This is considered a solution that brings great benefits to both producers and consumers, and this proposal has received support from many experts and legislators. However, there are also many concerns about the possibility of increasing fertilizer prices when applying the new tax rate.

At the consultation seminar "Impact of applying 5% VAT rate on fertilizer industry" organized by Vietnam General Association of Agriculture and Rural Development, Vietnam Tax Consulting Association, Foreign Trade University on October 17, experts provided detailed data on the impact of switching fertilizer to apply 5% VAT rate.

Accordingly, the prices of domestically produced urea, DAP and phosphate fertilizers may decrease by 2%, 1.13% and 0.87% respectively, while NPK prices may increase slightly (0.09%) or remain unchanged. This shows that the imposition of a 5% VAT not only does not increase fertilizer prices but may also help reduce the prices of some domestically produced fertilizers.

National Assembly Delegate Trinh Xuan An shared his opinion at the seminar "Imposing value-added tax on fertilizers: For sustainable agricultural development" on November 17.

National Assembly Delegate Trinh Xuan An, Standing Member of the National Defense and Security Committee of the 15th National Assembly, said that there is no basis to assert that imposing a 5% VAT will increase fertilizer prices. He emphasized that it is necessary to have an objective and scientific view when assessing the impact of a 5% VAT, avoiding subjective and emotional views. According to him, returning fertilizers to a 5% VAT is completely reasonable in terms of scientific basis and will not have a negative impact on farmers.

The application of a 5% VAT on fertilizers is expected to bring many benefits to farmers. When the cost of domestically produced fertilizers decreases, the selling price of fertilizers has room to decrease, creating downward pressure on imported fertilizers. The current market structure, with domestic fertilizer consumption accounting for over 70% and imported fertilizer accounting for less than 30%, will allow domestic producers to lead the adjustment of the fertilizer market price level. This will bring great benefits to farmers, helping to reduce production costs and increase economic efficiency.

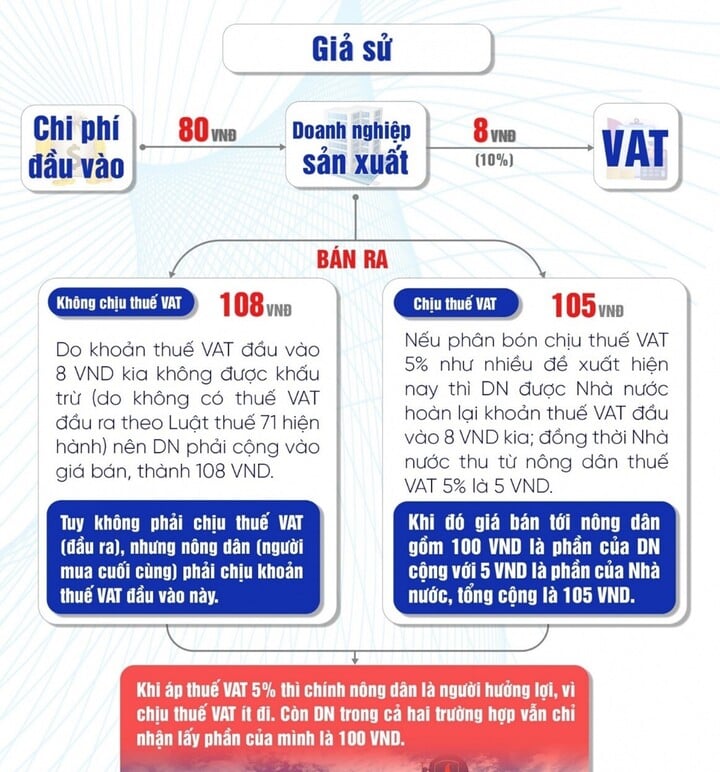

Mr. Nguyen Van Duoc, Standing Member of the Vietnam Tax Consulting Association, analyzed that if fertilizers are not subject to VAT, input VAT will not be deductible and will have to be included in the enterprise's expenses, increasing the cost of products. This will make the price of fertilizers to farmers higher. On the contrary, if a 5% VAT is applied, domestic production enterprises will have room to reduce prices, creating fair competition with imported fertilizers and promoting domestic production.

It is necessary to convert the 5% VAT rate on fertilizers to have room to reduce selling prices.

Economist, Associate Professor, Dr. Dinh Trong Thinh emphasized that applying a 5% VAT on fertilizers not only improves the quality of fertilizers but also increases the value of Vietnamese agricultural products, helping agriculture become a true pillar of the economy.

Countries around the world have preferential policies for agricultural production, and Vietnam needs to implement a reasonable VAT policy so that agriculture can take off. Mr. Thinh believes that switching fertilizers to a 5% VAT is necessary to improve fertilizer productivity and quality, meeting farmers' needs.

“ I am saddened to see that Vietnam’s fertilizer technology has not yet caught up with the world’s level, so I really hope that the National Assembly will make an accurate decision on fertilizer VAT, thereby improving the quality of fertilizers, increasing the value of Vietnamese agricultural products, and helping agriculture to truly be the pillar of the economy, ” said Associate Professor, Dr. Dinh Trong Thinh.

He hopes that the amended Law on VAT will change fertilizers to be subject to 5% VAT to transform resources to improve the productivity and quality of fertilizers, materials and equipment to meet farmers' needs.

Source: https://vtcnews.vn/ap-thue-gtgt-5-can-cu-giam-gia-phan-bon-ar908871.html

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/9f771126e94049ff97692935fa5533ec)

Comment (0)