On March 28, Vietnam Report announced the Top 10 Reputable Construction Materials Companies in 2025. The ceremony to honor the enterprises organized by Vietnam Report and VietNamNet Newspaper will take place in April 2025 in Hanoi .

Enterprises are filtered from the database of Vietnamese enterprises in Vietnam Report's ranking studies in the Construction Materials (VLXD) industry, with financial data updated to December 31, 2024, combined with the use of Media Coding method (coding press data on the media), surveying research subjects and stakeholders.

Construction Materials Industry 2024-2025: From recovery to finding new growth drivers

In 2024, Vietnam's construction materials industry will recover positively thanks to rapid urbanization, large-scale public investment and support policies, with crude steel output reaching 21.98 million tons (up 14%), cement reaching 91 million tons (up 2%), ceramic tiles reaching 450 million m² (up 15%), and sanitary ceramics reaching 14.5 million products (up 15%), although construction glass will decrease by 16% (147 million m²).

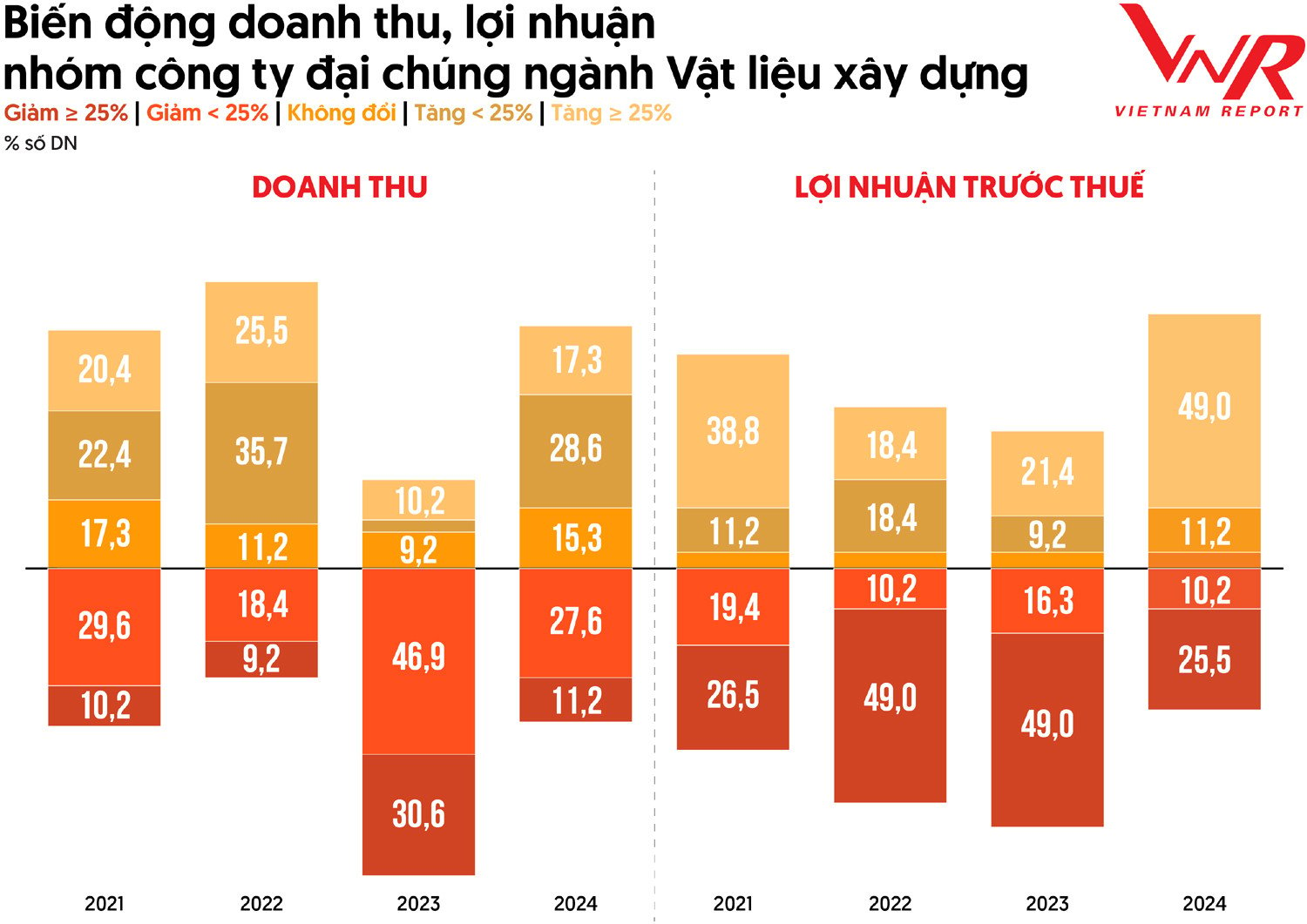

According to Vietnam Report, the business situation of construction materials enterprises has improved significantly, despite pressure from input material costs. The rate of enterprises with revenue reduction of over 25% decreased sharply to 11.2%, while the rate of enterprises achieving revenue growth increased to 45.9%. In terms of profit, 49.0% of enterprises recorded growth of over 25%.

However, price fluctuations remain a major challenge, with housing and construction material price indexes increasing by 26% from January 2019 to February 2025. Steel prices will increase by VND300,000-400,000/ton from August 2024, cement by VND50,000/ton, while sand and stone prices will increase due to mining restrictions. By early 2025, construction material prices will be more stable, creating conditions for construction projects to recover, but businesses still need to find new growth drivers.

According to Vietnam Report's business survey, the six main drivers of industry growth in the 2021-2025 period include: Promoting public investment, improving infrastructure (84.6%); Government support policies (61.5%); Economic recovery (61.5%); Developing new product lines, diversifying business activities (53.8%); Rapid urbanization (46.2%); Strong increase in FDI inflows into Vietnam (38.5%).

In addition to domestic growth factors, the export market is opening up great potential for the industry. After 5 years of being affected by the US-China trade war, Vietnam has taken advantage of its geopolitical advantages to become a new strategic destination for US and Western businesses. Although the capacity of Vietnam's construction materials industry is still small compared to the global scale, the export potential is still outstanding with the strong increase in infrastructure demand. According to a survey by Vietnam Report, 45.7% of enterprises assessed the export potential from high to very high, with 92.3% planning to expand abroad in the next 1-3 years, mainly to Asian markets (45.0%), Americas (26.7%) and Europe (23.1%).

Also according to Vietnam Report, the 5 priority strategies of construction materials enterprises in the period of 2024-2025 include: Promoting investment and developing technology applications; Focusing on building brand image and marketing; Enhancing social responsibility, promoting sustainable development; Restructuring enterprises, streamlining human resources; Strengthening risk management, especially financial management.

