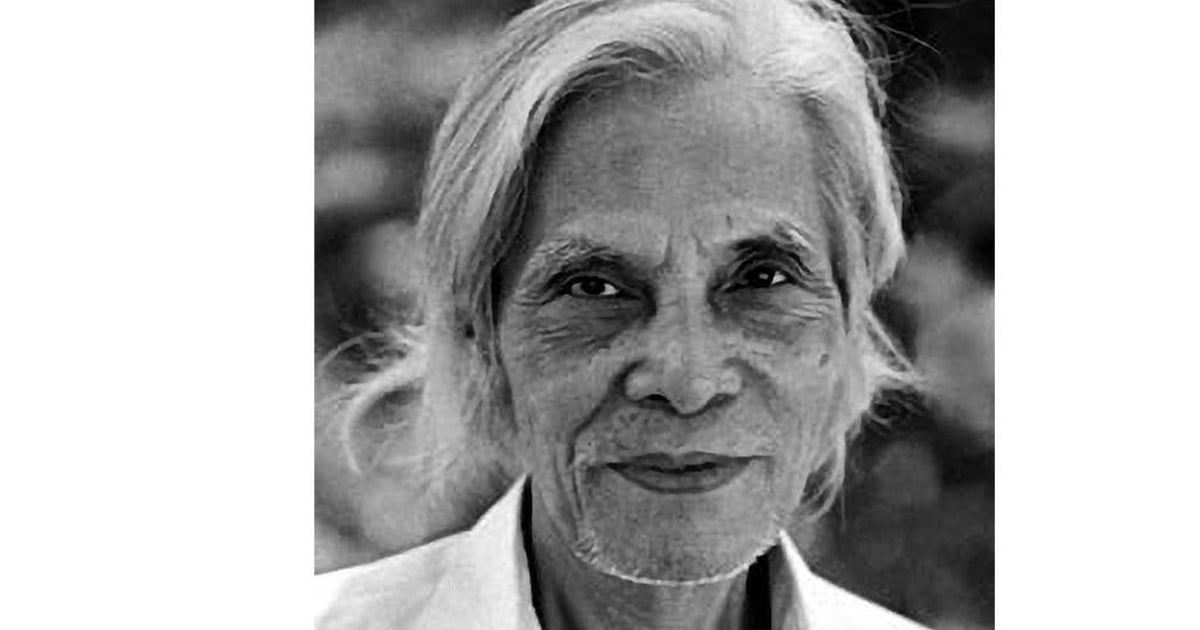

Thanh Hoa TCVM staff apply AI and Big Data in operations.

Sensitive to digital transformation, promoting financial inclusion

The artificial intelligence (AI) revolution has become a powerful driving force for socio -economic change, including financial services. For MFIs, where each small loan is tied to the livelihoods and trust of rural families, AI is not simply a “cost optimization” tool, but can be a tool to expand equitable access, reduce application barriers, and make more sophisticated credit decisions. However, this potential can only be realized when deployed responsibly, combining technology, people, and the right governance framework.

In Thanh Hoa, Thanh Hoa Microfinance Institution has made strong changes when applying AI to its operations to help optimize efficiency and work performance in the new era. Thanh Hoa Microfinance Institution focuses on applying technology, promoting digital transformation in operations (website, management software, support channels via zalo...) to improve management capacity, accumulate transaction data, make cash flow transparent and facilitate the application of advanced analytical tools, diversify and improve service quality. Thanks to the standardized and digitized customer database, Microfinance Institution can shorten the time to process documents and reduce the use of paperwork. This is one of the favorable premises to move towards testing AI solutions suitable for the Microfinance Institution model.

Application of AI and Big Data analysis in Thanh Hoa TCVM activities

The application of AI and Big Data analysis allows microfinance institutions in general and Thanh Hoa microfinance institutions in particular to make breakthrough developments with three core activities.

