Update gold price today 4/12/2025 latest in domestic market

At the time of survey at 11:00 on April 12, 2025, today's gold price on April 12, 2025 recorded a strong upward trend, continuously setting new peaks, surpassing the 106 million VND/tael mark, reflecting the heat of the market in the context of global trade tensions. Specifically:

Gold price on April 12, 2025 at DOJI Group was listed at 102.8-106.2 million VND/tael (buy - sell); increased by 600 thousand VND/tael for buying and increased by 1 million VND/tael for selling compared to yesterday. The difference between buying and selling prices reached 3.4 million VND/tael.

At the same time, the price of SJC gold bars at SJC Hanoi was listed at 103.0-106.5 million VND/tael (buy - sell); an increase of 0.8 million VND/tael for buying and an increase of 1.3 million VND/tael for selling compared to the previous day. The difference between buying and selling prices was 3.5 million VND/tael.

Gold price today, April 12, 2025 at Bao Tin Minh Chau Company Limited is listed at 102.7-106.2 million VND/tael (buy - sell); increase 0.5 million VND/tael for buying and increase 1 million VND/tael for selling compared to yesterday. The difference between buying and selling prices is 3.5 million VND/tael.

At PNJ Company, the gold price on April 12, 2025 reached 101.0-104.7 million VND/tael (buy - sell); increased by 200 thousand VND/tael for buying and increased by 0.4 million VND/tael for selling compared to the previous day. The difference between buying and selling prices is 3.7 million VND/tael.

The appeal of domestic gold continues to increase, making it impossible for investors to take their eyes off price developments, especially when today's gold price, April 12, 2025, continuously breaks records.

As of 11:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 101.0 - 104.6 million VND/tael (buy - sell); Bao Tin Minh Chau listed the price of gold rings at 101.5 - 105.0 million VND/tael (buy - sell), an increase of 600 thousand VND/tael for buying and an increase of 500 thousand VND/tael for selling.

The latest gold price update table today, April 12, 2025 is as follows:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 103.0 | ▲800 | 106.5 | ▲1300 |

| DOJI Group | 102.8 | ▲600 | 106.2 | ▲1000 |

| Red Eyelashes | 102.8 | ▲300 | 104.5 | - |

| PNJ | 101.0 | ▲200 | 104.7 | ▲400 |

| Vietinbank Gold | 106.2 | ▲1000 | ||

| Bao Tin Minh Chau | 102.7 | ▲500 | 106.2 | ▲1000 |

| Phu Quy | 102.0 | ▲200 | 106.2 | ▲1000 |

| 1. DOJI - Updated: April 12, 2025 11:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 103,000 ▲800 | 106,500 ▲1300 |

| AVPL/SJC HCM | 103,000 ▲800 | 106,500 ▲1300 |

| AVPL/SJC DN | 103,000 ▲800 | 106,500 ▲1300 |

| Raw material 9999 - HN | 100,800 ▲300 | 103,700 ▲300 |

| Raw material 999 - HN | 100,700 ▲300 | 103,600 ▲300 |

| 2. PNJ - Updated: April 12, 2025 11:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 101,000 ▲200K | 104,700 ▲400K |

| HCMC - SJC | 103,000 ▲800 | 106,500 ▲1300 |

| Hanoi - PNJ | 101,000 ▲200K | 104,700 ▲400K |

| Hanoi - SJC | 103,000 ▲800 | 106,500 ▲1300 |

| Da Nang - PNJ | 101,000 ▲200K | 104,700 ▲400K |

| Da Nang - SJC | 103,000 ▲800 | 106,500 ▲1300 |

| Western Region - PNJ | 101,000 ▲200K | 104,700 ▲400K |

| Western Region - SJC | 103,000 ▲800 | 106,500 ▲1300 |

| Jewelry gold price - PNJ | 101,000 ▲200K | 104,700 ▲400K |

| Jewelry gold price - SJC | 103,000 ▲800 | 106,500 ▲1300 |

| Jewelry gold price - Southeast | PNJ | 101,000 ▲200K |

| Jewelry gold price - SJC | 103,000 ▲800 | 106,500 ▲1300 |

| Jewelry gold price - PNJ 999.9 Plain Ring | 101,000 ▲200K | |

| Jewelry gold price - Kim Bao Gold 999.9 | 101,000 ▲200K | 104,700 ▲400K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 101,000 ▲200K | 104,700 ▲400K |

