At the end of the session on August 25, VN-Index lost another 31 points, equivalent to a decrease of 1.91%, stopping at 1,614 points.

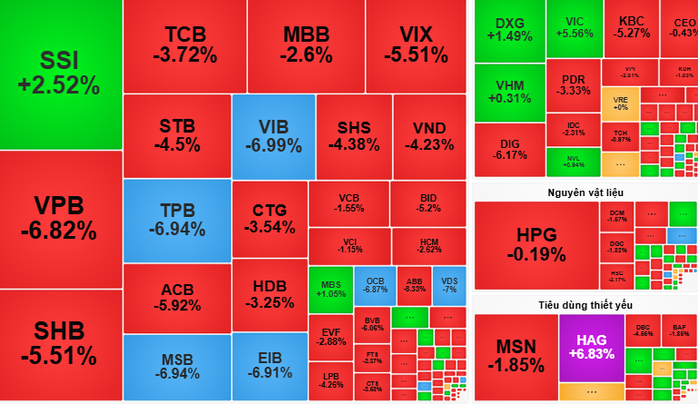

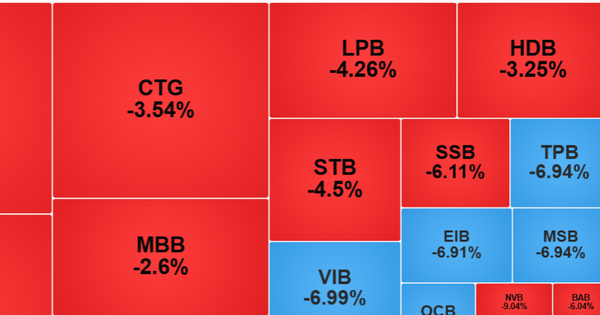

The VN-Index opened the trading session on August 25 with an increase of 8 points compared to the reference, thanks to the leadership of large-cap stocks such as VIC, VHM and SSI. However, profit-taking pressure quickly appeared, causing the index to gradually retreat to the 1,640-point mark. The banking group, including VPB,SHB , TCB and CTG, was under significant correction pressure after a series of hot price increases in the previous sessions.

In the afternoon session, the market continued to be in the red. Despite efforts to recover thanks to bottom-fishing demand in some banking stocks, selling pressure still prevailed. The decline spread to other sectors, causing the VN-Index to lose another 31 points at the close, down 1.91%, stopping at 1,614 points.

The entire HOSE (Ho Chi Minh City) recorded 233 stocks decreasing in price, overwhelming the 100 stocks increasing in price. Notably, the liquidity on this floor decreased, reflecting the cautious sentiment of investors, instead of panic selling.

Foreign investors also contributed to increasing pressure by increasing net selling with a total value of VND 1,715 billion, focusing on codes such as HPG, VPB and STB.

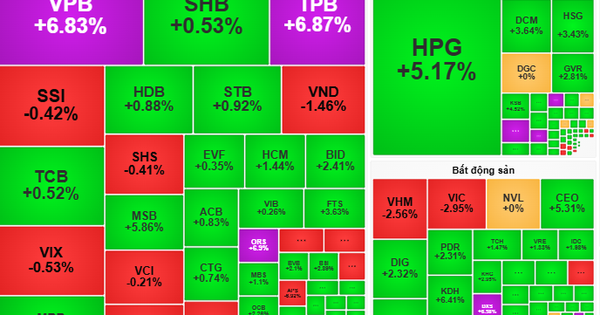

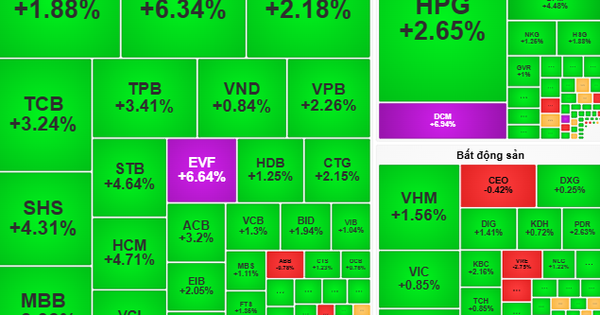

According to Vietcombank Securities Company (VCBS), VN-Index recorded the second consecutive sharp decline after many previous hot sessions. With the current developments, VCBS recommends that investors closely monitor market fluctuations and prioritize realizing profits from stocks that have increased sharply. The sharp declines in the session on August 25 could be an opportunity for investors to consider disbursing. Some notable industry groups include: real estate, securities and steel.

Dragon Capital Securities Company (VDSC) commented that the market could not recover and continued to decline. The decrease in liquidity compared to the previous session showed that profit-taking pressure was less intense, but still large enough to pull the VN-Index closer to the support zone of 1,600 points. VDSC expects that this zone will create good support force, helping the market recover in the trading session on August 26. If successful, the VN-Index may retest the resistance zone of 1,665 points in the near future.

Source: https://nld.com.vn/chung-khoan-ngay-26-8-co-hoi-thu-ve-loi-nhuan-tu-cac-co-phieu-tang-nong-196250825171633032.htm

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)