|

| Foreign exchange rates today, January 29: USD, EUR, CAD, Yen, Japanese Pound, exchange rates... Waiting for the Fed meeting, the greenback is stable. (Source: Capital) |

The central foreign exchange rate between Vietnamese Dong (VND) and US Dollar (USD) on the morning of January 29 was announced by the State Bank at 24,036 VND/USD, unchanged compared to the weekend of January 27.

Domestic market:

USD exchange rate for buying is 24,425 VND/USD, selling is 24,765 VND/USD.

EUR exchange rate for buying is 26,242 VND/EUR and selling is 27,405 VND/EUR.

BIDV Bank:

USD exchange rate for buying is 24,460 VND/USD, selling is 24,770 VND/USD.

EUR exchange rate for buying is 26,251 VND/EUR, selling is 27,391 VND/EUR.

| STT | Currency code | Currency name | Bank rate commerce Buy | Bank rate commerce Sell | *State Bank exchange rate Apply import and export from 25/1- 31/1 |

| 1 | EUR | Euro | 26,242.13 | 27,405.62 | 26,098.98 |

| 2 | JPY | Japanese Yen | 163.18 | 170.99 | 162.45 |

| 3 | GBP | British Pound | 30,746.94 | 31,734.96 | 30,520.50 |

| 4 | AUD | Australian Dollar | 15,927.79 | 16,439.62 | 15,790.11 |

| 5 | CAD | Canadian Dollar | 17,971.96 | 18,549.47 | 17,842.29 |

| 6 | RUB | Russian Ruble | 262.91 | 291.06 | 271.97 |

| 7 | KRW | Korean Won | 17.66 | 19.27 | 17.95 |

| 8 | INR | Indian Rupee | 295.15 | 306.97 | 289.03 |

| 9 | HKD | Hong Kong Dollar (China) | 3,097.09 | 3,196.61 | 3,072.14 |

| 10 | CNY | Chinese Yuan China | 3,394.01 | 3,503.61 | 3,350.11 |

(Source: State Bank, Commercial Bank, Customs Department)

Exchange rate developments in the world market

In the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) stood at 103.47.

Forecast for the greenback trend this week, unchanged until January 31, the Euro is likely to fluctuate.

The greenback has just had a relatively quiet week in the currency market. Accordingly, the USD and US Treasury yields remained stable and range-bound last week. They may continue to remain stable in this range in the first half of the week until the results of the US Federal Reserve (Fed) meeting on January 31.

The Fed is likely to keep interest rates unchanged at 5.25-5.5% at its meeting this week. However, the market is closely watching the meeting for more information on the central bank's plans for future rate cuts. The meeting is unlikely to be an event for the currency market unless the Fed surprises with a rate cut or continues to maintain its high interest rate policy, exceeding market expectations. Some market players are expecting the Fed to start its rate cut cycle in March 2024.

The DXY index has been in the range of 102.75-103.85 for more than a week now. The short-term trend is positive for the USD. Thus, the possibility of this index breaking above 103.85 and rising above 104 is very high in the coming days. The index achieving a sustainable increase above 104 will be the driving force for the USD to continue to increase in price to the 105-105.30 range in the short term.

Conversely, a break below 102.75 could drag the DXY Index down to 102 – a key support level. The index would come under more downside pressure if it falls below 102. This could send the index back down to the 101-100 zone.

Elsewhere, the euro has been falling steadily over the past few weeks. The short-term downtrend remains intact. Resistance for the EUR/USD index lies in the 1.0900 - 1.0920 zone. The euro could fall to 1.0770 or 1.0730 this week.

Price action will then need to be closely watched. A bounce from the 1.0770 or 1.0730 level itself could send the EUR back up to 1.0900 again.

Source

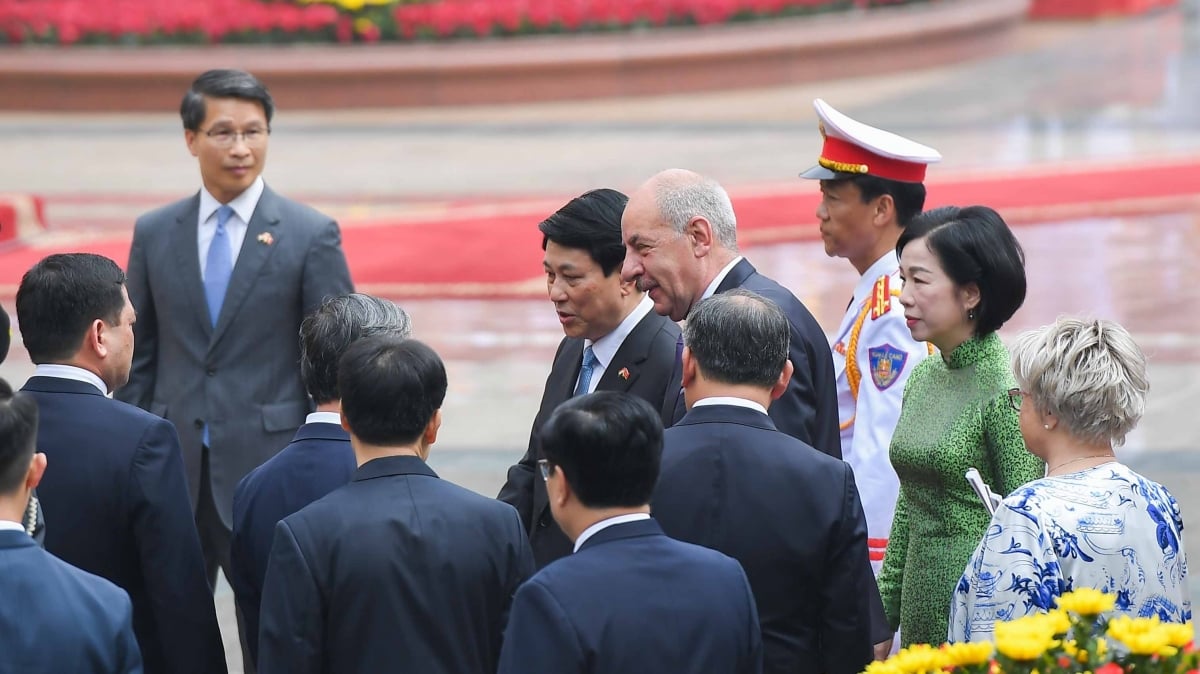

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)