According to the current Personal Income Tax Law, taxable income includes 10 types.

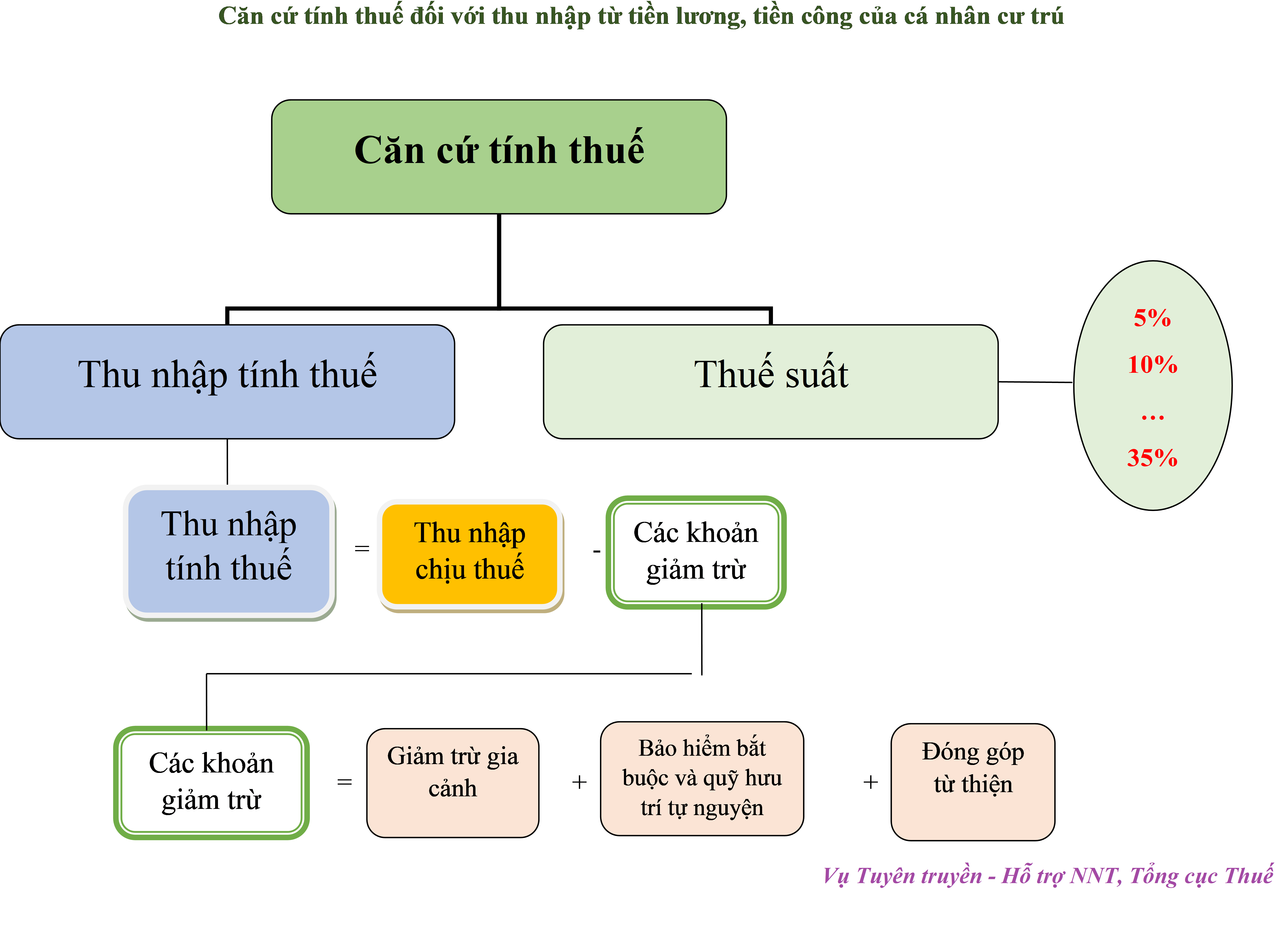

According to the General Department of Taxation ( Ministry of Finance ), each type of income has a method for determining taxable income and applying tax rates according to the appropriate tax table. For income from salaries and wages of resident individuals, the basis for calculating tax is taxable income and tax rates, determined as follows:

Personal income tax rates on income from salaries and wages are applied according to the progressive tax schedule prescribed in Article 22 of the Law on Personal Income Tax, specifically:

Tax level | Taxable income/year (million VND) | Taxable income/month (million VND) | Tax rate (%) |

1 | Up to 60 | Up to 5 | 5 |

2 | Over 60 to 120 | Over 5 to 10 | 10 |

3 | Over 120 to 216 | Over 10 to 18 | 15 |

4 | Over 216 to 384 | Over 18 to 32 | 20 |

5 | Above 384 to 624 | Over 32 to 52 | 25 |

6 | Above 624 to 960 | Over 52 to 80 | 30 |

7 | Over 960 | Over 80 | 35 |

For family deductions, taxpayers are entitled to a personal deduction of VND 11 million/month (VND 132 million/year); the deduction for each dependent is VND 4.4 million/month.

For personal income tax settlement in 2023, organizations and individuals paying income should note that the deadline is April 1st at the latest.

For individuals directly settling personal income tax, the latest deadline is the last day of the 4th month from the end of the calendar year; the last day of the 4th month from the end of the calendar year is April 30, 2024 and the next day is May 1, 2024 (Holiday), so the latest deadline for individuals directly settling personal income tax is May 2, 2024.

