One of the goals set by the Government and the expectations of the National Assembly when allowing the 2024 Land Law to take effect five months earlier (from January 1, 2025) is to simplify procedures and resolve problems related to housing and land for businesses and people.

However, in some localities, especially Ho Chi Minh City, many land procedures have been "frozen" since this law took effect.

People are like sitting on fire

Signing the transfer of real estate from the beginning of August 2024 (when the 2024 Land Law comes into effect), on August 5, Mr. V., a resident of Vinh Loc A (Binh Chanh, Ho Chi Minh City), submitted the registration documents to the district registration office and the tax calculation form was transferred to the tax authority from August 14.

However, after more than a month, the tax authority has not yet issued a tax notice to transfer to the registration office to complete the registration procedure to transfer the name to the buyer.

Mr. V. said that when signing the transfer contract, he committed to the buyer that he would update the name change within 20 days. Because the file was slow to be processed, the buyer put a lot of pressure on him to resolve it or return the money.

"For the past month, reading news reports and seeing tax and resource agencies going back and forth, reporting and asking for opinions on inadequacies, I've been so impatient that I can't sit still.

"The procedures for buying, selling and transferring need to be resolved quickly, but instead of waiting for ministries and localities to hold one meeting after another, people and businesses miss so many things and suffer all kinds of losses," Mr. V. was indignant.

Similarly, Mr. TQĐ. bought a house in Phu Nhuan district on August 8, 2024, but after more than a month of submitting the application for transfer of ownership, he still has not received the result, causing all his plans to be delayed.

Specifically, the house Mr. D. bought cost 14 billion VND. He planned to quickly borrow 10 billion VND from outside to pay it off, then borrow from the bank to pay it back.

The file is not yet complete, although the bank has completed the valuation and loan procedures but cannot disburse, so Mr. D. is struggling to bear the interest on the loan from outside without knowing when it will be repaid.

"The interest rate for borrowing outside is tens of millions a day, while the agencies are slow in deciding how to resolve the issue, people have to bear the heavy burden," said Mr. D.

Due to lack of money, Ms. PL (living in District 12, Ho Chi Minh City) had to sell two plots of land in District 12 for 6 billion VND. Because both plots of land were being mortgaged for loans at the bank, she had to borrow more than 4 billion VND from acquaintances to complete the procedures to release the red book mortgage.

Meanwhile, the home buyer also borrowed money from the bank, so Ms. L. assisted the buyer with the procedures. The bank agreed to disburse the money to the buyer when the procedures for paying transfer tax and registering the change of name were completed.

When submitting the application at the tax office, Ms. L. was told that because the City People's Committee was about to issue a new land price list, she should temporarily wait to calculate the transfer tax according to the new land price list.

However, up to now, the transfer tax calculation files are still stuck, causing both the seller and the buyer to be "stuck".

"I sold the land because I was short of money. I didn't expect that it would be even more difficult after selling it. I just hope the authorities will quickly calculate the transfer tax so I can complete the land sale procedures," said Ms. L.