| Jewelry gold price - Jewelry gold 999.9 | 101,000 ▲200K | 103,500 ▲200K |

| Jewelry gold price - Jewelry gold 999 | 100,900 ▲200K | 103,400 ▲200K |

| Jewelry gold price - Jewelry gold 9920 | 100,270 ▲200K | 102,770 ▲200K |

| Jewelry gold price - Jewelry gold 99 | 100,070 ▲200K | 102,570 ▲200K |

| Jewelry gold price - 750 gold (18K) | 75,280 ▲150K | 77,780 ▲150K |

| Jewelry gold price - 585 gold (14K) | 58,200 ▲120K | 60,700 ▲120K |

| Jewelry gold price - 416 gold (10K) | 40,710 ▲90K | 43,210 ▲90K |

| Jewelry gold price - 916 gold (22K) | 92,410 ▲190K | 94,910 ▲190K |

| Jewelry gold price - 610 gold (14.6K) | 60,790 ▲130K | 63,290 ▲130K |

| Jewelry gold price - 650 gold (15.6K) | 64,930 ▲130K | 67,430 ▲130K |

| Jewelry gold price - 680 gold (16.3K) | 68,030 ▲140K | 70,530 ▲140K |

| Jewelry gold price - 375 gold (9K) | 36,460 ▲70K | 38,960 ▲70K |

| Jewelry gold price - 333 gold (8K) | 31,810 ▲70K | 34,310 ▲70K |

| 3. SJC - Updated: 12/04/2025 11:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 103,800 ▲800 | 106,530 ▲1300 |

| SJC gold 5 chi | 103,800 ▲800 | 106,520 ▲1300 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 103,800 ▲800 | 106,530 ▲1300 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 101,400 ▲300 | 104,900 ▲500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 101,400 ▲300 | 105,000 ▲500 |

| Jewelry 99.99% | 101,400 ▲300 | 104,400 ▲500 |

| Jewelry 99% | 99,566 ▲495 | 103,366 ▲495 |

| Jewelry 68% | 67,349 ▲340 | 71,149 ▲340 |

| Jewelry 41.7% | 39,889 ▲208 | 43,689 ▲208 |

Update gold price today April 12, 2025 latest on the world market

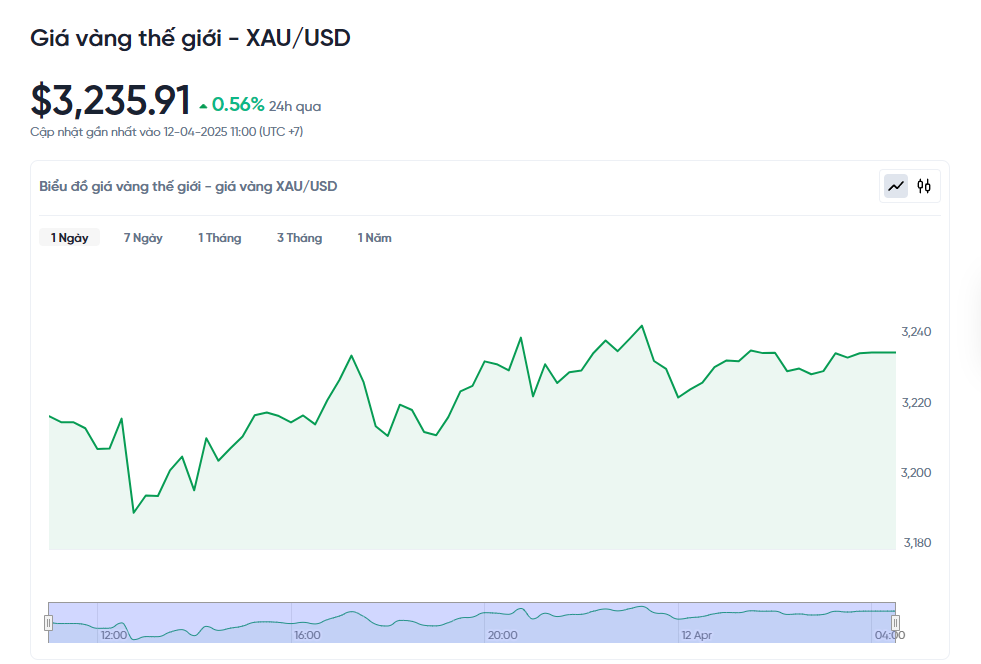

At the time of trading at 11:00 a.m. on April 12, 2025 (Vietnam time), the world gold price recorded by Kitco was at 3,235.91 USD/ounce. Converted according to the USD exchange rate on the free market (25,960 VND/USD), the world gold price is equivalent to about 102.4 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (103.0-106.5 million VND/tael), the SJC gold price is currently about 4.33 million VND/tael higher than the international gold price.

