Applying advanced technology to protect customer accounts, multi-layered security strategy helpsACB detect and warn of risks, bringing peace of mind when using digital banking services.

ACB ONE digital banking service - Photo: ACB

In the third quarter of 2024, ACB Bank reported that it had monitored and blacklisted nearly 10,000 suspicious accounts at banks, in order to temporarily suspend transactions to these accounts to avoid losses to customers, and the number of fraud cases decreased by 50%.

Multi-layered security banking for customers

According to bank representatives, security solutions are always designed to ensure prevention and limitation of online transaction risks.

For the defense layer, the bank conducts a review of new customer information, proactively eliminates unregistered accounts through eKYC and IDCheck identification methods compared with citizen identification data stored at the Ministry of Public Security , and simultaneously implements facial authentication registration with chip-embedded citizen identification cards when customers open online accounts (eKYC),... effectively preventing the forgery of identification documents when transacting with the bank.

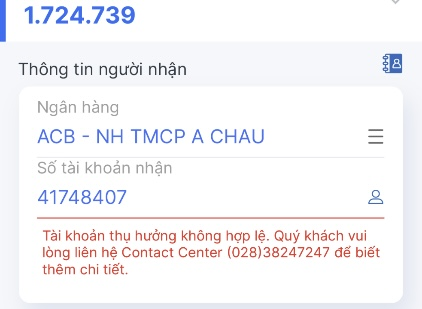

On the other hand, the bank also continuously updates information about fraudulent accounts, helping the system to identify and immediately warn customers if they are about to transfer money to an account on the suspect list. This not only protects customers but also helps prevent the activities of fraudulent subjects.

To date, the "blacklist" has recorded up to 10,000 accounts from banks, and transactions to these accounts have also been suspended to avoid damage to customers.

The bank continuously updates information about fraudulent accounts, helping the system identify and immediately warn customers if they are about to transfer money to an account on the suspect list - Photo: ACB

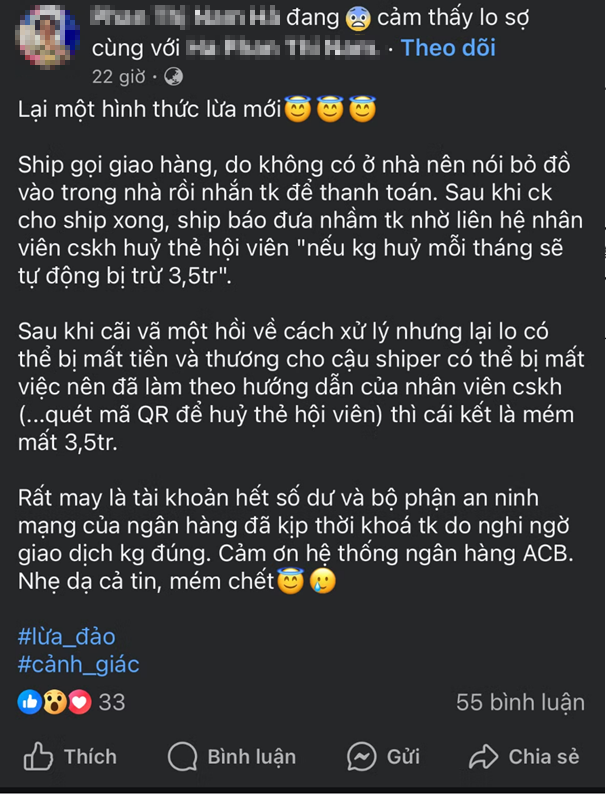

There have been many cases where customers have been scammed by fake delivery agents who ask to transfer money. However, when customers transfer money, the ACB ONE system displays an invalid account warning, preventing customers from making this transaction.

Another quite popular form is to fake websites and information pages using the name of the Vietnam Fatherland Front to mobilize and call for charity and support for provinces and cities affected by storm No. 3. Banks have proactively prevented this by using a system to identify unusual money transfers and stop customers from making fraudulent transactions.

Ms. PH Nam said: "Fortunately, the bank's system promptly blocked the account due to suspicion of incorrect transactions. Thank you bank. I was so gullible that I almost lost all my money."

Another customer was also impersonated by Facebook as a relative to borrow money, but the bank promptly blocked the transaction so the account was protected: "I just transferred money to the account of a relative who asked me to send it, but it was blocked because I suspected that I had made a transaction with a fraudulent account. When I asked, I found out that I had been scammed. The system has technology to identify risks through transaction behavior. Luckily, the bank has good security, otherwise I don't know how much money I was scammed."

Customers were lured into a scam, but did not lose money because the bank's security system blocked transactions to accounts on the suspect list - Photo: ACB

The ACB ONE Digital Banking application is also equipped with the most advanced technologies, which can identify and warn users when mobile devices show signs of being attacked by external factors such as malware, causing loss of control of the device leading to the risk of losing money in the account. When there are signs of suspicious transactions, the bank will proactively prevent money transfers.

Customers will also be notified if there is malware, spyware or unsafe devices due to unauthorized interference or remote control from another device.

According to Decision No. 2345/QD-NHΝΝ, last July, the bank also simultaneously deployed a facial authentication combo combined with ACB Safekey - a method of authenticating online transactions with OTP codes right on the app, ensuring that the data matches exactly with the biometric data stored in the chip of the citizen identification card issued by the police agency, acting as an important line of defense to prevent fraud, even when the fraudster uses sophisticated Deepfake technology.

Customers can rest assured that not only their accounts but also their transactions are guaranteed to be "authentic", even if their identity is stolen, criminals will have difficulty getting their money. Up to now, more than 1.5 million accounts have successfully registered for facial authentication, the number of fraud cases has decreased by 50%.

In addition, in compliance with Circulars 17 and 18/2024/TT-NHNN of the State Bank, the bank also recommends that all customers register for face authentication with a chip-embedded citizen identification card/ID card before January 1, 2025 to avoid interruption of all online transactions with payment accounts, cards on ACB ONE Digital Bank and ATM withdrawals.

Especially for customers whose identification documents (ID card/citizen identification card/other identification documents) are about to expire, in order to avoid temporary blocking of cash withdrawal transactions on payment accounts and card transactions from January 1, 2025, customers need to proactively register for new identification documents at the competent authority, then update the new identification documents with ACB.

There is no perfect defense.

It is undeniable that not only ACB but the entire banking system is making efforts to improve the digital ecosystem and prevent risks in cyberspace for customers. However, the press still regularly reports on incidents of lost social network accounts, online investment fraud, or even lost bank accounts...

These events remind us that: The most modern security methods cannot create a perfect defense. Because the loophole can also come from the users themselves.

There is no perfect defense shield, because the gap can come from the user - Photo: ACB

Raising awareness and understanding the principles of safe transactions is always a solid first line of defense. The bank affirms that digital banking is still a safe and convenient transaction channel as long as customers are fully equipped with knowledge about safety & security. Customers only transact, contact and report through the bank's official channels (acb.com.vn, Asia Commercial Bank Fanpage ACB, ACB ONE/ ACB ONE BIZ/ ACB ONE PRO Digital Banking application), Customer Service Center Contact Center 1900 54 54 86 or (028) 38 247 247 or at the transaction counter, not through any other website or application.

In cases where a transaction has occurred, the rapid response team will also support account blocking (depending on each situation), and at the same time guide customers to report to the authorities to limit damage to customers.

Source: https://tuoitre.vn/acb-ngan-chan-giao-dich-10-000-tai-khoan-nghi-ngo-gian-lan-20241031181153579.htm

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)