According to data just released by the State Bank of Vietnam (SBV) Region 1, credit activities in Hanoi in the first quarter of 2025 have recorded positive signals. In the context of the economy still facing many potential challenges, the stable growth of credit shows the continuous efforts of credit institutions (CIs) in unblocking capital flows into the economy, especially in key sectors.

|

| Banks actively support people and businesses to access capital |

Regarding capital mobilization activities, the report shows that the mobilized capital of credit institutions in the area continues to grow, ensuring to meet credit needs and comply with regulations on safety ratios. By the end of March 2025, the total mobilized capital is estimated at VND 6,092,162 billion, an increase of 0.54% compared to the end of 2024. This growth shows that the trust of people and businesses in the banking system is still maintained, while creating a solid foundation for credit activities in the coming time. The liquidity situation of credit institutions in the area is also assessed to be guaranteed, creating stability for the entire system.

The bright spot in the credit picture in the first quarter of 2025 is the impressive growth in total outstanding loans. Following the direction and management orientation of the State Bank of Vietnam, credit institutions in Hanoi have proactively implemented many preferential credit programs and packages, applying flexible interest rate policies to support businesses in accessing capital sources. Special attention is paid to production and business sectors, priority sectors according to the Government's policies.

The total outstanding debt of credit institutions in the area by the end of March 2025 is estimated at VND 4,610,024 billion, an increase of 2.32% compared to December 31, 2024. This growth rate shows that credit capital has been effectively channeled into the economy, supporting businesses to expand production and business activities, creating momentum for local economic growth.

Notably, credit quality in the area is still well controlled. It is estimated that by the end of March 2025, the bad debt ratio of credit institutions accounted for 1.79% of total outstanding debt, remaining below the permitted threshold of 3%. This shows that credit institutions have been cautious in credit granting activities, ensuring the safety and efficiency of capital sources.

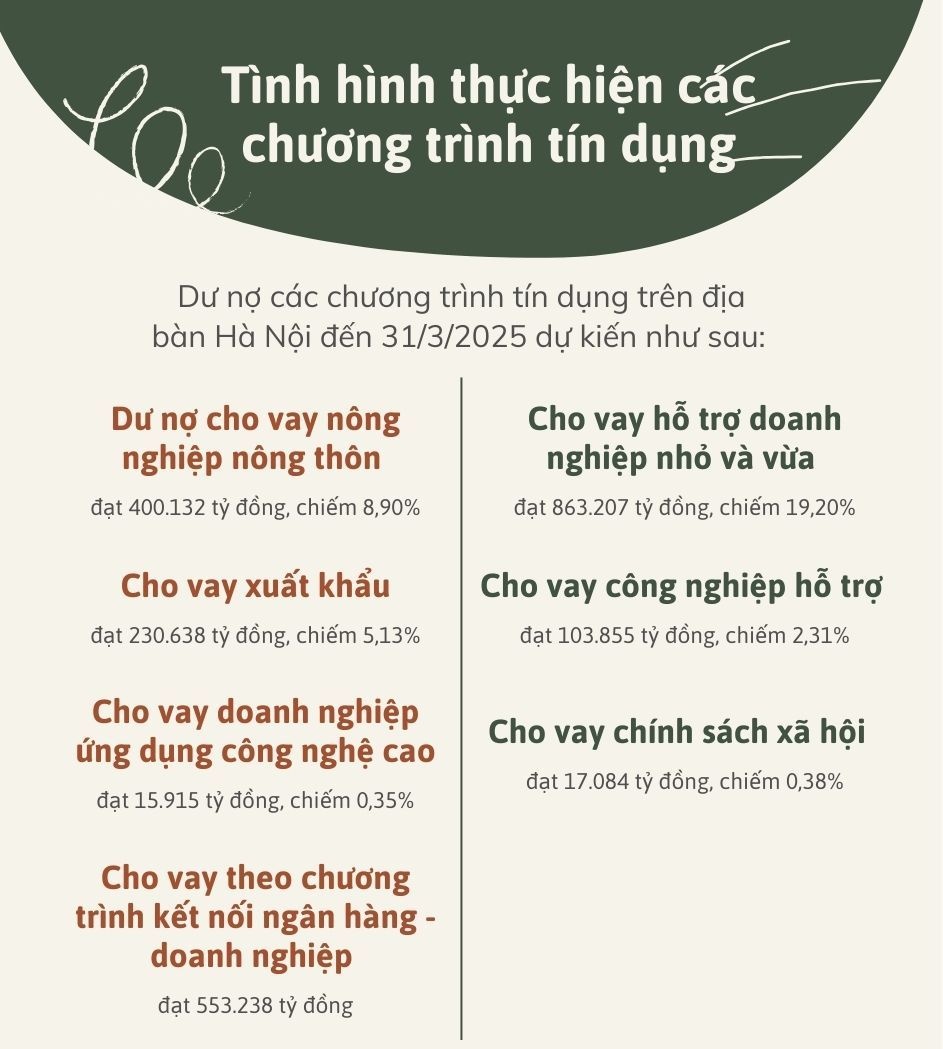

The credit growth results in the first quarter of 2025 are a positive signal, showing the recovery and adaptation of the economy, as well as the proactive and effective management of monetary policy by the State Bank and the operations of credit institutions. The concentration of capital resources on production and business sectors and priority programs will continue to create momentum for economic growth in the following quarters. As of March 31, 2025, outstanding credit programs reached encouraging figures, demonstrating the active participation of the banking system in implementing the Government's policies and guidelines.

|

| Credit focused on priority areas |

Mr. Nguyen Quoc Huy, Deputy Director of the State Bank of Vietnam, Region 1 Branch, said that in the coming time, the State Bank of Vietnam, Region 1 will direct credit institutions to practically and effectively implement support solutions, creating favorable conditions for customers to access bank credit capital on the basis of reviewing, simplifying and shortening procedures, enhancing the application of technology and digital transformation to speed up the speed and time of processing customer requests, along with strictly complying with legal regulations to ensure operational safety, continuing to reduce costs to reduce lending interest rates; at the same time, actively implementing bank-enterprise connection activities in appropriate forms to promptly grasp and remove difficulties and problems of customers; Promote the implementation of credit lending programs for investors and home buyers of social housing projects, worker housing projects, projects to renovate and rebuild old apartments according to Resolution No. 33/NQ-CP of the Government, credit programs for the forestry and fishery sectors and other credit programs. Thereby maintaining stable credit growth momentum and strongly supporting the development of the business community and the economy of the capital in particular and the whole country in general in 2025.

|

| Banks promote simplification and shortening of procedures |

Source: https://thoibaonganhang.vn/tin-dung-ha-noi-quy-1-tang-truong-on-dinh-tap-trung-vao-cac-linh-vuc-uu-tien-162362.html

![[Infographic] Cross exchange rates of Vietnamese Dong with some foreign currencies to determine taxable value from May 1-7](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/2/e4631afaeaf54451b5132f3c5d3341cd)

![[Photo] Thousands of Buddhists wait to worship Buddha's relics in Binh Chanh district](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/3/e25a3fc76a6b41a5ac5ddb93627f4a7a)

Comment (0)