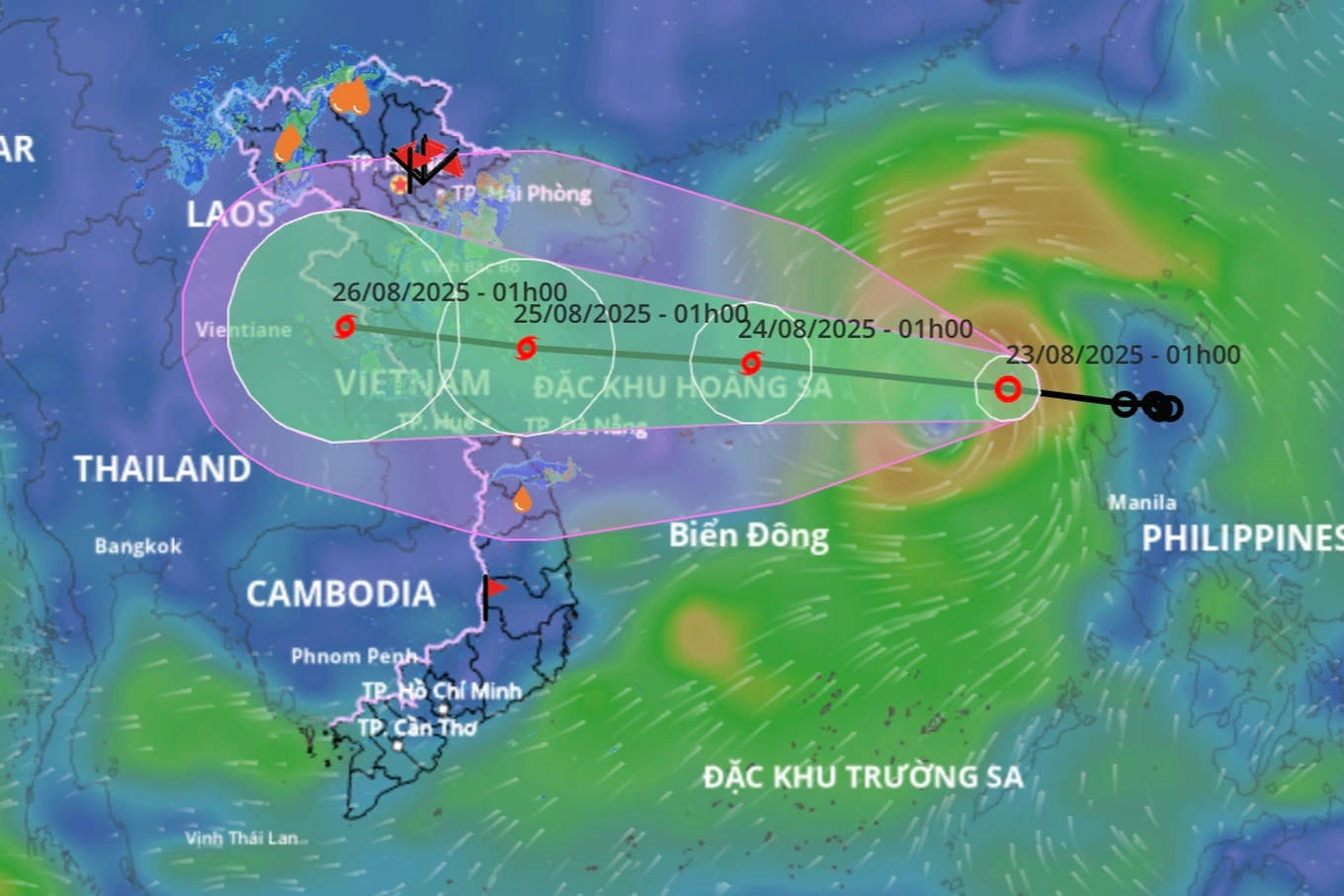

Storm No. 3 (Yagi) has caused severe damage in many northern provinces and cities. Preliminary reports from the State Bank of Vietnam branches in Quang Ninh and Hai Phong provinces show that nearly 12,000 customers with total outstanding debts of more than VND 26,000 billion have been severely affected by the consequences of storm No. 3.

The State Bank of Vietnam has issued Document No. 7417/NHNN-TD directing credit institutions and State Bank of Vietnam branches in some provinces and cities to deploy solutions to support customers to overcome the consequences caused by storm No. 3.

People and businesses suffered heavy losses.

As one of the households that borrowed money from the bank and suffered losses due to storm No. 3, Ms. Ngo Thi Thuy, living in Thong Nhat 2 area, Tan An (Quang Yen town, Quang Ninh province) said: After the storm passed, her family's 600 large fish cages in Cam Pha (each cage held 500 fish, each fish weighed about 3 kg) were "wiped out". "As for the small fish cages in Quang Yen, I still have about 20 cages, but with the water like this, it's not certain that the small fish will survive", Ms. Thuy couldn't help but worry.