Breaking down barriers, paving the way for green materials

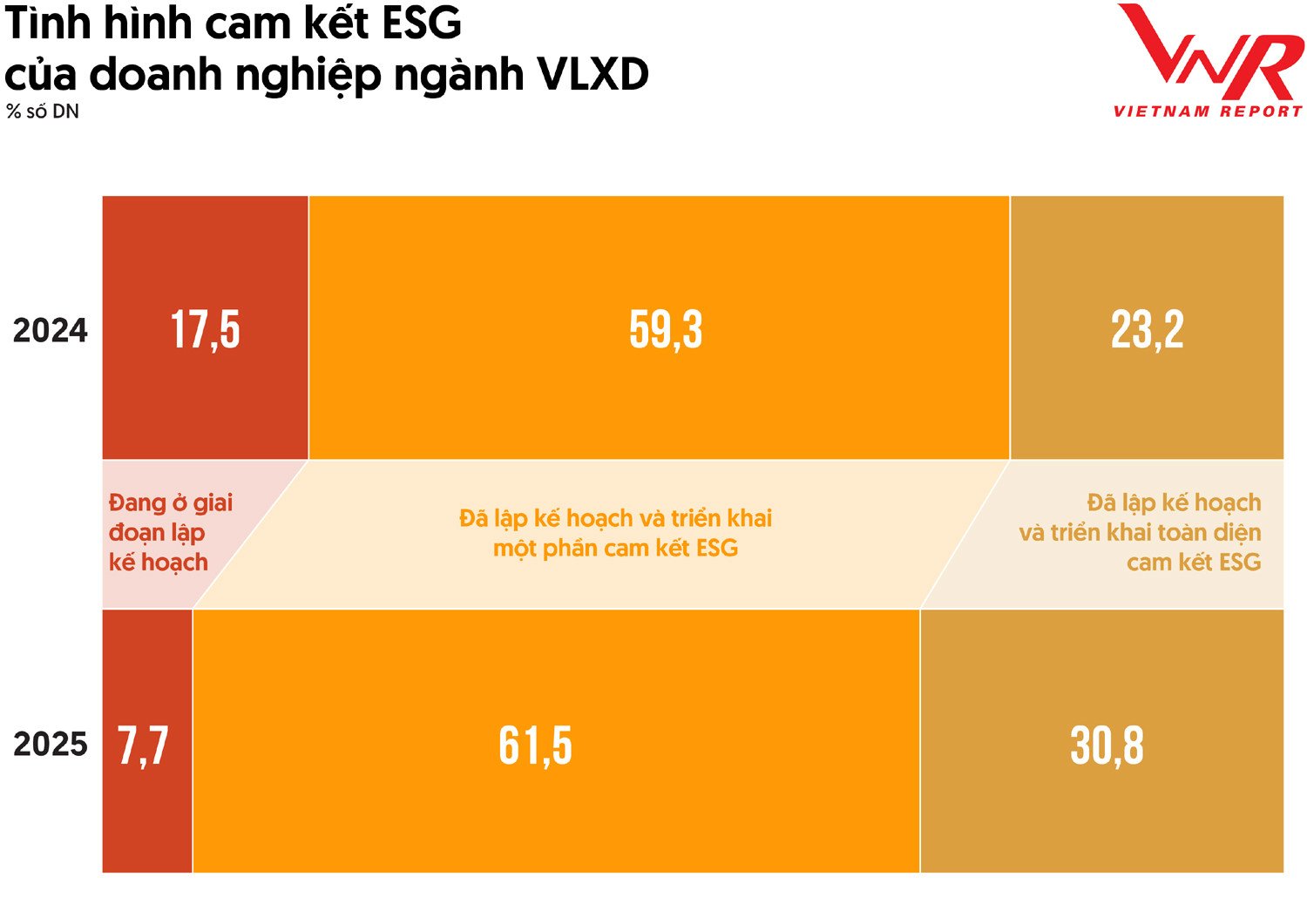

Green transformation is not only a trend but also a strategic requirement. The proportion of enterprises prioritizing CSR and sustainable development will increase from 61.5% in 2024 to 76.9% in 2025, demonstrating a long-term strategic vision to meet ESG (environmental, social, governance) standards.

With the increasing urbanization and construction demand, Vietnam's construction materials industry is facing great pressure to balance economic growth and environmental protection. Although some remarkable results have been achieved, the green transformation process in the industry still has many limitations, requiring concerted efforts from stakeholders.

According to a survey by Vietnam Report, the biggest barriers to ESG implementation today are: The legal framework is not transparent and clear (53.8%); There is not enough information (46.2%); Financial limitations (38.5%); Employees lack knowledge and expertise in ESG (30.8%); Limited business scale (30.8%)...

On the other hand, in recent years, the change in consumption behavior of construction materials and interiors has been quite obvious. Previously, people's basic needs focused on owning houses, means of transportation and essential living conditions. However, Vietnam is entering a new economic cycle, with the middle class expected to increase sharply, leading to a shift in consumption behavior from focusing on ownership to improving the quality of life. In particular, the younger generation - currently accounting for about 47% of the population - is expecting more from living space instead of simply owning a house.

In addition to aesthetics and convenience, consumers are increasingly paying attention to the sustainability of building materials and interiors. Products not only need to be durable and beautiful, but also environmentally friendly. This trend reflects the community's growing awareness of environmental protection, and at the same time requires the building materials industry to meet green standards, contributing to building a more sustainable market.

Thuy Nga

Source: https://vietnamnet.vn/top-10-cong-ty-vat-lieu-xay-dung-uy-tin-nam-2025-2385435.html

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)