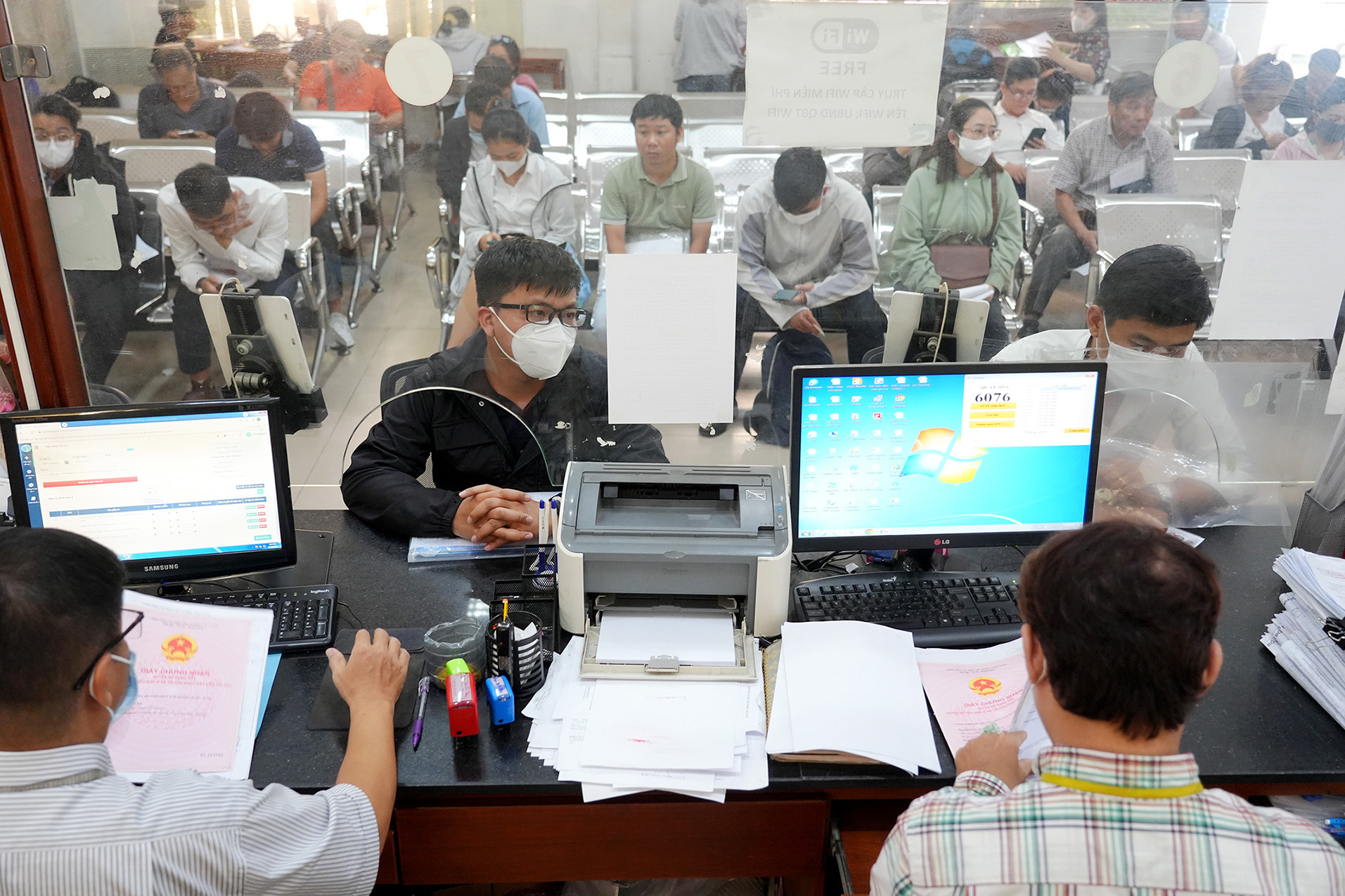

Real estate transactions in Ho Chi Minh City tend to stagnate because after buying and selling, it is still not possible to complete the procedures for changing the name and registering the land - Photo: QUANG DINH

More difficulties for the real estate market

Meanwhile, Mr. Tran Duc Thuan (director of a real estate trading floor in District 7) said that this business alone has nearly 20 real estate purchase and sale files that are stuck at the tax payment stage.

According to Mr. Thuan, all records before and after August 1st were suspended, causing completed transactions to be "frozen" and for new transactions, people found it difficult so they also stopped buying and selling during this period.

"I thought the new law would open up the market and help people trade more conveniently, but instead it makes things more difficult for people.

Initially, the tax department said that it would only take 1-2 weeks for a new land price list to be available as a basis for calculating transfer tax, but up to now, we have been waiting for more than 1.5 months without any progress. Every week, we have to go to the tax department to ask because customers are constantly rushing us," said Mr. Thuan.

Mr. Ta Trung Kien (real estate broker in Ho Chi Minh City) said that there are many cases where the seller is in dire need of money so they have to sell the house but in the end the procedure cannot be completed, the buyer cannot borrow from the bank and pay 100% of the amount to the seller.