The recent trade war between the US and China has shaken global financial markets, affecting everything from stocks and bonds to gold and oil prices. It all started when the US imposed record-high import tariffs, with a general 10% tariff on all goods and up to 145% on some partners, especially China. China did not stand still, responding with a 34% tariff on US goods, which was later increased to 125%. These changes caused market prices to fluctuate wildly, surprising and worrying many investors.

Imagine being on a ship in the middle of a major storm – that’s how investors are feeling these days. Global stock prices have plummeted, wiping out more than $5 trillion in market value in just a few days. Even gold, which is often considered a safe haven in times of market turmoil, has fallen in value. This is because many people are selling gold to cover other losses. US government bonds, considered the safest asset, have also been sold off sharply, causing bond yields to spike in just a few hours. This is rare and shows the panic in the market.

These changes are not just numbers on a screen. They affect companies like Apple, which relies on Chinese supply chains, as well as banks and the metals industry. Many investors did not anticipate the full force of these tariffs. Some, like Singaporean Wong Kok Hoi, were lucky enough to invest in sectors like Chinese semiconductors and artificial intelligence early on, and have still made money. But for most, these are risky and difficult times.

Against this backdrop, hedge fund managers are trying to stay calm. They are focusing on careful stock selection, avoiding large bets on any one sector because no one knows what will happen next. Some are hoping that high tariffs will be eased, but when the US president calls it “Liberation Day” and says that “sometimes you have to take bitter medicine,” the market is in even more turmoil. The Nasdaq stock index fell more than 5% in a single day, and the market’s fear gauge rose to its highest level since the 2008 financial crisis.

While markets have rebounded since the US suspended some of its higher tariffs, uncertainty remains. No one knows for sure how long the tariff war will last or how far-reaching its impact will be. Some experts worry that it could be a sign that America’s central role in the global financial system is being eroded. For ordinary people, this could mean higher prices for everything from phones to cars to food, as production and import costs rise.

In short, what is happening is a major financial storm, and we are not seeing an end in sight. Investors are trying to find shelter, but the road ahead is still uncertain. For those who are not familiar with economics, it is important to understand that these changes can affect prices and daily life, and we need to monitor them closely to prepare for what is coming.

News, gold price trends today April 12, 2025 domestic and world gold prices

Gold prices today, April 12, 2025, continued to break out strongly, setting a new record high in the US market. According to Kitco, the price of gold for June delivery on the Comex floor reached $3,255.90/ounce, up nearly $58 compared to the previous level. Silver prices were not far behind, reaching $31.45/ounce, up $0.691. This increase came from the need to find a safe haven when the global stock market fluctuated and US Treasury bonds were shaky.

The trade war between the US and China remains the focus of attention. Both countries continue to raise tariffs, escalating economic tensions. This has investors worried, but surprisingly, the US dollar and US bonds are no longer sought after as traditional safe-haven assets. Instead, gold has become the top choice, helping the price of this precious metal continue to break records.

Global stock markets are mixed, with Asia and Europe uncertain, while the US is expected to open positively. However, a new concern has emerged from US Treasury bonds, with yields soaring to 4.403% and the US dollar falling sharply to a three-year low. If US bonds continue to be volatile, the global financial system could face major risks.

Technically, gold is in a strong position, with a target of $3,300 an ounce. If it falls, it could find support around $3,200 an ounce. The market is very sensitive to tariff news, and any surprise developments over the weekend could cause volatility when trading resumes. Crude oil is currently flat around $60 a barrel, with little impact on gold’s trend.

Source: https://baoquangnam.vn/gia-vang-hom-nay-12-4-2025-moi-nhat-gia-vang-trong-nuoc-va-the-gioi-tao-dinh-moi-qua-moc-106-trieu-3152613.html

![[Photo] Vietnam and Sri Lanka sign cooperation agreements in many important fields](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/9d5c9d2cb45e413c91a4b4067947b8c8)

![[Photo] President Luong Cuong and Sri Lankan President Anura Kumara Dissanayaka visit President Ho Chi Minh relic site](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/0ff75a6ffec545cf8f9538e2c1f7f87a)

Comment (0)