Saving for 6 months or 1 year depends on each customer's saving purpose. Saving for 6 months has the advantage of time to complete the payment, while saving for 12 months is highly appreciated for its interest rate.

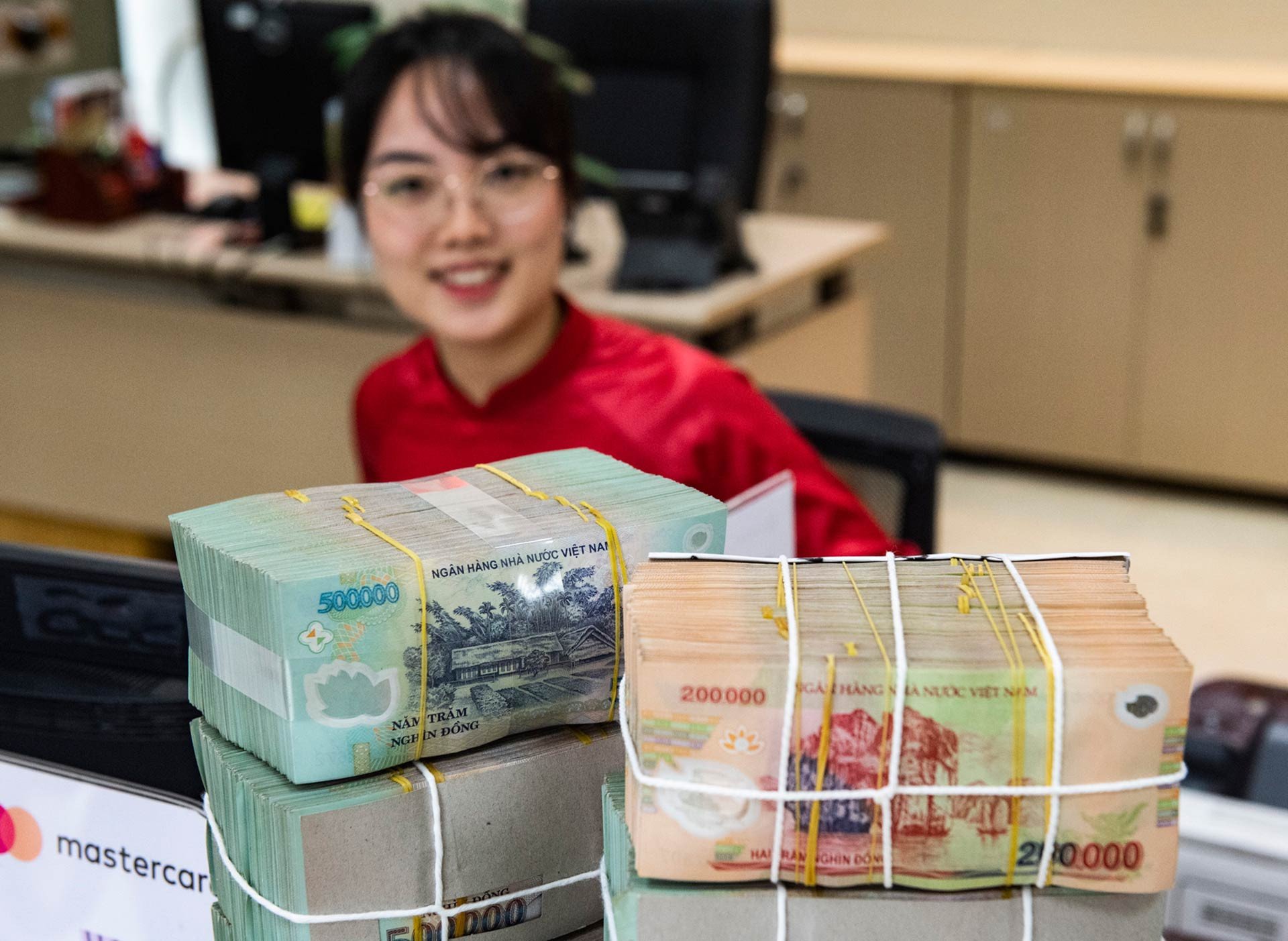

Savings is a form of investment chosen by many people. Banks have many different deposit terms for customers to choose from, from short-term 1 week, 2 weeks, 1 month, 3 months, 6 months,... to long-term 1 year, 2 years, 3 years. The last day of each term is called the maturity date.

Of which, 6-month and 1-year terms are often chosen the most by customers.

However, many people wonder whether they should save for 6 months or 1 year to receive good interest rates?

The difference between 6-month and 1-year term deposits

The biggest difference between a 6-month and 12-month term deposit is the maturity date and interest rate.

6-month term deposit is suitable for customers who have idle money for 6 months or those who have investment plans in the near future, want to take advantage of high interest rates to gain more profit within 6 months.

The 6-month term interest rate for online deposits of banks currently ranges from 2.9-5.5%/year (interest rates may change from time to time and depending on each bank).

Meanwhile, a 1-year term deposit is suitable for people who have money that they do not need to use for a long time, from 12 months or more, and want to save to earn a high and safe profit. This term is suitable for people with a stable income, who already have another separate amount of money to reserve for urgent cases without having to withdraw money from savings.

The 12-month term interest rate of banks for online deposits currently ranges from 4.6-6.05%/year (varies by period and bank).

It can be seen that 6-month savings have the advantage of time to pay off, while 12-month savings are highly appreciated because of good interest rates.

Depositing money for a 6-month term helps customers reduce the risk of early payment when they need money urgently. In addition, customers can also predict, calculate and change their savings orientation more easily. However, the interest rate received will not be as high as the 12-month term.

A 12-month term offers a higher interest rate than a 6-month term. However, when choosing to deposit savings with a long term of up to 12 months, customers need to make sure they have idle money for at least 1 year to avoid losing interest when withdrawing early.

Should I save for 6 months or 1 year?

To choose whether to deposit savings for a 6-month or 1-year term, customers should base their decision on their financial ability and money needs.

If you intend to use the money in the short term, customers should deposit for a term of 6 months to be able to rotate capital when necessary.

On the contrary, if there is idle money that is not used, customers can deposit for a 1-year term to receive a high interest rate.

Depositors should choose the savings term based on market interest rates. Customers can flexibly change the savings term based on market interest rate fluctuations to receive the most profit in each period.

If the market interest rate tends to increase, customers can choose a 6-month term, then close and continue to deposit for another 6 months to enjoy higher profits. On the contrary, if the market interest rate tends to decrease, depositors should choose a 12-month term to enjoy the best interest rate.

In case of uncertainty about future money needs, customers can divide money into two savings accounts. One part is deposited for 1 year to receive higher interest rate. One part is deposited for 6 months to be able to withdraw the principal or pay off in a short time, in case of emergency.

With a 1-year deposit term, when it matures, customers should complete the final settlement procedure regardless of whether they decide to withdraw or continue depositing. This helps depositors control the principal and interest after each deposit term.

When deciding to deposit savings in a bank, customers need to pay attention to interest rates as well as accompanying services to increase deposit benefits.

(article compiled from information sources on Techcombank's website)

Source: https://vietnamnet.vn/nen-gui-tiet-kiem-6-thang-hay-1-nam-de-huong-lai-suat-tot-nhat-2380522.html

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Infographic] Cross exchange rates of Vietnamese Dong with some foreign currencies to determine taxable value from May 1-7](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/2/e4631afaeaf54451b5132f3c5d3341cd)

![[Photo] Ha Giang: Many key projects under construction during the holiday season](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/8b8d87a9bd9b4d279bf5c1f71c030dec)

Comment (0)