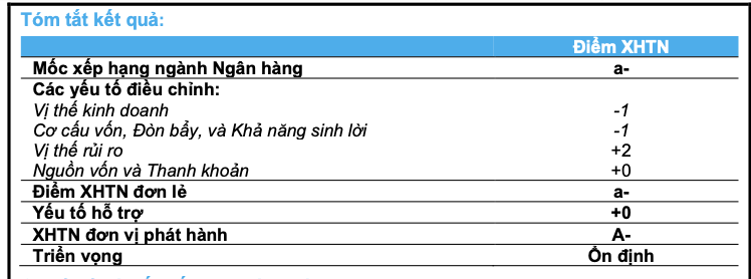

“We rate BAC A BANK's business stability at 'Adequate', contributed by its modest scale but maintained stability in the industry over many years; the consistent maintenance of lending policies towards essential sectors and less sensitive to economic fluctuations, along with the strategy of expanding the customer base in the medium term”.

Source: https://www.baca-bank.vn/SitePages/website/tin-tuc.aspx?ttid=1069<tid=17&pb=False&s=TT&tt=BAC%20A%20BANK%20%C4%90%C6%AF%E1%BB%A2C%20X%E1%BA%BEP%20H%E1%BA%A0NG%20T%C3%8DN%20NHI%E1%BB%86M%20M%E1%BB%A8C

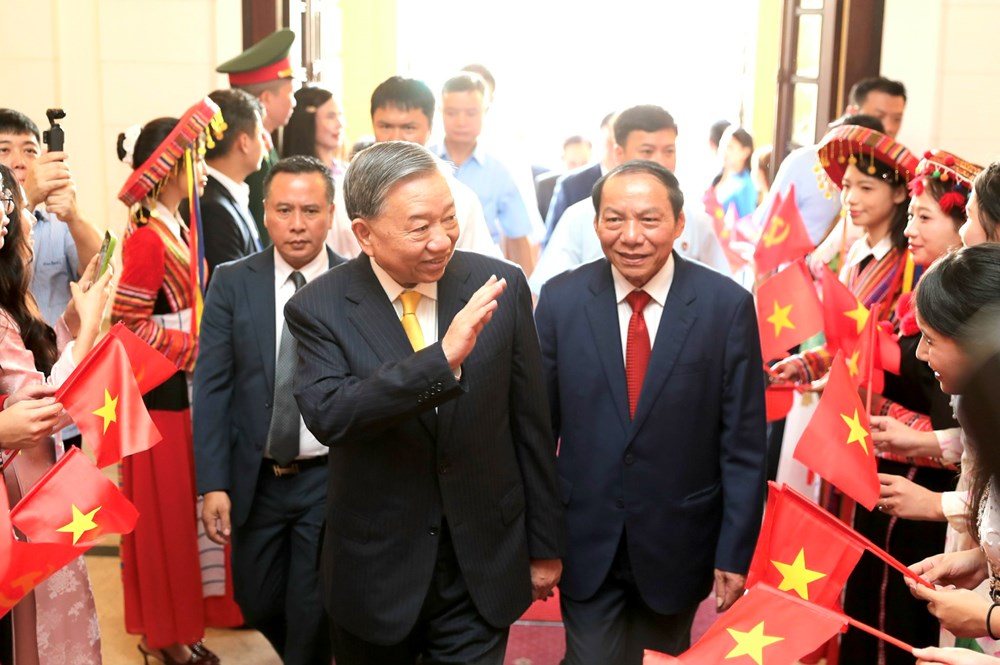

![[Photo] President Luong Cuong attends special political-artistic television show "Golden Opportunity"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/44ca13c28fa7476796f9aa3618ff74c4)

Comment (0)