Analysts expect gold prices to continue rising this week, after soaring to a record high last weekend.

Gold prices rose to an all-time high on Friday (December 1) after comments from US Federal Reserve Chairman Jerome Powell increased confidence that the central bank has finished tightening monetary policy and could cut interest rates starting in March.

Specifically, each ounce of gold increased to $2,075.09, surpassing the previous all-time high of $2,072.49 in 2020. Spot prices then closed up 1.6%, reaching $2,069.1 per ounce.

The precious metal also closed above $2,000 an ounce for the first time this week, helped by positive inflation data and dovish comments from Fed members, reinforcing growing confidence that a much-awaited big rally could come soon.

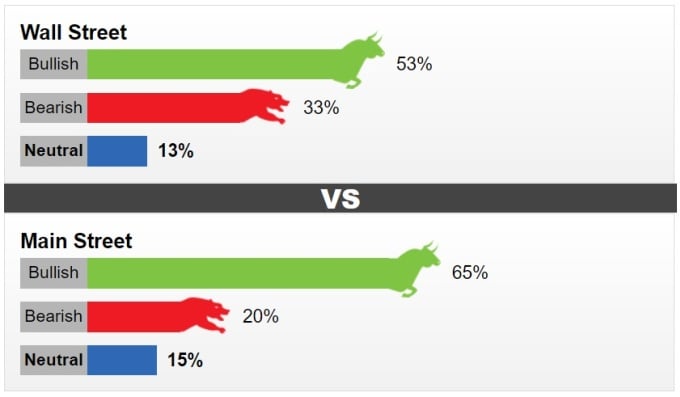

Kitco News ’ weekly gold survey also found that professionals and retail investors remain bullish this week, while a majority of analysts also expect gold to continue rising. Of the 15 Wall Street analysts surveyed, eight (53%) see higher prices this week. Five (33%) see lower prices, while two are neutral.

Meanwhile, 65% of more than 760 retail investors surveyed expect gold to rise. 20% predict lower prices, while 15% think the market will move sideways.

Kitco's gold price survey results for the week of December 4-8. Photo: Kitco News

Everett Millman, chief market analyst at Gainesville Coins, believes gold prices will continue to rise after the recent rally. "Positive seasonality is still in play. For the past six years, gold has been up on Christmas. I don't see that being any different, even though prices are actually at the top of this range," Millman said.

The expert also acknowledged that November was only gold's first close above $2,000, but the trend is showing the possibility of continuation. "Every time gold has traded above this level, it has been followed by a fairly rapid pullback. The fact that we haven't seen that yet, I expect gold to continue trading near the top of this range and it will remain strong throughout December," said the chief market analyst at Gainesville Coins.

Darin Newsom, senior market analyst at Barchart.com, is also bullish on gold. “The short-term trend for the precious metal is bullish, although the market is currently overbought and could be in a double top on the daily chart,” Newsom said. “Do investors have a reason to stop buying? Not right now. There could be some pressure next week, but we have to take what we see in front of us,” he added.

Meanwhile, Colin Cieszynski, chief market strategist at SIA Wealth Management, said gold could correct next week.

"I think both gold and the US dollar have had a big month in November and are due for a technical correction," Cieszynski said. "Yesterday's Chicago PMI report showed a stronger-than-expected US economy , which could reduce the likelihood of a rapid rate cut, which could take some pressure off the US dollar and reduce the upside potential for gold."

Ole Hansen, head of commodity strategy at Saxo Bank, is also cautious about gold's direction. "Gold is likely to correct to $2,010 before moving higher before the end of the year," he said.

Hansen also maintained a bullish outlook for gold next year, confident that interest rates have peaked and real yields will start trending lower. “However, with so much easing already priced in, a straight-line recovery is unlikely. Both silver and gold will continue to see periods where confidence may be challenged,” Hansen said.

Minh Son (according to Kitco)

Source link

![[Photo] President Luong Cuong receives delegation of the Youth Committee of the Liberal Democratic Party of Japan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2632d7f5cf4f4a8e90ce5f5e1989194a)

![[Photo] Prime Minister Pham Minh Chinh chairs the conference to review the 2024-2025 school year and deploy tasks for the 2025-2026 school year.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2ca5ed79ce6a46a1ac7706a42cefafae)

Comment (0)