VN-Index sets many new records

The Vietnamese stock market experienced an impressive trading week, marking new record milestones, from indexes to cash flow, especially at the HOSE floor.

At the end of the week, VN-Index increased by 6% to 1,584.95 points. On the two Hanoi Stock Exchanges, the HNX-Index and HNXUPCoM-Index closed the week at 272.46 points and 108.54 points, respectively.

At the all-time peak price range, despite experiencing some "shakes", VN-Index continued to show its strong ability to overcome the wind and waves when closing the highest weekly candle ever, reaching a record number of closing points.

Average matched liquidity, although 4.5% lower than last week, was 75.5% higher than the 20-week average.

Accumulated to the end of last week's trading session, average liquidity on the HOSE floor reached 1,825 million shares (down 3.85%), equivalent to a value of VND 50,706 billion (up 3.96%).

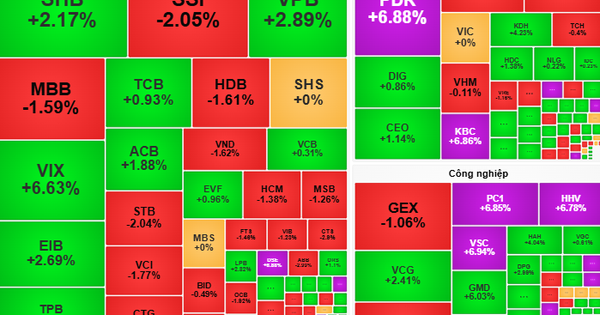

Stocks that strongly affected the VN-Index last week (Screenshot: SSI iBoard)

In terms of industry groups, the market witnessed 21/21 industry groups with "green color". The 3 industry groups leading the strongest increasing trend were Fertilizer (+14.51%), Steel (+10.7%), Real Estate (+8.67%).

Foreign investors became a "minus point" when they sold strongly, with a value of VND12,849 billion at the end of the week. The focus was on VIC (Vingroup, HOSE) with VND12,427 billion,FPT (FPT, HOSE) with VND1,533 billion, SSI (SSI Securities, HOSE) with VND387 billion, these were the 3 stocks under the strongest net selling pressure.

In the opposite direction, the 3 codes that were bought the most strongly included: HPG (Hoa Phat Steel, HOSE) reaching 1,228 billion VND, VPB (VPBank, HOSe) reaching 674 billion VND, STB ( Sacombank , HOSE) reaching 464 billion VND.

According to experts, while the codes have not increased much, they have attracted increased cash flow and have positive price movements when business results have grown well. This is a development that short-term speculative positions need to pay attention to in the current context.

20 stock billionaires' assets got richer by 56,000 billion VND last week

After an exciting trading week, the assets of 20 stock market billionaires also increased strongly, up to 56,000 billion VND.

Accordingly, leading the way is Mr. Pham Nhat Vuong, Chairman of Vingroup (VIC, HOSE) with assets of VND 262,700 billion, an increase of VND 29,200 billion (equivalent to 13%) in just one week. In addition, Ms. Pham Thu Huong (position 7) and Ms. Pham Thuy Hang (position 11), Vice Chairman of Vingroup, also increased by 13%, increasing by VND 2,200 billion and VND 1,500 billion, respectively.

Stock billionaires' assets increase sharply thanks to positive market developments (Photo: Internet)

The top eight spots on the chart remained virtually unchanged from the previous week.

Mr. Tran Dinh Long, Chairman of Hoa Phat Group (HPG, HOSE) ranked second with VND 55,400 billion, an increase of VND 5,600 billion (equivalent to 11%) compared to the previous week.

3rd place is Mr. Do Anh Tuan, Chairman of Sunshine Group with codes SCG (SCG Construction, HNX), KSF (Sunshine Group, HNX), KLB (Kienlongbank, UPCoM), SSH (Sunshine Homes, UPCoM), increased by 1,400 billion VND (+45).

In 4th place is Ms. Nguyen Phuong Thao, Chairwoman of VietJet Air, with codes VJC (VietJet, HOSE), HDB (HDBank, HOSE), up 600 billion VND (equivalent to 2%).

