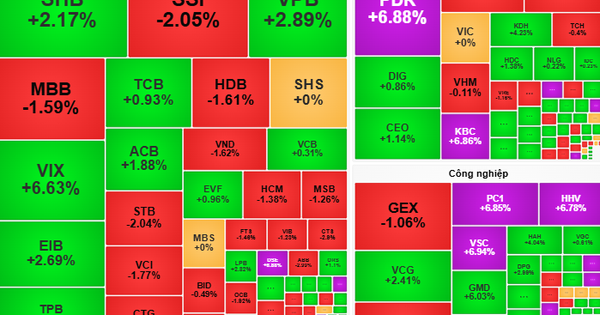

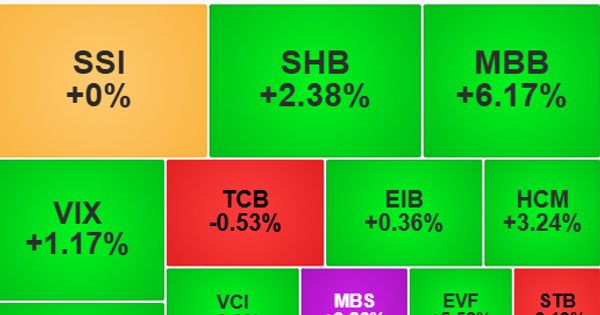

NDO - In the first trading session of the week, November 4, the market traded in a tug-of-war with selling pressure dominating, stocks of many industry groups were in red, large stocks such as VCB, VPB, GVR,FPT ... decreased sharply, negatively affecting the VN-Index, causing it to decrease by 10.18 points at the close of the session, down to 1,244.71 points.

Market liquidity continued to increase significantly compared to the previous session, with the total trading volume of the three floors reaching more than 787.21 million shares, equivalent to a total trading value of more than VND 17,009.14 billion.

Foreign investors continued to net sell for the 17th consecutive session with a value of more than VND 710.05 billion, focusing on codes MSN (more than VND 245 billion), VHM (more than VND 201 billion), FPT (more than VND 101 billion), SSI (more than VND 45 billion), DXG (more than VND 40 billion)...

On the contrary, the stocks with the most net purchases in this session included STB (over 76 billion VND), MWG (over 61 billion VND), TCB (over 43 billion VND), CTG (over 24 billion VND), VPB (over 15 billion VND)...

On the HoSE floor, the order matching value of this session was approximately the same as the previous session, reaching more than 13,369.25 billion VND.

In this session, the codes that contributed positively to the VN-Index increased by more than 1.14 points include: REE, KBC, CTG, FTS, PNJ, HCM, VTP, VCI, SAB, QCG.

On the contrary, the stocks that negatively impacted the VN-Index by more than 6.04 points included: VCB, VPB, GVR, FPT, HVN, MSN, TCB, EIB, HPG, HDB.

In terms of industry groups, energy stocks traded quite negatively, with a decrease of 0.75%, mainly coming from codes BSR , PVS, PVD, PVC, CST, TMB, CLM POS...

Similarly, the group of raw material stocks was in red with a sharp decrease of 1.43%, mainly coming from codes HPG, GVR, DGC, DCM, VGC, MSR, DPM, HSG, KSV, BMP, VCS, PHR, NTP, NKG, TVN, HT1, PTB, CSV...

Retail stocks also leaned towards red, with a decrease of 0.79%, mainly coming from codes MWG, PLX, OIL, DGW, SAS, PET, CTF, HHS, VPG, HAX, SVC... The increase included codes PNJ, FRT, VFG, HTM...

Banking stocks this session performed very negatively, with a decrease of 1.05%, mainly coming from codes VCB, BID, TCB, VPB, MBB, ACB, LPB, VIB, SSB, HDB, STB, TPB,SHB , EIB MSB, OCB, NAB, BVA, BAB... The only code that increased was CTG.

Information technology stocks also fell sharply by 1.20%, mainly from FPT (-1.34%)... The increase was led by CMG (+1.38%)...

Real estate stocks also leaned towards red, with a slight decrease of 0.19%, mainly coming from codes VRE, KDH, SSH, NVL, IDC, VPI, NLG, SIP, KSF, TCH, KOS, CEO, SJS, TAL... The increase included codes BCM, KBC, PDR, DIG, DXG, SNZ, HDG, SZC...

This session, the group of securities stocks improved again with an increase of 0.61%, mainly from codes SSI, HCM, VCI, MBS, FTS, CTS, BSI, TVS, BVS... Declining codes include VND, ORS, OGC, VFS...

* The Vietnamese stock market index today had another strong decline, VNXALL-Index closed down 18.44 points (-0.89%), down to 2,061.12 points. Liquidity with a trading volume of more than 689.49 million units, equivalent to a trading value of more than VND 16,220.97 billion. In the whole market, there were 105 stocks increasing in price, 76 stocks remaining unchanged and 271 stocks decreasing in price.

* At the Hanoi Stock Exchange, the HNX-Index closed at 224.45 points, down 0.96 points (-0.43%). Liquidity reached a total of more than 47.12 million shares transferred, with a corresponding trading value of more than VND 794.85 billion. In the whole market, there were 48 stocks increasing in price, 59 stocks remaining unchanged and 102 stocks decreasing in price.

The HNX30 index closed down 2.47 points (-0.51%) at 481.96 points. Trading volume reached over 21.18 million units, equivalent to over VND459.24 billion. In the whole market, there were 5 stocks increasing in price, 3 stocks remaining unchanged and 22 stocks decreasing in price.

On the UPCoM market, the UPCoM-Index closed at 91.61 points, down 0.35 points (-0.38%). Market liquidity, total trading volume reached more than 30.42 million shares, corresponding trading value reached more than 359.99 billion VND. In the whole market, there were 116 stocks increasing in price, 87 stocks remaining unchanged and 153 stocks decreasing in price.

* At the Ho Chi Minh City Stock Exchange, the VN-Index closed down 10.18 points (-0.81%) to 1,244.71 points. Liquidity reached over 709.67 million units, equivalent to a trading value of VND15,854.30 billion. The entire floor had 93 stocks increasing, 59 stocks remaining unchanged and 287 stocks decreasing.

The VN30 Index decreased by 12.98 points (-0.98%) to 1,312.64 points. Liquidity reached more than 311.29 million units, equivalent to a trading value of more than VND8,848.19. The VN30 group of stocks ended the trading day with 5 stocks increasing, 2 stocks remaining unchanged and 23 stocks decreasing.

The 5 stocks with the highest trading volume are VPB (over 30.56 million units), TPB (over 27.01 million units), VIX (over 25.13 million units), DXG (over 20.84 million units), VHM (over 19.83 million units).

The 5 stocks with the highest price increase are QCG (+6.97%), TMT (+6.93%), VSI (+6.86%), DC4 (+6.64%), HRC (+6.60%).

The 5 stocks with the biggest price decrease were COM (-6.94%), SC5 (-6.80%), PTC (-6.37%), FUEIP100 (-5.86%), EVG (-5.45%).

* Today's derivatives market had 214,359 contracts traded, worth more than VND 28,357.41 billion.

Source: https://nhandan.vn/vn-index-roi-moc-1250-diem-khoi-ngoai-ban-rong-hon-700-ty-dong-post842978.html

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)