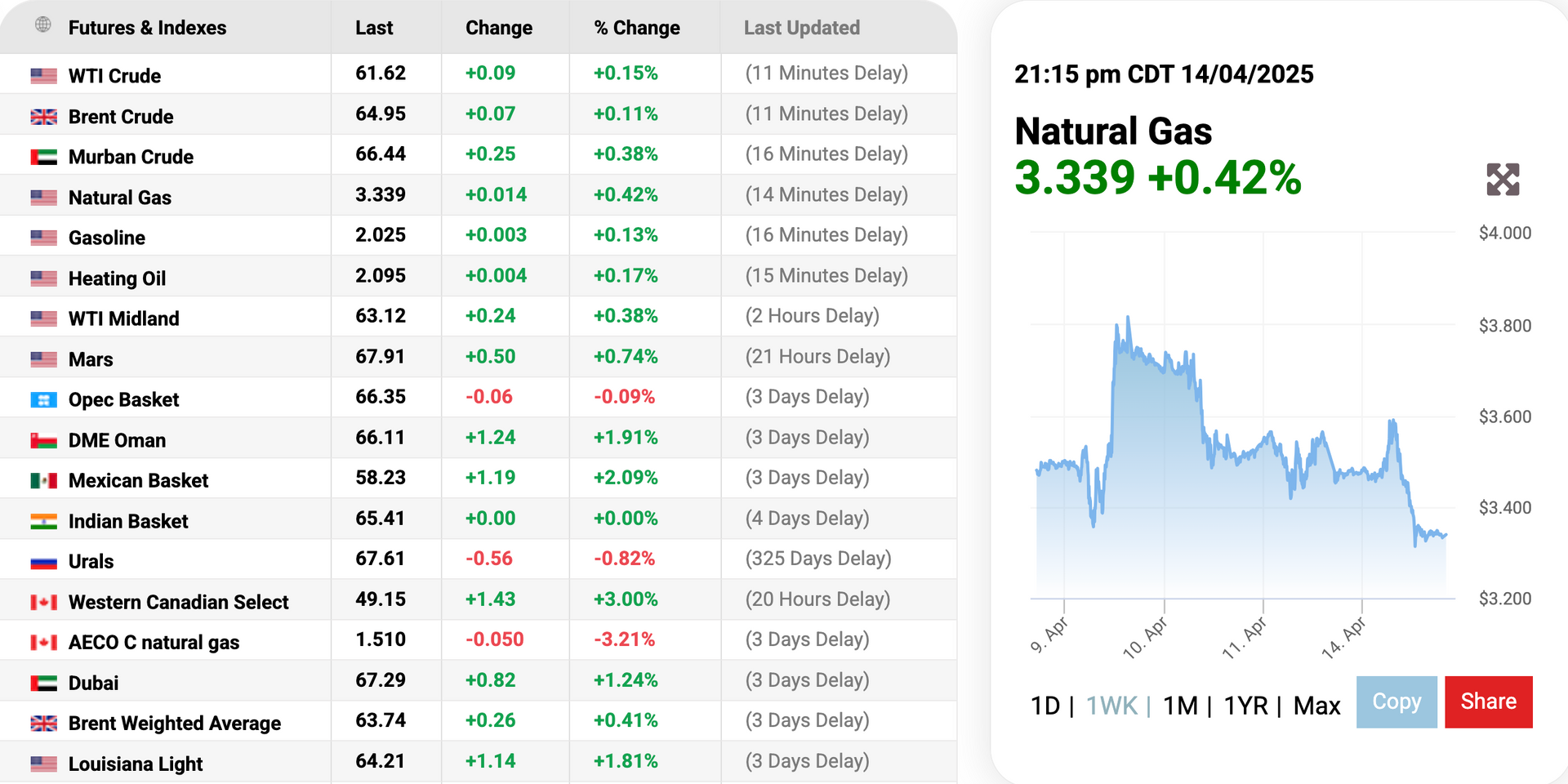

Recorded on Oilprice.com at 09:15 on April 15, 2025 (Vietnam time), world natural gas prices reversed and increased slightly by 0.42% (equivalent to an increase of 0.014 USD) to 3,339 USD/mmBTU at the time of survey.

