According to the financial report for the fourth quarter of 2023, Long Hau Corporation (code: LHG) recorded revenue of VND 145 billion, an increase of 40% and profit after tax of VND 61.6 billion, an increase of 90% over the same period in 2022.

The report stated that during the period, LHG significantly reduced the increase in cost of goods sold, which helped gross profit increase from 42.6% to 53.1%.

Not only that, LHG's financial revenue increased by 76% compared to last year, to VND24 billion, and operating costs did not increase.

Although business activities in the fourth quarter increased sharply, it could not help the company grow in 2023. Specifically, for the whole year of 2023, LHG only achieved 395 billion VND in net revenue and 166.5 billion VND in profit after tax, respectively 37% and 18% lower than the previous year.

However, in 2023, Long Hau plans to have revenue of VND902 billion and profit after tax of VND127 billion. With this result, LHG's revenue decreased by 56% but profit after tax increased by 31% compared to the set target.

Long Hau Corporation was established on May 23, 2006 in Long An . The founding shareholder is Tan Thuan Industrial Development Company Limited (IPC). In the field of industrial real estate, LHG emerged with the Long Hau Industrial Park project (Long An), with a scale of 500 hectares; Long Hau high-tech factory area (Da Nang High-tech Park), with a scale of 29.6 hectares.

At the end of the trading session on January 18, LHG shares reached 30,550 VND/share.

Also having good business results in the industrial real estate sector, Kinh Bac Urban Development Corporation (code: KBC) of Mr. Dang Thanh Tam benefited from the strong increase in cash flow in industrial real estate business. Thereby, KBC reduced its debt and erased all 2,400 billion VND of bond debt from its books.

Vietnam's industrial real estate market is assessed to be in a vibrant period and has brighter prospects than ever in the context of two superpowers, the US and China, racing to create influence in important regions, including an Asia that is expected to make a breakthrough, including Vietnam.

In a recently published report, SSI Securities said that the demand for industrial park (IP) land lease will be positive in 2024.

Accordingly, the demand for land rental in industrial parks in the North is expected to increase thanks to the trend of shifting production facilities from China to Vietnam, mainly in the electronics and semiconductor industries.

As of September 2023, according to CBRE, Apple has 11 audio equipment manufacturing facilities in Vietnam and Apple suppliers such as Lux Share, Foxconn, Compal and GoTek are operating 32 factories in Vietnam.

Meanwhile, industrial parks in the South may record a recovery from a low base in 2023, with the main land tenants in the manufacturing sector (textiles, wood, footwear), logistics, and food and beverage.

Business News

The stock market has a number of other important events of listed companies.

* RTB: Tan Bien Rubber Joint Stock Company ended 2023 with after-tax profit of VND 225 billion, down 15% compared to the previous year, completing the set plan of VND 218 billion.

* SZL: In the fourth quarter of 2023, Sonadezi Long Thanh Joint Stock Company recorded net revenue of more than VND 126 billion and net profit of more than VND 34 billion, up 20% and 74% respectively over the same period.

* SZG: According to the financial statements of the fourth quarter of 2023, Sonadezi Giang Dien Joint Stock Company recorded net revenue of more than VND 88 billion, an increase of 15% over the same period; net profit was nearly 4 times higher than the same period, reaching more than VND 48 billion.

* HMS: Ho Chi Minh Museum Construction JSC plans to privately offer up to 800,000 shares at VND15,000/share to strategic investors and professional securities investors, expected to raise VND12 billion.

* PC1: BEHS JSC (major shareholder) and subsidiaries of BEHS simultaneously want to divest all 53.8 million PC1 shares (17.32%) at PC1 Group JSC.

* VNS: From December 15, 2023 to January 12, 2024, major shareholder of Vietnam Sun Corporation, TAEL Two Partners Ltd, registered to sell 2.5 million shares to restructure its investment portfolio, reducing its ownership from more than 12.4 million shares (18.3%) to more than 9.9 million shares (14.6%). This is the third consecutive time this major shareholder has failed to sell the above shares.

* DDG: On January 16, Dong Duong Import-Export Industrial Investment Joint Stock Company announced that DDG Board Member and Deputy General Director Tran Kim Cuong wanted to sell 500,000 shares, thereby reducing the ownership ratio from 2.92% to 2.09% for personal financial reasons.

* DVP: Dinh Vu Port Investment and Development JSC ended 2023 with pre-tax profit of VND 396 billion, up 15% over the previous year (exceeding 10% of the annual plan) and net profit of VND 329 billion, up 16%.

* TDP: Thuan Duc Joint Stock Company has just been approved by the State Securities Commission for two capital mobilization plans through stocks and bonds. TDP plans to offer 7.55 million shares at VND15,000 and 3 million bonds at a par value of VND100,000/bond.

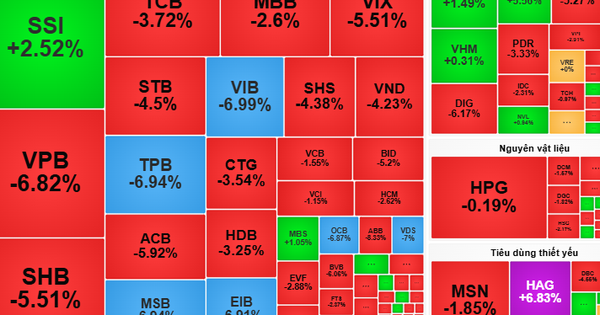

VN-Index

At the end of the trading session on January 18, VN-Index increased by 6.53 points (+0.56%) to 1,169.06 points, HNX-Index increased by 0.42 points (+0.19%) to 229.93 points, UpCOM-Index increased by 0.2 points (+0.23%), to 87.16 points.

According to KB Securities Vietnam (KBSV), although the opportunity to continue to rise is still open with the next resistance zone located at 1,185 (+/-10) points, the recovery is not highly appreciated due to the decline in liquidity during the increasing sessions.

Investors are recommended to only participate in low-weight trading at the support zone near 1,140 (+/-5) points and vice versa, sell to reduce the weight of the stocks they are holding at the uptrends that are about to surpass the peak/touch the resistance.

Yuanta Vietnam Securities Company believes that the short-term trend of the general market is still increasing. Therefore, Yuanta Vietnam recommends that short-term investors can hold a high proportion of stocks and can take advantage of the correction to buy new stocks with a low proportion.

Source

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)