World oil prices today

WTI crude oil prices were at $63.14/barrel and Brent at $66.70/barrel, weighed by Norwegian supply, Russia-Ukraine pipeline risks and US reserve data.

Crude oil markets maintained their momentum at the end of August, with WTI rising 1.27% to $63.14 a barrel and Brent rising 1.38% to $66.70 a barrel. Murban, meanwhile, traded higher at $69.95 a barrel. Other grades fell, with Louisiana Light at $65.53 and Nigeria's Bonny Light down 2.84% to $78.62.

Gasoline futures also rose 1.39% to $2.118 a gallon, indicating that demand for refined products remains supportive of the market despite crude oil volatility.

Norway's oil production in July reached 1.958 million barrels per day, exceeding forecasts by nearly 150,000 barrels and up 16.8% from June. This was thanks to the Johan Castberg field reaching its maximum capacity of 220,000 barrels per day.

The breakthrough cements Norway’s position as Western Europe’s largest oil and gas supplier, especially as Russia’s role as a major exporter to Europe declines. The Norwegian government also opened a 26th round of drilling licenses, signaling additional supply into the 2030s.

The Brent futures curve is showing an unusual shape: near-term is still backwardation (spot prices are higher than forward), but forecasts of a sharp increase in global supply from 2025–2026 are causing the far-term to shift into contango.

The IEA and EIA forecast an increase of 2.5 million barrels per day in 2025 and nearly 1.9 million barrels per day in 2026, while demand has only increased slightly. This signals the risk of a large oversupply, which could cause the market to reverse quickly when storage costs change.

The Druzhba pipeline from Russia to Central Europe was briefly disrupted after a drone attack in Ukraine, raising concerns in Hungary and Slovakia about supply security.

Meanwhile, the US raised import duties on Indian goods to 50% in response to the country’s continued purchases of Russian oil. Indian refiners temporarily suspended spot purchases but quickly resumed them as Urals crude fell $3 a barrel. China absorbed some of the surplus supply, but not enough to balance the market.

The EIA report showed that US commercial crude oil inventories fell by 6 million barrels to 420.7 million barrels - 6% below the five-year average. Gasoline stocks fell by 2.7 million barrels, while distillate stocks rose by 2.3 million barrels.

The Strategic Petroleum Reserve (SPR) unexpectedly rose by 400,000 barrels, bringing the total to 403.4 million barrels. These figures support prices in the short term but do not overshadow the prospect of a global supply surplus from 2025.

China imported 401,000 barrels per day of fuel oil in July, up 40% from the previous month and the highest in seven months. Private refiners were given tax incentives of up to 95%, boosting imports of cheap feedstock to improve profits.

However, the excess domestic refining capacity still poses a risk of product surplus in the future.

Ithaca Energy raised its full-year production forecast to 119,000-125,000 barrels of oil equivalent per day after a series of North Sea acquisitions, making it the region’s largest independent producer. The company added stakes in the Seagull and Cygnus fields, but is also under pressure from the Rosebank project, which has been delayed due to new emissions regulations.

According to JODI, oil demand increased by 1.23 million barrels per day in June while production increased by only 524,000 barrels per day, causing global inventories to decrease by 1.14 million barrels. This factor explains the short-term stability of Brent and WTI prices.

However, as OPEC+ lifts 2.2 million barrels per day of cuts from September, the market could soon face a supply glut.

Technically, short-term prices are still holding up thanks to summer demand, but potential oversupply keeps upside momentum limited.

Domestic gasoline prices today

Domestic retail prices of gasoline on August 21 are as follows:

- E5RON92 gasoline: No higher than 19,354 VND/liter.

- RON95-III gasoline: No higher than 19,884 VND/liter

- Diesel 0.05S: Not higher than 18,077 VND/liter

- Kerosene: Not higher than 18,020 VND/liter

- Mazut oil 180CST 3.5S: Not higher than 15,268 VND/kg.

In response to recent developments in world petroleum product prices, the above domestic petroleum retail prices were adjusted by the Ministry of Industry and Trade - Ministry of Finance from the afternoon of August 14. Accordingly, petroleum prices decreased simultaneously. E5RON92 gasoline price decreased by 254 VND/liter, RON95-III gasoline decreased by 190 VND/liter, diesel oil decreased by 723 VND/liter, kerosene decreased by 640 VND/liter, and fuel oil decreased by 379 VND/kg.

In this management period, the Ministry of Industry and Trade - Ministry of Finance decided to continue not to set aside and not to use the petroleum price stabilization fund for E5-RON 92 gasoline, RON95 gasoline, diesel oil, kerosene and fuel oil.

Source: https://baonghean.vn/gia-xang-dau-hom-nay-21-8-gia-dau-wti-va-brent-ket-vung-nhay-cam-10304863.html

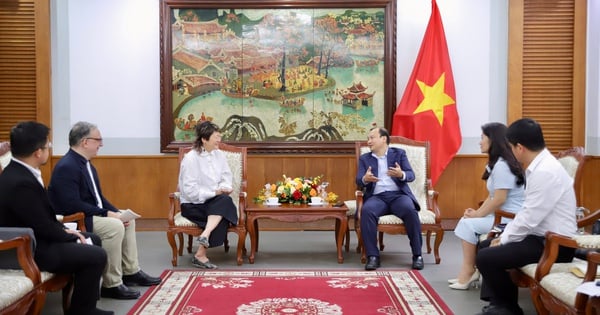

![[Photo] Prime Minister Pham Minh Chinh receives Australian Foreign Minister Penny Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/20/f5d413a946444bd2be288d6b700afc33)

![[Photo] Politburo works with Standing Committees of Lang Son and Bac Ninh Provincial Party Committees](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/20/0666629afb39421d8e1bd8922a0537e6)

![[Photo] An Phu intersection project connecting Ho Chi Minh City-Long Thanh-Dau Giay expressway behind schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/21/1ad80e9dd8944150bb72e6c49ecc7e08)

Comment (0)