There is a case where a customer sold the house to cover the costs of settling abroad, the flight schedule was September 15, so the sale procedures were completed from the beginning of August 2024.

The notarized documents and deposit were completed, but the tax calculation process was stuck, causing the seller to not know what to do. The seller was forced to accept flying abroad from September 15, while the tax payment process continued to wait.

"Customers accept that if there are any problems later, they will have to spend more money on flights back and forth to handle them later because they don't know when the procedure will be completed," said Mr. Kien.

In addition, according to Mr. Kien, in reality, there are cases where when selling a house, one has to borrow money from outside to pay off the loan in order to get the red book to do the name change procedure. In cases where the buyer also borrows from the bank but cannot disburse the money, the seller will fall into a "dilemma" and have to take on debt when selling the house.

Mr. Pham Trong Phu, director of Titanium Real Estate Management Company, commented that the suspension of procedures for issuing and changing land use certificates has made it impossible for people to trade and buy and sell, causing difficulties for brokerage businesses.

"Authorities need to quickly remove obstacles for real estate transactions in Ho Chi Minh City or apply a temporary mechanism. Transactions should not be "frozen" like they have been for the past month," said Mr. Phu.

According to Mr. Tran Khanh Quang - Director of Viet An Hoa Real Estate Investment Company, businesses expect that the early application of laws related to the land sector will remove obstacles for the market and promote real estate transactions, but in reality, problems have arisen, causing further transaction delays.

"Each locality is implementing it in a different way, causing people and businesses to suffer the consequences," Mr. Quang was indignant.

People do real estate procedures in Binh Thanh district, Ho Chi Minh City - Photo: H.HANH

The Ministry of Natural Resources and Environment has not yet spoken out.

According to lawyer Ngo Huynh Phuong Thao (TAT Law Firm), adjusting the land price list to match market value is necessary, but people and businesses cannot be stuck in procedural steps.

Notably, while many other localities are still handling land records according to the old K coefficient and price list, Ho Chi Minh City is "waiting" to issue an adjusted land price list.

"Waiting for the new price list not only makes it difficult for people to complete land procedures but also seriously affects the operations of businesses and especially negatively affects the economic growth rate of Ho Chi Minh City," said Ms. Thao, suggesting that the old land price list should continue to be applied while waiting for the new land price list to be issued.

National Assembly Delegate Le Xuan Than, Chairman of Khanh Hoa Province Lawyers Association, said that as an agency assisting the Government in drafting the 2024 Land Law, the Ministry of Natural Resources and Environment should proactively propose to the Government or organize a national conference to listen to ministries, branches and localities talk about problems in order to have timely solutions and guidance.

According to Mr. Than, the 2024 Land Law stipulates that the land price list according to the old law will be applied until December 31, 2025. Therefore, if necessary, the provincial People's Committee will adjust it to suit the local market price.

Otherwise, the old land price list will still be applied and a new land price list will be developed for use from January 1, 2026.

Therefore, it is completely normal for some localities to not adjust while others adjust land price lists.

"The law has assigned to localities that if Ho Chi Minh City feels that the old land price list is low and could cause losses, they must quickly complete the procedures to issue an adjusted land price list and simplify procedures for people," said Mr. Than.

Lawyer Tran Duc Phuong (Ho Chi Minh City Bar Association) also said that while waiting for the issuance of the new land price adjustment, Ho Chi Minh City must apply the old price list and the tax authority must resolve administrative procedures for the people.

Furthermore, the new Land Law also allows the application of the old land price list until December 31, 2025. Therefore, when the adjusted land price list has not been issued, the old price list is still valid.

"If the new price list is not available, it is allowed to apply the old price list, but why stop handling administrative procedures so that people suffer losses?

Faced with the fact that localities have stopped their applications to seek opinions, relevant ministries and branches need to quickly give their opinions and unify their viewpoints for localities to implement. People cannot sit and wait for agencies to discuss like that," said Mr. Phuong.

