(GLO)- The Government issued Decree 37/2023/ND-CP on the establishment, organization and operation of the Farmers Support Fund. Accordingly, the Farmers Support Fund is a non-budgetary state financial fund, under the Farmers' Association at all levels; operating not for profit, preserving and developing capital. This Decree takes effect from August 8, 2023.

The Farmers Support Fund has legal status, charter capital, seal, and is allowed to open accounts at the State Treasury, the Vietnam Bank for Social Policies, and commercial banks operating legally in Vietnam in accordance with the law. The Farmers Support Fund fulfills its obligations to the state budget in accordance with the law on taxes and other relevant legal regulations.

|

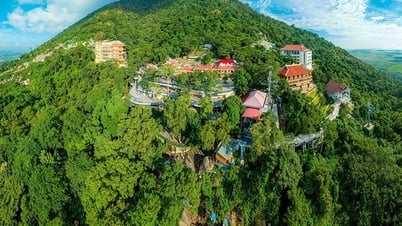

With a loan from the Farmers' Support Fund, Ms. Tran Thi Bich (Kdau village, Kong Long Khong commune) expanded her pineapple growing area to increase her income. Photo: Minh Nguyen |

The operating principles of the Farmers Support Fund are financial autonomy, not for profit, openness, transparency, capital preservation and development; limited liability within the scope of the Farmers Support Fund's equity capital; performing the assigned functions and tasks in accordance with the provisions of law. At the same time, the Farmers Support Fund operates with the goal of supporting members of the Vietnam Farmers' Union to build and replicate effective production and business models, contributing to increasing income and improving the lives of farmers; creating resources, conditions and tools to unite and gather farmers into the association, contributing to building the association and the farmers' movement.

According to the Decree, the functions and tasks of the Farmers Support Fund are to receive and manage the charter capital allocated from the state budget according to the provisions of this Decree and relevant laws; mobilize sources of support, sponsorship, and non-refundable aid for the activities of the Farmers Support Fund; and lend capital to members of the Vietnam Farmers' Association to build and replicate production and business models.

Receive loan entrustment from domestic and foreign organizations and individuals according to the provisions of law; entrust the lower-level Farmers Support Fund to perform lending tasks according to the provisions of this Decree and relevant laws; perform other tasks assigned by competent authorities according to the provisions of law.

Borrowers of the Farmers Support Fund are members of the Vietnam Farmers' Association who need to borrow capital to develop production and business in the agricultural sector.

According to the Decree, the conditions for borrowing capital from the Farmers Support Fund are: borrowers must be eligible for loans according to regulations, have full civil capacity according to the provisions of law; borrowers must be confirmed by the People's Committee of the commune level to be residing in the locality where the Farmers Support Fund lends capital at the time of requesting a loan from the Farmers Support Fund; the purpose of using the loan is legal; the borrower's loan plan must be compiled into a common plan of the group of Farmers' Association members who produce and trade the same type of product, in the same commune level area.

The loan plan of each customer and the general plan of the Farmers' Association members group are assessed by the Farmers' Support Fund as feasible and capable of repaying the loan; at one point in time, a customer can only borrow capital from one general plan of the Farmers' Association members group from the Farmers' Support Fund; members of the same household are not allowed to have outstanding loans at the Farmers' Support Fund at the same time; other lending conditions are specifically stipulated in the internal regulations on lending and debt management of the Farmers' Support Fund issued by the Farmers' Support Fund Management Boards at all levels in accordance with the provisions of this Decree.

The loan term for each customer's plan and the general plan of the Vietnam Farmers' Association members at the Farmers' Support Fund is determined based on the capital recovery ability, in accordance with the production and business cycle, and the customer's debt repayment ability, but not exceeding 5 years (excluding the debt extension period).

The specific loan term for each customer's plan and the general plan of the Farmers' Association members group will be considered and decided by the Farmers' Support Fund. The total maximum debt extension period shall not exceed 1/2 of the loan term in the first signed Credit Contract.

The loan interest rate of the Farmers Support Fund is determined in each period, according to the principle of ensuring adequate compensation for management costs and other costs related to lending activities. Based on the principle of determining the loan interest rate, the Management Board decides on the specific loan interest rate of the Farmers Support Fund in each period. The currency for lending and debt collection is Vietnamese Dong (VND).

Source link

![[Photo] President Luong Cuong and Sri Lankan President Anura Kumara Dissanayaka visit President Ho Chi Minh relic site](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/0ff75a6ffec545cf8f9538e2c1f7f87a)

Comment (0)