Q3 profit drops 43%

Attracting the attention of investors due to its stable business operations, Thien Long Group (TLG) has gone through 10 consecutive years without recording a loss until the fourth quarter of 2022. In the fourth quarter of 2022, Thien Long reported a loss after tax of VND 2.8 billion for the first time after 10 consecutive years of reporting profits.

In Q1 and Q2 of 2023, TLG regained growth momentum with after-tax profits of VND100.1 billion and VND168.2 billion, respectively. However, this growth momentum continued to be broken, with Q3 revenue and profit continuing to decline.

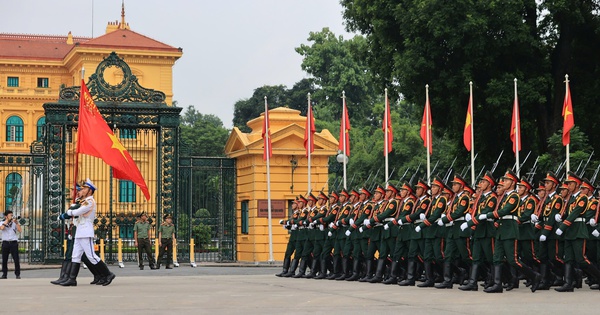

Thien Long (TLG) Q3 profit dropped 43% (Photo TL)

Specifically, Thien Long's revenue in the third quarter of 2023 reached VND 785 billion, down 13% year-on-year. Cost of goods sold also decreased by 13% to VND 430.7 billion. Gross profit was VND 354.3 billion, down 12%.

Financial revenue in the period decreased by 78%, down to 3.1 billion VND. In contrast, interest expense increased from 2.3 billion to 5 billion VND, an increase of nearly 1.2 times. Selling expenses and business management expenses fluctuated slightly, accounting for 193.6 billion and 86.5 billion VND.

Thien Long's third quarter after-tax profit decreased from 103.6 billion to only 59.5 billion VND, a decrease of 43%.

Thien Long Group's accumulated net revenue in the first 9 months of the year reached VND2,772.8 billion, profit after tax reached VND327.7 billion, down 19% compared to the same period last year. TLG's target set at the beginning of the year was VND4,000 billion in revenue and VND400 billion in profit after tax. Thus, after 9 months of operation, TLG has achieved 69% of the revenue target and 82% of the profit plan.

Trade receivables increased sharply

At the end of the third quarter, Thien Long's total assets reached VND2,661 billion, down 7% compared to the beginning of the period. Cash and cash equivalents decreased by 45%, to only VND225 billion. In addition, the company also had an additional VND28 billion in short-term deposits at the bank.

Notably, short-term receivables recorded VND536 billion, up 45%. Most of which were short-term receivables from customers. Other receivables also recorded an increase of 42%, up to VND425 billion.

Also in the explanation of short-term receivables, TLG recorded that short-term receivables worth 3.9 million USD were used as collateral for short-term loans from banks.

Regarding the capital structure, Thien Long recorded a decreasing trend in short-term debt, from VND831.3 billion to only VND508 billion. Meanwhile, long-term debt increased from VND79.9 billion to VND93.1 billion. Owner's equity currently accounts for VND2,060.3 billion. Of which, undistributed profit after tax accounts for VND658.1 billion.

Source

![[Photo] Politburo works with Standing Committees of Lang Son and Bac Ninh Provincial Party Committees](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/20/0666629afb39421d8e1bd8922a0537e6)

![[Photo] An Phu intersection project connecting Ho Chi Minh City-Long Thanh-Dau Giay expressway behind schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/21/1ad80e9dd8944150bb72e6c49ecc7e08)

![[Photo] Prime Minister Pham Minh Chinh receives Australian Foreign Minister Penny Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/20/f5d413a946444bd2be288d6b700afc33)

Comment (0)