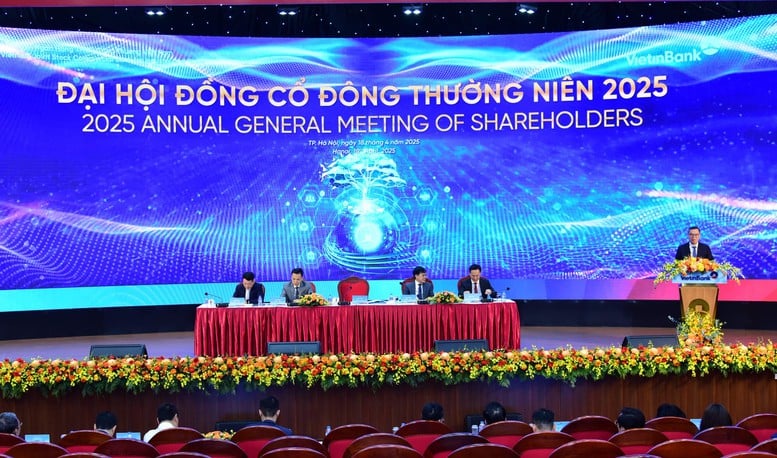

Annual General Meeting of Shareholders (AGM) 2025 - Photo: VGP/HT

This information was shared at the 2025 Annual General Meeting of Shareholders (AGM) organized by VietinBank on April 18 in Hanoi.

Solid growth, outstanding results in 2024

At the 2025 Annual General Meeting of Shareholders (AGM), Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank) approved many important contents. Reports from the Board of Directors, Executive Board and Supervisory Board all recorded positive results in 2024, along with major plans for finance, human resources and growth strategy for the coming period.

First of all, the Congress approved the audited financial report for 2024 and selected an independent auditing company for 2026. At the same time, shareholders also agreed to the plan to increase charter capital through the issuance of shares to pay dividends from the remaining profits of 2021, 2022 and the period 2009-2016. In addition, the profit distribution plan for 2024 and the listing of publicly issued bonds on the Hanoi Stock Exchange were also approved.

In addition, personnel issues also received considerable attention. The Congress unanimously dismissed Mr. Nguyen Duc Thanh - a member of the Board of Directors, and elected Mr. Nguyen Van Anh to the Board of Directors for the 2024-2029 term. In particular, the Supervisory Board was strengthened with 4 more members, including Mr. Dao Xuan Tuyen, Mr. Nguyen Hai Dang, Ms. Mai Huong Thao and Ms. Pham Thi Thu Huyen, creating a solid foundation for the next management period.

Looking back at 2024, VietinBank has recorded outstanding achievements. Total consolidated assets reached VND 2.39 million billion, up 17.4% compared to 2023. Similarly, consolidated outstanding credit reached VND 1.73 million billion, up 16.8%, with a stable and sustainable growth rate. Notably, the credit structure shifted positively, the proportion of small and medium enterprises and retail segments increased from 61.2% to 61.5%.

Not only that, capital mobilization reached nearly 1.76 million billion VND, an increase of 15.2%, of which CASA capital continued to increase strongly, reaching nearly 400 thousand billion VND - putting VietinBank in the Top 3 banks with the highest scale and CASA growth rate in Vietnam.

Regarding risk control, the bad debt ratio was kept at 1.1%, while the bad debt coverage ratio was up to 171.7% - showing the bank's initiative in preventing credit risks. Total operating income last year reached VND81.9 trillion, up 16.1%; individual pre-tax profit reached VND30.4 trillion, up 25% - exceeding 115% of the plan assigned by the General Meeting of Shareholders.

In particular, VietinBank always strives to effectively supply capital to the economy, through a series of preferential credit programs, supporting production and business, developing green credit and priority areas under the direction of the Government and the State Bank. Not only focusing on the central level, VietinBank also accompanies localities and key economic regions to promote regional growth.

Digital transformation continues to be identified by the bank as the fourth pillar, along with the three traditional pillars: core income growth, effective resource management, and exploitation of the ESG ecosystem. In 2024, the bank completed the "run-up" phase with 45 prioritized digital transformation initiatives. New products such as DigiGOLD, online disbursement and guarantee have helped optimize processes, reduce procedures, improve customer experience, and improve labor productivity.

Another highlight is the birth of the Digital Factory, operating under the Agile model, helping to shorten the time to market and continuously improve thanks to user feedback. VietinBank puts people at the center of transformation, continuously training, adding personnel, and spreading digital culture throughout the system.

VietinBank Chairman Tran Minh Binh speaks at the Congress - Photo: VGP/HT

2025 - A pivotal year for sustainable development strategy and banking modernization

VietinBank's leaders said: 2025 is identified by VietinBank as an acceleration period, playing a pivotal role in implementing the 2021-2025 Development Strategy, towards the 2030 goal. The bank's key orientations this year include 4 strategies: effective core income growth, improving customer engagement, optimal resource management and improving risk management capacity.

With great determination, VietinBank will transform more comprehensively in all aspects. The bank has completed a master plan for a comprehensive digital transformation program, focusing on deep digitalization of products and services, redesigning business processes and optimizing operations through data mining.

VietinBank General Director Nguyen Tran Manh Trung speaks at the Shareholders' Meeting - Photo: VGP/HT

According to a representative of VietinBank, the major goal this year is to realize the vision of becoming the leading modern, multi-functional and efficient bank in Vietnam and the region. To do that, the bank will maximize its internal strength while promoting dual transformation - including digital transformation and green transformation.

VietinBank also commits to continue to actively contribute to the country's economic development, ensuring timely and oriented capital supply. Not only that, the bank also focuses on bringing maximum benefits and sustainable value to shareholders - a vital factor to maintain trust and affirm the brand.

The financial targets for 2025 set by VietinBank are quite cautious but have clear orientations. Total assets are expected to grow by 8%-10%, outstanding credit is within the limit assigned by the State Bank, capital mobilization increases in line with credit, ensuring liquidity safety. The goal is to keep the bad debt ratio below 1.8%, pre-tax profit as approved by the management agency, and the dividend rate is flexibly adjusted, in accordance with regulations.

Updated to the end of the first quarter of 2025, the bank achieved positive results. Total assets increased by 3.9% compared to the end of 2024; outstanding credit increased by 4.7%; mobilized capital increased by 3.9%; bad debt ratio remained at 1.3%; pre-tax profit increased by about 6% compared to the same period. This is a positive signal, affirming that VietinBank is on the path of stable and effective growth right from the first months of the year.

Mr. Minh

Source: https://baochinhphu.vn/vietinbank-buoc-vao-giai-doan-tang-toc-doi-moi-chuyen-doi-phat-trien-ben-vung-102250418194331895.htm

![[Photo] Bustling construction at key national traffic construction sites](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

Comment (0)