Ranked 5th is Mr. Ho Hung Anh, Chairman of Techcombank with TCB (Techcombank, HOSE), MSN (Masan, HOSE), increased by 1,600 billion VND (+6%).

Notably, Mr. Nguyen Duc Tai, Chairman of Mobile World (MWG, HOSE) was in the Top 10 last week with assets of 13,400 billion VND, an increase of 10% compared to the previous week.

Individuals related to VPB (VPBank, HOSE) such as Chairman Ngo Chi Dung, Ms. Hoang Anh Minh (Mr. Dung's wife) and Ms. Vu Thi Quyen (Mr. Dung's mother) all recorded a 15% increase in assets last week, ranking 17th, 18th, and 19th, respectively. This is the strongest increase of the week.

VN-Index is expected to move towards the 1,800 point zone.

The VN-Index closed July at 1,502.5 points with an impressive increase of 9.2%, bringing the total increase since the beginning of the year to 18.6%.

Based on that, in the newly published August strategy report, SSI Securities (SSI Research) assessed that investor optimism has increased with many prominent catalysts, including: (1) Favorable macroeconomic conditions when Vietnam officially reached a trade agreement with the US with a reciprocal tax rate of 20%, lower than the 46% rate announced in April; (2) Positive effects from the US stock market; (3) The Q2/2025 business results season exceeded expectations and spread across most industry groups.

Banking continued to be the main growth driver, followed by real estate and utilities.

Although the market may face short-term fluctuations due to increased profit-taking pressure after a period of high margins in late July, SSI still expects the VN-Index to head towards the 1,750-1,800 point range in 2026.

The main driver comes from the solid recovery of profit growth, supported by: (1) The recovery momentum of the real estate market and public investment, (2) The favorable interest rate environment, (3) The gradual easing of concerns about tariff risks, (4) and especially the expectation of market upgrade in October.

SSI Research maintains its forecast for 2025 parent company shareholders' after-tax profit growth of 13.8% for the whole market, equivalent to 15.5% growth over the same period in the second half of the year, although there may be slight adjustments after the financial reporting season ends.

Observations from other markets show that the market often has positive developments in the period before being upgraded, thanks to expectations of increased foreign capital flows and significantly improved investor sentiment. This will be one of the important supporting factors for the Vietnamese market in the second half of 2025.

Vietnam remains attractive in the medium and long term thanks to its stable macro economy and recovering growth. The government continues to promote public investment disbursement, especially in transport and energy infrastructure. It is promoting policies to remove difficulties for real estate, typically shortening legal procedures and speeding up disbursement of social housing credit packages.

List of businesses with growth potential

According to the strategic report of Dragon Viet Securities (VDSC) , the trading score range of VN-Index in the next 3 months is in the range of 1,445 - 1,646 points.

Regarding investment strategy, VDSC's analysis team continues to maintain a high proportion of listed stock assets, especially focusing on businesses with the ability to expand their operations and good resistance to inflation.

At the same time, the company released a list of potential stocks. In the banking group, VDSC has a positive view on MBB (MBBank, HOSE) when forecasting a profit growth rate of 19%/year in the 2025–2028 period, thanks to clear competitive advantages: the ability to grow credit scale quickly thanks to a strong digital banking platform, a comprehensive financial group model and low capital costs.

MBB's net interest margin (NIM) is expected to be more stable than other banks in the same group, thanks to its diverse and loyal customer base.

Next is VCB (Vietcombank, HOSE) thanks to two main drivers: (1) NIM recovered to nearly 3% thanks to improved credit demand and (2) risks from counterpart taxes gradually decreased.

In the industrial park group, the analysis team evaluates KBC (Kinh Bac, HOSE) directly benefit from the recovery of industrial park (IP) real estate in 2025. Typical projects include: Nam Son Hap Linh, Trang Due 03, Kim Thanh (North) and Tan Phu Trung, Tan Tap, Loc Giang (South).

In the oil and gas group, the analysis team evaluates the business performance of PVS (PTSC, HNX) will continue to thrive in the second half of 2025, thanks to positive construction progress at a series of offshore oil and gas and energy projects.

In the retail group, stocks MWG (Mobile World, HOSE) , MSN (Masan. HOSE) and SAB (Sabeco, HOSE) appear in the potential list.

