An Cuong Wood (ACG) issues 14.9 million shares to pay 2022 dividend at 11% rate

An Cuong Wood Joint Stock Company (Code: ACG) has just announced the Board of Directors' Resolution approving the implementation of the plan to issue shares to pay dividends in 2022 at a rate of 11%. Correspondingly, each shareholder owning 100 shares will receive 11 newly issued shares.

With the number of shares currently circulating on the market, An Cuong Wood is expected to issue an additional 14.9 million shares to pay dividends in 2022. The capital for issuance will be taken from undistributed profit after tax according to the audited consolidated financial statements for 2022.

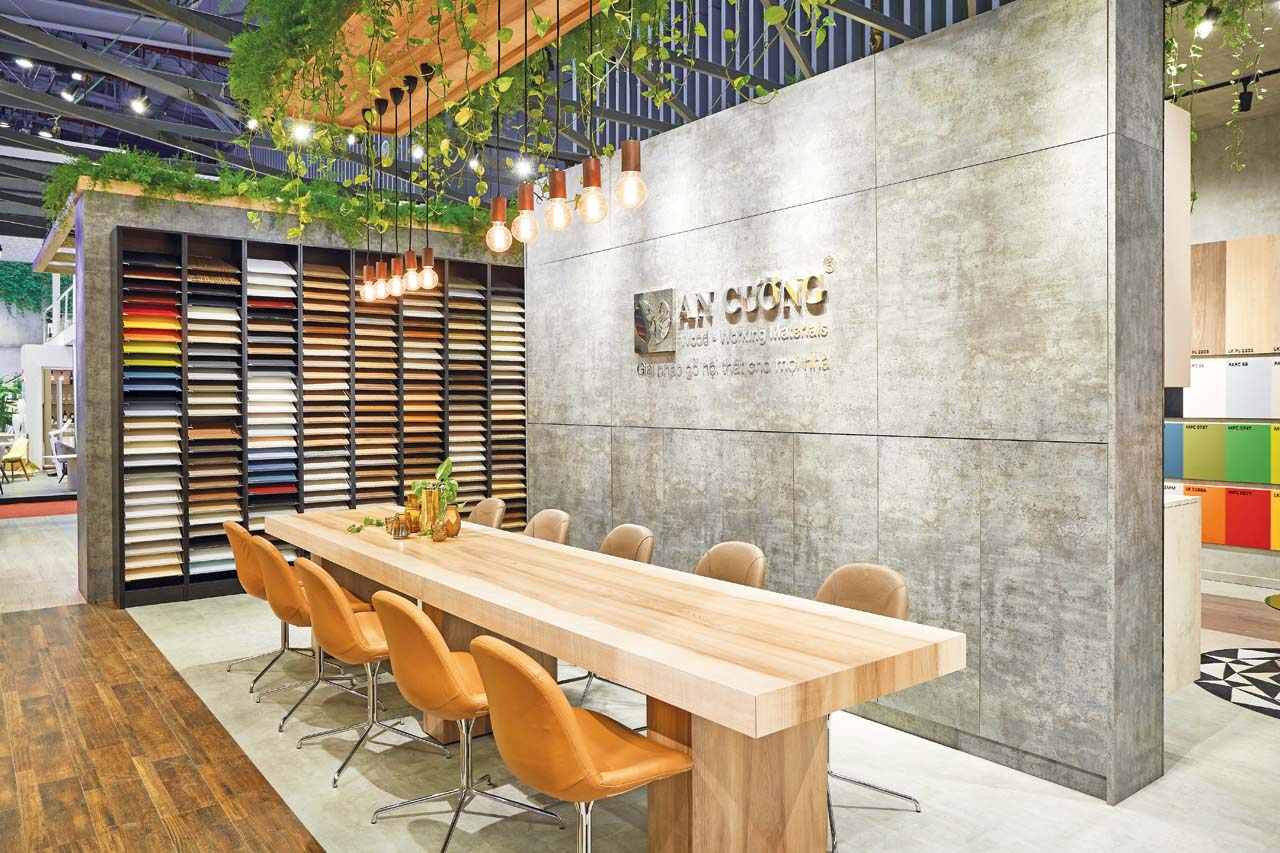

An Cuong Wood (ACG) after 2 floor changes, market price is only half. (Photo TL)

The expected time to issue shares to pay dividends is in the second and third quarters of 2023.

Regarding the price movement of ACG shares, this stock once peaked at 46,500 VND/share in early February 2023. Up to now, ACG code only recorded transactions around the price of 40,000 VND/share. In the trading session on June 23, 2023, ACG was traded at 39,600 VND/share.

Q1 profit "evaporated" nearly 70% due to decreased consumption demand, risk of breaking 2023 business plan

In 2022, An Cuong Wood had a strong breakthrough when both revenue and profit after tax grew rapidly. Net revenue reached 4,475 billion VND, profit after tax reached 616 billion VND.

With the positive business results of 2022, An Cuong Wood has confidently set a higher target for 2023 with revenue of VND 5,000 billion and profit after tax of VND 668 billion, up 12% and 8% respectively compared to the results in 2022.

However, the actual business results of the first quarter showed a gloomy outlook, completely opposite to what the company had forecasted at the beginning of the year. Specifically, revenue in the first quarter of An Cuong Wood only reached 679 billion VND, down 20% compared to last year. Profit after tax was only 36 billion VND, down 70% compared to the same period.

Explaining the poor business results in the first quarter, An Cuong Wood said the reason was the complicated domestic and international economic situation, consumers being cautious in spending, and increased selling costs, which caused the company's profits to decline sharply.

Compared with the business target set at the beginning of the year, An Cuong Wood has only completed 13.6% of the revenue plan and 5.4% of the annual profit plan.

ACG transferred to HoSE floor, market price plummeted by more than half

On October 10, 2023, An Cuong Wood JSC changed floors, listing code ACG on HoSE with a reference price on the first trading day of VND 67,300/share. Before moving to HoSE, ACG was listed on UPCoM from August 2021 with a price of up to nearly VND 90,000/share.

Thus, it can be seen that from the time it was listed on UPCoM until it moved to HoSE, after only 1 year, ACG's price has decreased by 23%.

On the HoSE, ACG's stock price continued to shock investors as it plummeted continuously in the first month after the transfer. ACG even recorded a bottom price of VND33,900/share on November 21, 2022, down nearly half compared to when it first started transferring.

Although ACG had a recovery in late January, it then only resisted around the price of VND40,000/share, corresponding to the loss of more than 1/3 of its value since its listing on HoSE. Compared to the time of the previous UPCoM transfer, after 2 transfers, the market price of An Cuong Wood shares has been "blown away" by more than half.

Source

![[Photo] Thousands of Buddhists wait to worship Buddha's relics in Binh Chanh district](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/3/e25a3fc76a6b41a5ac5ddb93627f4a7a)

Comment (0)