VN-Index closed the first session of the week in green, but the increase range narrowed compared to the beginning of the session. The number of increasing codes was no longer overwhelming as profit-taking selling pressure increased.

In the forecast last weekend, most securities companies held an optimistic view that the market would soon head towards the resistance zone of 1,100 points. This happened in the first session of this week.

VN-Index surpassed the 1,100 point mark after the ATO session this morning, expanding its increase to nearly 13 points in the middle of the morning session. Green spread across the market along with investor excitement, active buying power dominated.

However, as trading time progressed, selling pressure increased. The market encountered strong resistance when the VN-Index traded around the resistance level. Selling pressure with many stocks that had increased sharply recently caused the green color to gradually narrow. In the afternoon session, the index's increase amplitude gradually decreased, and the number of increasing stocks was no longer dominant.

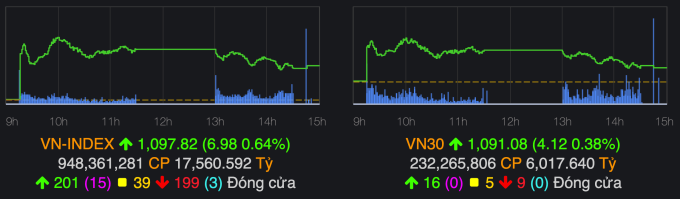

At the end of the session, VN-Index only increased by nearly 7 points (0.64%), stopping at 1,097.82 points. VN30-Index increased by more than 4 points (0.38%) to 1,091 points. On the Hanoi Stock Exchange, HNX-Index and UPCOM-Index narrowed the green color to near the reference.

VN-Index closed the session on June 5 up nearly 7 points. Photo: VNDirect

The number of codes increasing and decreasing on HoSE is almost equal, with the scale of each side being about 200 codes. In the large-cap group, the number of codes increasing is more dominant with a ratio of 16:9.

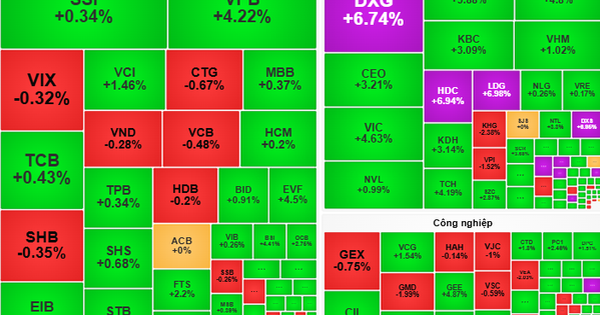

Leading the market today were some banking, retail and oil and gas stocks. VCB closed up 3.3%, the most active stock in the VN30 group. According to Bloomberg , Vietcombank is looking for a consultant for its plan to raise about 1 billion USD to increase capital. This bank may offer 5% of its shares through private placement. MBB, CTG and VIB also closed in the green.

In the retail group, MSN added 2.5%, MWG increased 1%. Oil, gas and electricity stocks such as PLX, GAS, POW also traded well.

In the mid-cap segment, steel stocks, energy stocks, some banking stocks and real estate stocks are also in a similar state.

On the contrary, the real estate group and some banking stocks led the market decline. At the end of the session, GVR and NVL fell over 2%, PDR lost 1.7%, and some banking stocks such as STB, VPB, TPB andACB closed in red.

Market liquidity remained high, with transaction value on HoSE reaching over VND17,500 billion, of which the VN30 group alone traded over VND6,000 billion. Foreign investors maintained a net selling status with a scale of nearly VND150 billion.

Minh Son

Source link

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/9f771126e94049ff97692935fa5533ec)

Comment (0)