Expanding the scope and lending objects

Implementing the Government's direction on focusing on removing difficulties to promote production and export for the Forestry and Fisheries sectors, in July 2023, the State Bank of Vietnam deployed a VND 10 trillion credit package to support customers in this sector. The goal is to help people and businesses overcome difficulties, produce and do business effectively, contributing to promoting local economic growth.

|

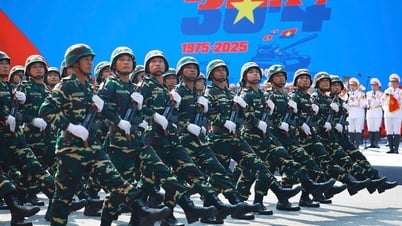

Officers of the Bank for Agriculture and Rural Development, Bo Ha Branch - Bac Giang II, grasp the situation of loan capital use of the forest product processing facility in Bo Ha town (Yen The). |

The capital for the program is self-mobilized by banks. The borrowers are customers with projects and plans for production and business activities in the forestry and fishery sectors that meet all the prescribed conditions. The lending interest rate is at least 1-2%/year lower than the average interest rate of the same term applied by the lending bank in each period.

| In addition to participating in the preferential credit package of 100 trillion VND, the system of credit institutions in the province has focused on implementing a number of other credit programs in the agricultural and rural sectors with preferential interest rates. As of March 31, 2025, outstanding loans for the agricultural, forestry and fishery sectors in the province reached more than 16.4 trillion VND; an increase of 3.9% compared to the end of 2024, accounting for 13.2% of the total outstanding credit balance of the province. |

Implementing the program, 15 commercial banks nationwide have registered to participate in the program with an increasingly expanding credit scale and very high lending turnover. Based on the results achieved, on April 15, the State Bank of Vietnam continued to issue a document requesting commercial banks to implement the preferential credit program in the direction of expanding the scope and participants. Accordingly, the subjects eligible for preferential loans, in addition to customers producing and trading forestry and aquatic products, also include customers in the agricultural sector. The program will be implemented until the credit package reaches 100 trillion VND.

In Bac Giang, the program was deployed by the State Bank of Vietnam Provincial Branch (now merged into the State Bank of Vietnam Region 5) to credit institutions in the area. According to the representative of the State Bank of Vietnam Region 5, Bac Giang has 12 branches of commercial banks participating in this program. However, due to many reasons, the results of the program implementation are still limited. After more than 1 year of implementation, the whole province has only the Bank for Agriculture and Rural Development, Bac Giang Branch II, actively implementing the credit package of 10 trillion VND, helping many customers to produce and do business effectively.

Promote propaganda and guidance

After more than 1 year of implementing the credit package, as of March 31, 2025, the Bank for Agriculture and Rural Development, Bac Giang II Branch, has provided loans to more than 300 customers with a disbursement turnover of more than 1,000 billion VND, the current outstanding debt is nearly 280 billion VND. The customers mainly borrow to meet the needs of exploitation, purchase, consumption, processing, and preservation of forest products...

In which, the branches of the lending unit are the Bank for Agriculture and Rural Development, Bo Ha Branch - Bac Giang II, lending capital to 212 customers, disbursement turnover is nearly 325 billion VND, current outstanding debt is 101 billion VND; the Bank for Agriculture and Rural Development, Lang Giang Branch - Bac Giang II, lending 426 billion VND to 66 customers, current outstanding debt is 119 billion VND... This shows that the Bank for Agriculture and Rural Development, Bac Giang II Branch has directed capital flow to the right areas and subjects in need.

Mr. Luu The Manh, Deputy Director of the Bank for Agriculture and Rural Development, Bo Ha Branch - Bac Giang II, informed: "The above results were achieved because the unit paid attention to promoting and introducing credit packages to customers, especially forestry production establishments. Accompanying customers to set up documents as well as removing difficulties and obstacles in the production and business process, ensuring timely disbursement of loans and effective use".

Mr. Nguyen Xuan The, Deo Ca village, Dong Huu commune (Yen The) borrowed 6.8 billion VND from the Bank for Agriculture and Rural Development, Bo Ha Branch - Bac Giang II to serve wood processing activities. He said: "My family enjoys a preferential interest rate of more than 6%/year, about 2% lower than the normal interest rate. Thanks to this preferential loan, my family has been able to equip more machines and means for effective production, moving towards expanding the scale of production."

In addition to the Bank for Agriculture and Rural Development, Bac Giang II Branch, other commercial bank branches in the province have been interested in implementing the above preferential credit package but have reached very few customers in need. Mr. Nguyen Trung Kien, Director of the Vietnam Joint Stock Commercial Bank for Investment and Development - Bac Giang Branch, said that lending for agricultural, forestry and fishery development is the area in which the unit prioritizes capital investment. However, the implementation of this credit package by the Branch has encountered difficulties in approaching and connecting with customers in need of loans. Because the unit cannot organize investigations and surveys to grasp the actual needs of customers in regions and localities, especially in places where the forest product processing industry is strongly developed, the unit does not have transaction offices such as Yen The, Son Dong, etc.

According to preliminary statistics from the Department of Agriculture and Environment, there are currently more than 1,000 establishments trading, processing and preserving forest products in the province (of which more than 900 establishments are households and individuals); about 860 cooperatives, cooperative groups and more than 580 farms. Notably, most of the wood processing establishments, cooperatives, cooperative groups and farms have outdated processing and production technology, and monotonous product designs due to limited investment capital. Therefore, continuing to implement the preferential credit package of 100 trillion VND in the field of agriculture, forestry and fishery will create conditions for establishments, businesses and households to access capital, expand their scale, equip more modern machinery and means to improve product quality, increase competitiveness in the market and improve economic efficiency.

However, in order for this credit package to reach the right customers in need, the State Bank and credit institutions in the area, the Department of Agriculture and Environment, relevant units and local authorities need to continue to coordinate to promote propaganda and dissemination of the preferential credit package; review and investigate to grasp the needs of each region and customer as well as the problems and difficulties arising during the implementation process, creating conditions for commercial banks to effectively implement credit support for the development of agriculture, forestry and fishery, ensuring the program's objectives.

Source: https://baobacgiang.vn/mo-rong-goi-tin-dung-uu-dai-cho-nong-nghiep-postid417044.bbg

![[Photo] Ha Giang: Many key projects under construction during the holiday season](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/8b8d87a9bd9b4d279bf5c1f71c030dec)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] Feast your eyes on images of parades and marching groups seen from above](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/4/30/3525302266124e69819126aa93c41092)

Comment (0)