Comments and recommendations

SSI Securities comment, VN-Index closed the session on August 8 at 1,584.95 points, up 3.14 points (+0.2%). The index experienced a week of strong "shakes" and stagnated around the resistance zone of 1,585 points. Indicators reflect the cautious state of cash flow although a clear reversal pattern has not been confirmed. This week, the index may continue to move sideways to rebuild a more sustainable price level, at 1,550-1,560 points.

VN-Index fluctuates around 1,550 - 1,585 points

BSC Securities believes that the market is having good bottom-fishing power, but foreign investors are still maintaining a strong net selling status, so The tug-of-war trend in the 1,580 - 1,585 point range is likely to continue in the short term to consolidate a solid price base.

Phu Hung Securities assessment, work VN-Index maintains good movement above the 1,560-point peak, consolidating. If the market accumulates well around the current price range, it can help eliminate divergence and maintain a more sustainable upward momentum, aiming to break through the 1,600-point mark. On the cautious side, the support level to maintain the trend is raised to 1,530 points; a sign of a retreat below this level could push the index back into a correction phase.

At this time, the general strategy is to hold. In the new buying direction, investors can participate with stocks that have tested well the medium-term support area. Priority groups to pay attention to: banking, real estate, securities, public investment, utilities (electricity), retail.

Dividend schedule this week

According to statistics, there are 26 enterprises that have decided to pay dividends in the week of August 11-15, of which 22 enterprises pay in cash, 1 enterprise pays in shares, 1 enterprise rewards shares and 2 enterprises pay mixed dividends.

The highest rate is 100%, the lowest is 2.9%.

1 company pays by stock:

IDICO Corporation – JSC (IDC, HNX), ex-right trading date is August 14, rate 15%.

1 company rewards shares:

Viet A Commercial Joint Stock Bank (VAB, HOSE), ex-right trading date is July 9, rate 100%.

2 mixed enterprises:

Gas Products International Transport Joint Stock Company (GSP, HOSE) will pay in two forms: cash and shares. With the shares, the ex-dividend date is August 13, at a rate of 10%.

Military Commercial Joint Stock Bank (MBB, HOSE) will pay in two forms: cash and shares. With the shares, the ex-dividend date is August 13, at a rate of 32%.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Ratio |

|---|---|---|---|---|

| BBS | HNX | 11/8 | 8/28 | 10% |

| DDH | UPCOM | 11/8 | 8/22 | 3% |

| TOT | HNX | 13/8 | 8/29 | 20% |

| SBM | UPCOM | 13/8 | 8/28 | 10% |

| BDW | UPCOM | 13/8 | 9/11 | 11% |

| GSP | HOSE | 13/8 | 9/23 | 5% |

| QNS | UPCOM | 13/8 | 8/26 | 10% |

| MBB | HOSE | 13/8 | 8/21 | 3% |

| PGD | HOSE | 14/8 | 10/10 | 15% |

| ACE | UPCOM | 14/8 | 10/15 | 15% |

| ACE | UPCOM | 14/8 | 15/9 | 10% |

| LM8 | HOSE | 14/8 | 8/28 | 10% |

| SMB | HOSE | 14/8 | 8/25 | 20% |

| SHC | UPCOM | 14/8 | 8/29 | 5% |

| EMS | UPCOM | 14/8 | 9/29 | 10% |

| TID | UPCOM | 14/8 | 8/25 | 11% |

| KSV | HNX | 14/8 | 5/9 | 15% |

| TSJ | UPCOM | 14/8 | 15/9 | 9.9% |

| NQN | UPCOM | 15/8 | 8/28 | 2.9% |

| CCR | HNX | 15/8 | 8/29 | 5% |

| DOC | UPCOM | 15/8 | 24/9 | 3% |

| VIM | UPCOM | 15/8 | 18/9 | 7% |

| MNB | UPCOM | 15/8 | 8/29 | 20% |

| GTA | HOSE | 15/8 | 8/27 | 5% |

| SFI | HOSE | 15/8 | 8/25 | 10% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-11-15-8-diem-danh-co-phieu-tiem-nang-20250811082800474.htm

Comment (0)