AI and Big Data enable more accurate risk assessment using “alternative data”. Instead of relying solely on credit history that does not exist for many rural borrowers, Thanh Hoa Microfinance can now use transaction data, bill payment history, sales behavior, even social media data or agent data to predict debt repayment ability and assess borrowers. This “opens the door” to customers who currently do not have a credit profile, do not have much credit history information, but actually have the ability to repay debt.

Thanks to the application of AI and Big Data, Thanh Hoa Microfinance Institution can automate processes and shorten customer service time. The management software is continuously upgraded with the ability to check records, extract information, and support preliminary approval, helping to shorten the review time. This is of great significance to customers who need timely capital. At the same time, submitting loan applications via the website, online consultation via Zalo, Messenger, etc. can improve the 24/7 service experience in remote areas.

With portfolio management and early risk warning, customer forecasting and segmentation models help organizations focus resources on preventing bad debt, optimizing debt collection strategies and providing timely financial advice.

These applications not only help reduce operating costs but can also increase the ability to provide safe financing for customers who are poor, low-income, women starting businesses with micro loans... When deployed properly, AI can bring three benefits to Thanh Hoa Microfinance and customers at the same time: Expanding accessibility; speeding up and being friendly; and extending green impact.

Accordingly, many freelancers, small traders, and farmers without credit history will have more reasonable loan opportunities. Fast application approval, digital communication channels such as Zalo/applications help reduce travel costs for customers in remote areas. When AI supports the assessment of the capacity and profitability of green business models, "green" capital (green credit) will be allocated more effectively, thereby contributing to the sustainable development goal that Thanh Hoa Microfinance is aiming for.

However, Thanh Hoa Microfinance Organization is well aware that: To achieve those goals, there needs to be a roadmap with specific plans and directions. Therefore, based on analysis and assessment of the international and domestic situation, closely following strategic directions, goals and missions, Thanh Hoa Microfinance Organization has been flexible and proactive in building a roadmap in line with the general trend and the unit's reality.

First of all, data standardization is the first step, creating an important premise to be able to digitize the entire operation of the organization, including standardizing records, transactions, debt repayment history; at the same time, collecting transparent consent from customers according to security regulations.

AI is a tool, people are the center, Thanh Hoa Microfinance Institution applies AI for preliminary approval, while the final decision is reviewed by credit officers, to both speed up and ensure financial principles, and promote the sense of responsibility of officers and employees for assigned work.

Piloting a specific product, such as green credit for organic vegetable farms; evaluating the model using production data, sales, history of financial training programs... Thanh Hoa Microfinance has the advantage of having a list of customers participating in the green model.

Training and improving digital transformation capacity, AI and Big Data applications for officers and employees are indispensable in any development strategy. Credit officers need to understand the operating mechanism of AI applications, know how to explain the reasons for refusing/supporting customers and practice measures to prevent ethical risks.

Forming an AI governance framework and promoting cooperation to build a model control framework, assess fairness and legal compliance are also important contents that the TCVM Organization has implemented and wishes to further promote in the coming time.

AI is not the ultimate goal but a means to help microfinance institutions better fulfill their social mission: bringing capital to the right people, at the right time, with a sense of responsibility and transparency. With the results achieved and tireless efforts, Thanh Hoa Microfinance Institution has been actively contributing to the sustainable development of agriculture , farmers and rural areas.

Article and photos: Hoang Linh

Source: https://baothanhhoa.vn/dich-vu-tai-chinh-vi-mo-thoi-ai-258839.htm

![[Photo] Prime Minister Pham Minh Chinh receives Australian Foreign Minister Penny Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/20/f5d413a946444bd2be288d6b700afc33)

![[Photo] Politburo works with Standing Committees of Lang Son and Bac Ninh Provincial Party Committees](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/20/0666629afb39421d8e1bd8922a0537e6)

![[Photo] An Phu intersection project connecting Ho Chi Minh City-Long Thanh-Dau Giay expressway behind schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/21/1ad80e9dd8944150bb72e6c49ecc7e08)

Comment (0)