Ho Chi Minh City Tax Department urgently recommends again

People come to do real estate procedures at the branch of the Land Registration Office in Phu Nhuan District, Ho Chi Minh City - Photo: TTD

On September 16, the Ho Chi Minh City Tax Department continued to urgently request the Ho Chi Minh City People's Committee to organize a meeting to resolve land records from August 1, 2024.

Specifically, this agency proposed that the City organize a meeting to resolve and unify the application of legal documents such as land price tables, land price adjustment coefficients, land rent calculation percentages, etc. so that tax authorities can promptly calculate financial obligations on land.

According to the City Tax Department, for land records arising from August 1, 2024 to before the date the City issues a decision to adjust the land price list, apply according to Decision No. 02 dated January 16, 2020 of the Ho Chi Minh City People's Committee on promulgating regulations on land price lists in the area for the period 2020 - 2024.

Statistics from the City Tax Department show that from August 1 to 27, this agency received a total of 8,808 records. Of these, 346 records were for land use fee collection in cases of land use right recognition and 277 records were for land use fee collection in cases of land use purpose change.

In addition, there are 5,448 personal income tax records from real estate transfers and 2,737 records in cases where no financial obligations arise. However, due to the lack of issuance of the land price list, there has been a huge bottleneck in resolving land-related records.

According to Tuoi Tre's investigation, there are many land records left at tax offices from August 1, 2024. There are tax offices with 400-500 records left. The head of a tax office in a central district of Ho Chi Minh City said that they have to wait for the land price list to calculate tax obligations. Therefore, the tax office can only explain to the people and cannot do anything else.

However, some tax offices said they have flexibly resolved for people with transfer, inheritance, and gift documents that are exempt from personal income tax and registration fees. For documents that are subject to tax, people have to continue waiting and cannot do anything else.

Mr. NGUYEN VAN DINH (Chairman of Vietnam Real Estate Brokers Association):

Many localities are still confused

Although the three laws have been in effect for more than a month, there still seems to be a gap between the agencies drafting the laws and the localities implementing the laws. Enforcement officers in some localities have not "understood" the viewpoints of the agencies drafting the laws, so there is hesitation and confusion in handling land procedures, especially in the issue of land price lists - the basis for determining land financial obligations.

Although decrees and circulars guide the law, implementation is still very difficult. Therefore, although the new laws have been in effect for more than a month, most localities are still looking for appropriate implementation solutions, even issuing relevant regulations such as land price calculation and land price approval. In fact, the number of projects resolved under the new law is very small because localities are having to rebuild the process of handling related procedures.

Assoc.Prof.Dr. NGUYEN QUANG TUYEN (Head of Economic Law Department, Hanoi Law University):

Need a mechanism to protect law enforcement!

To see the clear effectiveness of the three laws, more time is needed for ministries, sectors and localities to unify their views on law enforcement. For example, the 2024 Land Law stipulates five principles for determining land prices, the first of which is to determine land prices according to market principles, not market prices.

Many localities understand that land valuation is based on market prices, so it is difficult to implement because market prices fluctuate daily. This "ambiguity" has facilitated speculators to easily inflate land prices through auctions, causing market disruption. In law enforcement, in addition to the local market principle, the remaining four principles must be applied in accordance with legal procedures.

In addition, there needs to be a mechanism to protect enforcement officers in the current context. At the same time, it is necessary to ensure independence between the land valuation organization and the land price decision agency. Land valuation must ensure the harmony of interests between land users, the State and investors. If land prices continue to be pushed up, it will be very difficult to promote land efficiency.

Source: https://tuoitre.vn/3-luat-ve-nha-dat-go-ngay-nhung-trac-tro-20240917083459974.htm

![[Photo] Prime Minister Pham Minh Chinh chairs the conference to review the 2024-2025 school year and deploy tasks for the 2025-2026 school year.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2ca5ed79ce6a46a1ac7706a42cefafae)

![[Photo] President Luong Cuong attends special political-artistic television show "Golden Opportunity"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/44ca13c28fa7476796f9aa3618ff74c4)

![[Photo] President Luong Cuong receives delegation of the Youth Committee of the Liberal Democratic Party of Japan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2632d7f5cf4f4a8e90ce5f5e1989194a)

Comment (0)