According to Oilprice.con, US President Donald Trump continues to pressure major trading partners to increase energy imports from the US as part of efforts to narrow the huge trade deficit. The message is not only diplomatic but also a strategic negotiating lever: buy more energy to avoid heavy tariffs.

For many countries with large surpluses with the US – such as Japan, South Korea, the EU – energy appears to be the most likely area of import from the US. After President Trump’s inauguration, some countries were quick to signal their willingness to buy more oil, liquefied natural gas (LNG) or coal to appease the White House.

However, the reality is that increasing energy purchases – however significant – cannot eliminate the trade deficit. The problem lies in the scale of supply, the trade value of energy products and the export structure of the countries involved.

A notable example is President Trump’s demand from the European Union: the EU should commit to buying $350 billion of energy from the US in return for tariff relief. That would be equivalent to about 40 million tonnes of LNG – more than half of the EU’s total LNG imports last year, of which the US was already the main supplier.

The EU has responded cautiously. This week, Energy Commissioner Dan Jørgensen said the EU could be ready to increase LNG imports from the US – but clearly the $350 billion commitment is a “red line” that is difficult to reach, both in terms of receiving infrastructure and long-term contracts with existing partners.

Similarly, Taiwan – a country that is pro-American and hostile to China – despite having committed to invest in a $44 billion LNG project in Alaska, was still hit with a 32% tariff (suspended for 90 days). The reason: Taiwan’s semiconductor exports to the US far exceed the amount of goods it imports from the US, increasing the deficit.

Notably, Taiwan is the only investor that has actually committed early on to the Alaska LNG project, while Japan and South Korea are still exploring. But even so, they have not been able to avoid tax pressure. This shows that energy commitments do not mean a "tax-free ticket".

If Japan increases its oil imports from the US to 10% of its total needs (from 1.6% last year), the import value will be about $4.8 billion (WTI oil price is about $60/barrel). But according to expert Clyde Russell (Reuters), Japan's trade surplus with the US is still at $68 billion - more than 14 times that figure.

The situation is even more difficult when it comes to LNG. Japan already imports about 10% of its LNG from the US, but the room for further growth is limited due to existing long-term contracts, shipping costs, and US LNG export restrictions.

President Trump is clearly using energy as a bargaining chip in trade negotiations, but the actual impact remains unclear. Trade partners’ pledges to buy more oil, gas, and coal from the United States do not guarantee that they will be exempt from tariffs—especially since Mr Trump’s focus remains on net trade deficits.

As the US and China continue to confront each other, the risk of a global energy recession is looming. If global demand declines, not only will US energy prices be affected, but the ability to maintain high production will also become fragile…

Domestic gas prices

According to the records of PV Thuong Truong, the domestic gas price in April did not change compared to the selling price in March because the average world gas price contract in April did not change compared to the previous month.

Specifically, the retail price of Petrolimex gas cylinders (including VAT) in April 2025 in the Hanoi market is 457,400 VND/12 kg household cylinder; 1,829,600 VND/48 kg industrial cylinder, unchanged compared to the selling price in March.

Similarly, according to the announcement from Southern Gas Trading Joint Stock Company (Gas South), domestic retail gas prices in April for the Company's brands including: Gas Dau Khi, VT-Gas, A Gas, JP Gas, Dak Gas and Dang Phuoc Gas remained unchanged compared to March 2025.

Specifically, the retail gas price to consumers is 475,400 VND/12kg cylinder and 1,784,111 VND/45kg cylinder (including VAT), applicable to the Eastern and Western regions of the South.

According to a representative of Petrolimex Gas Corporation, the gas price in April remained unchanged compared to March because the average world gas price contract in April was at 610 USD/ton, unchanged compared to March, so the Gas Corporation did not make any price adjustments.

Since the beginning of the year, gas prices have decreased twice and remained unchanged twice.

Source: https://baodaknong.vn/gas-price-hom-nay-15-4-dao-chieu-tang-nhe-249425.html

![[Photo] Thousands of Buddhists wait to worship Buddha's relics in Binh Chanh district](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/3/e25a3fc76a6b41a5ac5ddb93627f4a7a)

![[Photo] Bustling construction at key national traffic construction sites](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

Comment (0)