|

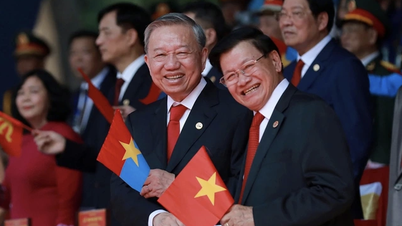

| National Assembly deputies meeting in the Hall. |

At the discussion session in the hall and in groups on the draft Law on Credit Institutions (amended), the majority of opinions of National Assembly deputies agreed with the necessity of amending the law to institutionalize the Party's policies and guidelines; overcome limitations and shortcomings after more than 12 years of implementing the Law on Credit Institutions 2010 and the Law amending and supplementing a number of articles of the Law on Credit Institutions 2017; ensure the unity and synchronization of the legal system and compatibility with Vietnam's international commitments related to the financial and banking sectors; enhance the safety, soundness and stability of the credit institution system; create a mechanism for handling bad debts and handling collateral of bad debts of credit institutions.

Compared to the current Law, the draft Law adjusts the share ownership ratio of individual shareholders, organizational shareholders, shareholders and related persons of such shareholders from not exceeding 5%, 15%, 20% down to 3%, 10% and 15%, respectively.

Examining this content, the Economic Committee proposed to clarify the basis for proposing these ratios; it is necessary to clearly assess the current status of share ownership at credit institutions to clearly determine the extent and causes of cross-ownership in order to propose fundamental and radical solutions to handle the current cross-ownership situation.

At the same time, supplement the assessment of the impact of the regulations on shareholders owning shares from over 3% to under 5%, over 10% to under 15% and over 15% to under 20%, especially foreign strategic shareholders who will have to reduce their share ownership ratio after the law takes effect; the impact of the policy on the stock market.

At the group discussion sessions, many opinions said that it is necessary to pay attention to the stability of the major shareholder structure which has a great influence on the development of joint stock commercial banks, and at the same time proposed to stipulate in the draft Law a suitable roadmap for existing shareholders to divest capital or a provision that does not apply retroactively (similar to the Enterprise Law) but does not allow additional shares to be purchased, except in cases where the additional share purchase does not exceed the new ownership limit to ensure investor interests.

Participating in the discussion at the hall about this draft law, delegate Tran Chi Cuong, National Assembly Delegation of Da Nang City, said that regarding the share ownership ratio, in order to limit the problem of manipulation of banking activities and limit cross-ownership, the draft law has amended and supplemented regulations on the limit of capital contribution and share purchase of credit institutions.

However, in this case, it is possible that someone else may be hired to own shares in order to indirectly increase the percentage of shares owned in order to dominate and control some credit institutions.

The delegate raised the question, how will this situation be resolved in practice? Can it be fundamentally resolved when reducing the share ownership ratio? The delegate suggested that there should be an assessment and clarification of whether the cause of cross-ownership comes from legal regulations or from the implementation organization.

At the same time, it is necessary to assess how existing shareholders with capital higher than the new regulations will be handled, whether to divest or not to apply the regulations retroactively to ensure the interests of investors, especially dedicated strategic investors.

Also concerned about this issue, delegate Nguyen Hai Trung - National Assembly Delegation of Hanoi City said that adjusting the ownership ratio of individuals and organizations, increasing the popularity of credit institutions, and expanding the scope of related subjects is necessary.

This helps the bank's shareholder structure to be more dispersed and healthier, avoiding too much power and autonomy concentrated in one individual, thereby limiting the organization's operations in the direction of serving backyard companies and the interests of major shareholders, which in turn harms the interests of the bank in general and the remaining shareholders in particular.

However, delegates reflected that in reality there may still be major shareholders, either named or anonymous, on the Board of Directors and Executive Board, who hold controlling shares and manage the bank's operations.

Assessing the solutions mentioned in the draft as only technical solutions to limit major shareholders, delegates said that it is necessary to add more regulations and strengthen the role of the State Bank to limit the abuse of power by major shareholders, management and operation rights to manipulate the operations of credit institutions.

Along with that, delegates said it is necessary to study and propose additional measures and solutions to manage and control the circumvention of the law, using many individuals and other legal entities to stand in the name of shares to create large shareholder groups to operate credit institutions.

Speaking on this issue, delegate Pham Van Hoa, National Assembly Delegation of Dong Thap province, requested clarification on why the share ownership ratio was reduced, and an assessment of the current share ownership situation at credit institutions in recent times, and the consequences of the reduction in share ownership ratio, especially strategic shareholders.

Limiting manipulation of banking activities is necessary, it is also important to note that shareholder stability is also very important. Credit limits, laws regulating the total outstanding credit balance for some banks not exceeding 15% to 20% down to 10-15% of the equity capital of commercial banks, credit funds,...

Similarly, reducing from 20% and 50% to 15% and 25% for non-bank credit institutions to reduce the concentration of credit risk is necessary. However, delegates said that it is necessary to explain convincingly whether there has been any risk in the past, whether there is a current risk trend or not; there are businesses that have borrowed up to the maximum limit, the new law stipulates reducing the credit limit will cause difficulties for businesses that have borrowed.

Contributing opinions at the meeting, delegate Van Thi Bach Tuyet, National Assembly Delegation of Ho Chi Minh City, said that the regulation of the maximum rate of individual share ownership in the direction of reducing compared to the provisions of the current law is not based on the economic aspect, it will reduce investment capacity and the profitability of cash flow, limiting the mobilization of capital from society into the banking and finance sector.

In addition, credit institutions always need resources to increase their charter capital to compete and ensure business efficiency. They need an open mechanism to attract shareholders with financial potential to participate solely in increasing the charter capital of the credit institution, not in implementing the governance and management aspects of the credit institution.

Delegates said that the charter capital of credit institutions needs to be considered from the perspective of investment and management factors from the State Bank on financial indicators, it is necessary to expand the scope of shareholders' capital ownership based on charter capital to ensure less restrictions on equity investment in credit institutions, but these shareholders are purely seeking profits from the business activities of credit institutions.

Source

![[Photo] "Lovely" moments on the 30/4 holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] Ha Giang: Many key projects under construction during the holiday season](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/8b8d87a9bd9b4d279bf5c1f71c030dec)

Comment (0)