In the face of recent consecutive bank money loss incidents, Dr. and economic expert Nguyen Tri Hieu expressed doubts about information security vulnerabilities of Vietnamese banks.

Specifically, the expert shared that not only individual customers lost money when depositing in the bank, Mr. Hieu himself a few months ago went to the bank to make a transaction and discovered that the 500 million in his account was only 50,000 VND left.

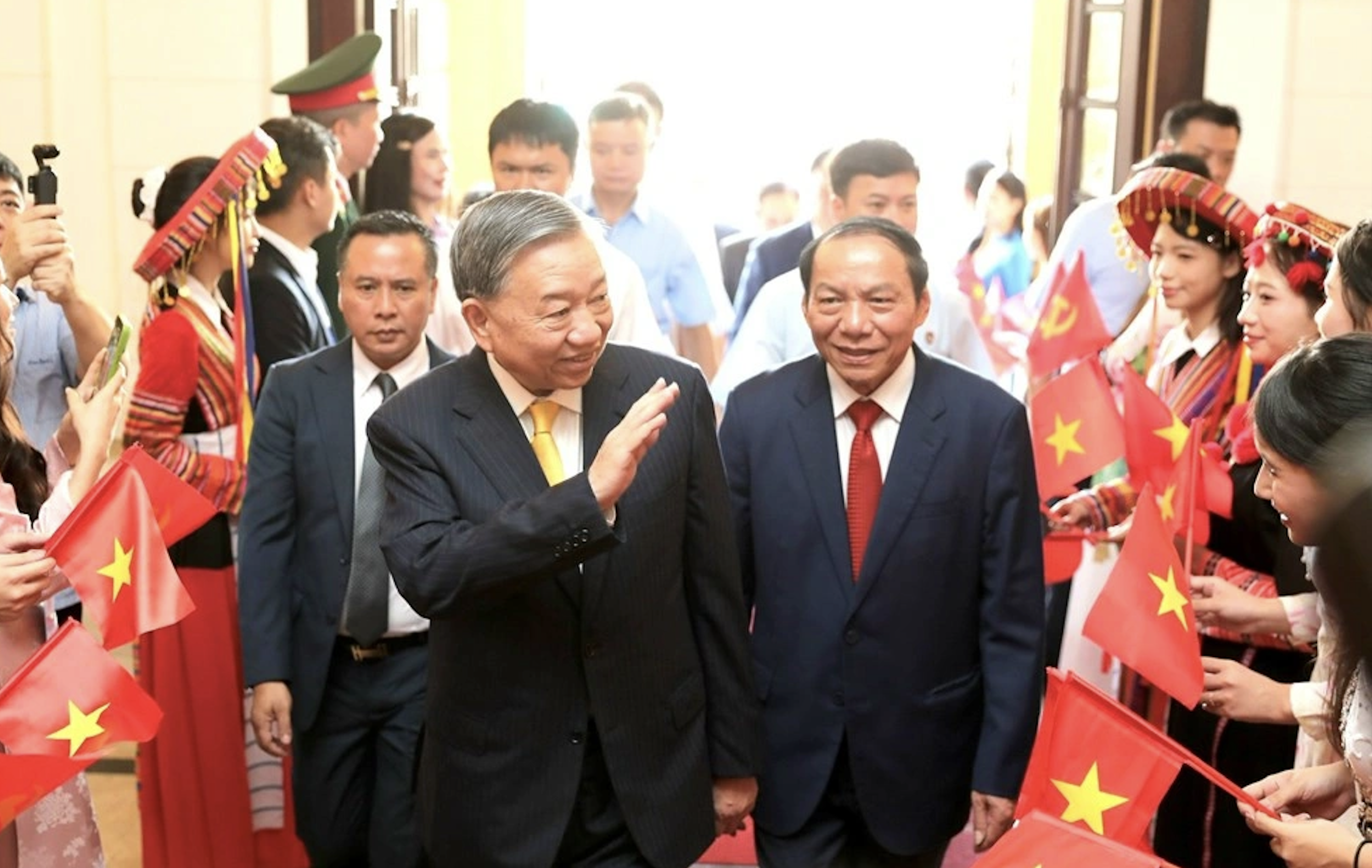

Dr. and economist Nguyen Tri Hieu said that 500 million VND deposited at the bank was stolen by a thief. (Photo: NVCC)

"Together with the bank, I reviewed the system and discovered that the bad guys used Internet Banking transactions (online banking services - PV), provided full personal information and impersonated me twice to ask the bank to provide a new password," Mr. Hieu shared.

The expert said that the banking system then sent an OTP code message to his phone number, but in fact, another person with the same phone number as him received the OTP code. The expert's phone did not receive the OTP code message.

After having the OTP code in hand, the bad guys changed the bank account password and quickly withdrew money.

“I have filed a complaint with the police, but so far there has been no result. I am planning to write a petition to the State Bank in the near future, and at the same time sue the bank in court to get back the lost money,” Mr. Hieu said.

In fact, Dr. Nguyen Tri Hieu himself is one of the experts who has many positive contributions to the development of the Vietnamese financial and banking sector. However, the unfortunate incident caused Mr. Hieu to warn more about the security vulnerabilities of banks. Especially the fact that the scammer may have infiltrated the system to steal bank messages sent to account holders.

"People losing money in their accounts is becoming more widespread and dangerous. The State Bank of Vietnam has issued Decision 2345 requiring banks to have facial or fingerprint confirmation when customers transfer money over 10 million VND. The decision takes effect from July 1 this year. There may have been a security hole and that's why the State Bank of Vietnam issued this decision," the expert added.

In fact, with the increasing number of people being scammed and having their bank deposits stolen, banks have continuously issued warnings to customers to be vigilant when receiving SMS messages and calls from strangers, who claim to be police officers, tax officers, postal officers , or even bank employees asking for information.

Accordingly, banks recommend that customers absolutely do not provide confidential information such as login name, OTP code, card number, CVV code, account password... to strangers. At the same time, do not access unverified links, messages, chats, or calls under any circumstances.

People only log in via trusted devices, do not save login information on any device; change passwords every 3 months or immediately when suspecting information disclosure; confirm the person requesting the request.

In particular, banks emphasize that anyone who asks customers to provide OTP codes is a scammer.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)