In case an individual has a personal income tax refund but is late in submitting the tax settlement declaration as prescribed, the administrative penalty for late tax settlement declaration will not be applied.

Things to know for individuals directly settling personal income tax

Nowadays, with the support of information technology applications, taxpayers can easily declare and pay taxes on a digital platform. Individuals can fulfill their tax obligations directly on the General Department of Taxation's Electronic Information Portal at https://thuedientu.gdt.gov.vn or the National Public Service Portal at https://dichvucong.gov.vn or directly on mobile devices via the eTax Mobile application.

According to the Law on Tax Administration, some cases where individuals with income from salaries and wages need to directly settle taxes are regulated as follows:

Firstly, resident individuals with income from salaries and wages from two or more places who do not meet the conditions for authorized settlement as prescribed must directly declare and settle personal income tax with the tax authority if there is additional tax payable or if there is excess tax paid and request for refund or offset in the next tax declaration period.

In case a resident individual has income from salary or wages and is authorized to settle the income for the organization or individual paying the income, including:

- Individuals with income from salaries and wages who sign labor contracts for 3 months or more at one place and are actually working there at the time the organization or individual paying the income makes tax settlement, even if they do not work for 12 months in a year.

In case an individual is an employee transferred from an old organization to a new organization according to the provisions of Point d.1, Clause 6, Article 8 of Decree 126/2020/ND-CP, the individual is authorized to settle taxes for the new organization.

- Individuals who have income from salaries and wages who sign labor contracts for 3 months or more at one place and are actually working there at the time the organization or individual pays the income and makes tax settlement, including cases where they do not work for 12 months in the year; at the same time, they have miscellaneous income from other places with an average monthly income of no more than 10 million VND in the year and have had personal income tax deducted at a rate of 10% if there is no request for tax settlement for this income.

Second, if an individual is present in Vietnam for less than 183 days in the first calendar year, but is present in Vietnam for 183 days or more in 12 consecutive months from the first day of presence in Vietnam, then the first settlement year is 12 consecutive months from the first day of presence in Vietnam.

Third, foreign individuals who have terminated their employment contracts in Vietnam must declare and settle their taxes with the tax authorities before leaving the country. In cases where individuals have not completed tax settlement procedures with the tax authorities, they must authorize the income-paying organization or another organization or individual to settle their taxes in accordance with the regulations on tax settlement for individuals. In cases where the income-paying organization or another organization or individual receives authorization to settle their taxes, they must be responsible for the additional personal income tax payable or be refunded the excess tax paid by the individual.

Fourth, resident individuals with income from salaries and wages paid from abroad and resident individuals with income from salaries and wages paid from international organizations, embassies and consulates that have not deducted tax in the year must directly settle with the tax authority. If there is additional tax payable or excess tax paid, they must request a refund or offset in the next tax declaration period.

Fifth, resident individuals with income from salaries and wages who are eligible for tax reduction due to natural disasters, fires, accidents, or serious illnesses that affect their ability to pay taxes must not authorize organizations or individuals paying income to make tax settlements on their behalf, but must directly declare and settle taxes with tax authorities according to regulations.

In addition, the place to submit tax settlement declaration is specified as follows:

- Individuals residing in one place with salary and wage income and subject to self-declaration of tax during the year shall submit tax finalization declaration dossiers to the tax authority where the individual directly declares tax during the year according to the provisions of Point a, Clause 8, Article 11 of Decree No. 126/2020/ND-CP. In case an individual has salary and wage income at two or more places, including cases where both income is subject to direct declaration and income deducted by the paying organization, the individual shall submit tax finalization declaration dossiers to the tax authority where the largest source of income is in the year. In case the largest source of income in the year cannot be determined, the individual shall choose to submit the finalization dossier at the tax authority directly managing the paying organization or the place where the individual resides.

- Resident individuals with salary and wage income subject to deduction at source from two or more paying organizations must submit tax finalization declaration documents as follows:

+ Individuals who have calculated family deductions for themselves at an organization or individual paying income shall submit their tax finalization declaration to the tax authority directly managing the organization or individual paying that income. In case an individual changes their workplace and the organization or individual paying the last income calculates family deductions for themselves, they shall submit their tax finalization declaration to the tax authority managing the organization or individual paying the last income. In case an individual changes their workplace and the organization or individual paying the last income does not calculate family deductions for themselves, they shall submit their tax finalization declaration to the tax authority where the individual resides. In case an individual has not calculated family deductions for themselves at any organization or individual paying income, they shall submit their tax finalization declaration to the tax authority where the individual resides.

+ In case a resident individual does not sign a labor contract, or signs a labor contract for less than 03 months, or signs a service provision contract with income at one or more places where 10% has been deducted, the tax finalization declaration must be submitted to the tax authority where the individual resides.

+ Individuals residing in the year with income from salary or wages at one or many places but at the time of settlement do not work for any organization or individual paying income, the place to submit tax settlement declaration is the tax authority where the individual resides.

- Resident individuals with income from salaries and wages who are subject to direct personal income tax settlement with the tax authority and have a dossier requesting tax reduction due to natural disasters, fires, accidents, or serious illnesses, the place to submit the tax settlement dossier is the tax authority where the individual submitted the tax reduction dossier. The tax authority processing the tax reduction dossier is responsible for processing the tax settlement dossier according to regulations.

Wisdom

Source

![[Photo] President Luong Cuong attends special political-artistic television show "Golden Opportunity"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/44ca13c28fa7476796f9aa3618ff74c4)

Comment (0)