The worry was even greater when Ms. Thuy shared that all her capital invested in fish farming was about 12 billion VND and now she is empty-handed. Of that, Ms. Thuy borrowed 4 billion VND from the bank, has paid back 500 million VND, and does not know how to manage the rest. "If the State supports the people with some capital, I will overcome it, build more rafts, release baby fish in time to rebuild. Now, when people here meet each other, they hug each other, cry, and encourage each other that as long as there are people, there is property," Ms. Thuy expressed.

In fact, after the storm passed, many people and businesses suffered heavy damage, even lost all their assets. Director of the State Bank of Vietnam, Quang Ninh branch, Nguyen Duc Hien, informed: Through the quick grasp of banking units in the province, by the end of September 10, a total of 11,058 customers with a total outstanding debt of VND 10,654 billion (accounting for 5.6% of the total outstanding debt in the whole area) were severely affected by the consequences of storm No. 3; some customers in the aquaculture sector were severely affected (lost their aquaculture rafts).

In Hai Phong, Director of the State Bank of Vietnam, Hai Phong City Branch Nguyen Thi Dung said that according to a quick report on the situation of customers affected after storm No. 3, there were 890 customers with a total outstanding debt of VND 15,686 billion affected after the storm, focusing on industries such as livestock, aquaculture, production, business and trade, ports, fishing vessels, etc.

Quickly apply support measures

Typhoon Yagi has caused many customers and businesses to suffer losses without being able to repay their debts, almost losing all their assets, with no source to compensate in the near future. Deputy Governor of the State Bank of Vietnam Dao Minh Tu emphasized that for debts of customers in the fields of rural agriculture, aquaculture, commercial banks need to have reasonable policies and mechanisms, first of all, deferring debts, reducing interest rates and especially boldly providing new loans so that businesses, people and households have new capital to rotate. Old debts will be considered for appropriate settlement.

Faced with the severe impact of Typhoon Yagi on people and businesses, representatives of commercial banks also said that banks are quickly implementing many solutions to support customers facing difficulties after the storm.

According to Mr. Le Hoang Tung, Deputy General Director of Vietcombank, although Vietcombank has proactively implemented measures to prevent and respond to storm No. 3 and floods, according to preliminary statistics, 34 branches at Vietcombank were directly affected by storms and floods, of which seven branches in Hai Phong and Quang Ninh were affected, with estimated damage to facilities of nearly 6 billion VND, and some transaction points had to temporarily suspend operations.

Currently, it is estimated that nearly 6,000 Vietcombank customers have been affected with a total outstanding debt of about 71,000 billion VND, of which in Hai Phong and Quang Ninh alone, 230 customers have been affected with a total outstanding debt of about 13,300 billion VND.

In this situation, to support and accompany people and businesses to overcome difficulties, Vietcombank has considered reducing interest rates by 0.5% from September 6 to December 31, 2024 for customers borrowing capital for production and business that suffered great damage caused by storm No. 3 in affected localities.

"It is estimated that nearly 20,000 individual and corporate customers will receive interest rate reductions with outstanding loans of nearly VND130 trillion. The interest rate reduction program applies to existing and new loans to create conditions for businesses and people to stabilize production, stabilize their lives and access bank credit capital," Mr. Tung shared.

According to Mr. Le Duy Hai, Deputy General Director of VietinBank, preliminary statistics show that about 195 corporate customers were affected by storm Yagi with outstanding debt of about 18,000 billion VND.

"The bank is assessing the overall damage to customers in the entire system to have appropriate support measures. For customers who have purchased insurance from the bank, VietinBank will quickly speed up compensation work to create conditions for people to quickly stabilize their lives," said Mr. Hai.

Agribank Deputy General Director Doan Ngoc Luu also said that, to implement solutions to support customers and overcome the consequences of storm No. 3, Agribank has directed ABIC Insurance Company to urgently carry out procedures to support and compensate customers, ensuring timely customer support; establish working groups to meet, encourage, and share directly with customers affected by storm No. 3; grasp and assess the overall level of damage to loan customers, expected affected outstanding debt, debt repayment capacity, and specific solutions to support customers.

Meanwhile, according to Mr. Le Trung Thanh, Deputy General Director of BIDV, recently, BIDV has continuously updated information from branches in Hai Phong, Quang Ninh and some other localities to assess the level of damage to customers. BIDV considers this an urgent task that needs to be prioritized, assessing each customer case to have a plan to restructure debt, extend debt, reduce interest, issue credit packages with reasonable interest rates, reasonable scale to accompany people and businesses to recover after the storm.

In addition, Deputy Governor of the State Bank of Vietnam Dao Minh Tu also requested credit institutions to quickly review each customer case, clarify the extent of damage, and grasp the wishes and proposals of customers. At the same time, credit institutions need to become a support for businesses, not to collect debts by any means but to be flexible, demonstrate shared responsibility, and create conditions for businesses to recover.

"During and after the storm, consumer loans are also needed so that people can have funds to buy household appliances and equipment because many people have suffered damage to even the assets they use every day," Mr. Tu added.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the conference to review the 2024-2025 school year and deploy tasks for the 2025-2026 school year.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2ca5ed79ce6a46a1ac7706a42cefafae)

![[Photo] President Luong Cuong attends special political-artistic television show "Golden Opportunity"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/44ca13c28fa7476796f9aa3618ff74c4)

Comment (0)