Semiconductors are essential components of electronic circuits (chips), which are used in almost every modern electronic device. As everything becomes “smarter” and the demand for electronic devices increases, the demand for semiconductors continues to increase rapidly.

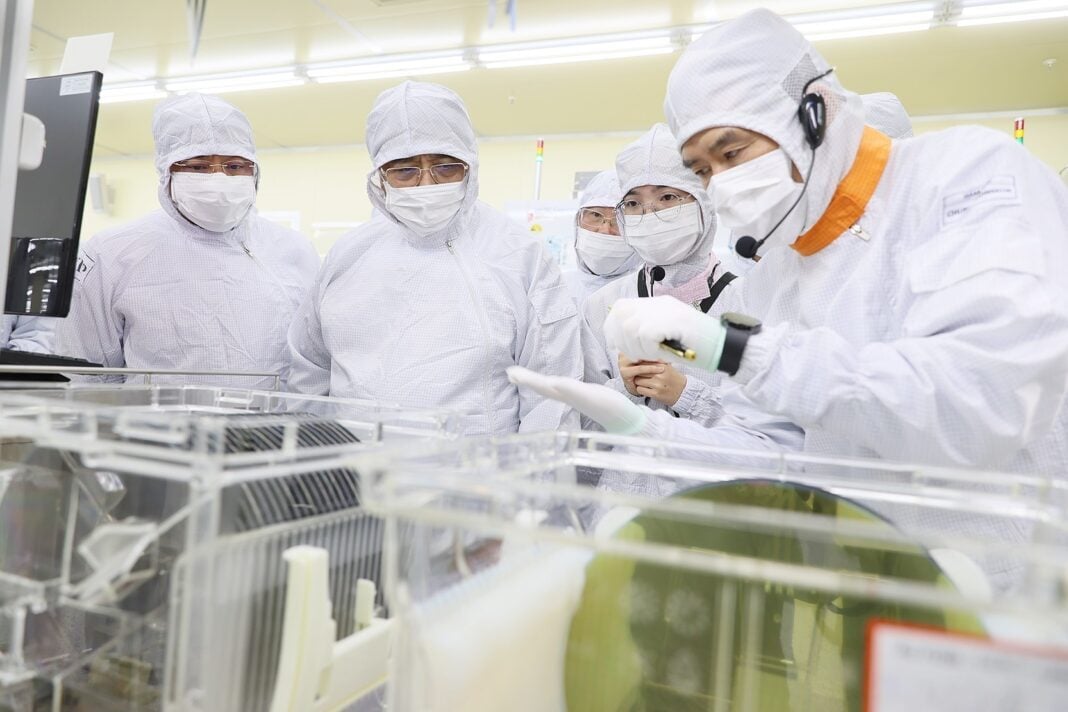

Semiconductor chip production line of Hana Micro Vina Co., Ltd. Photo: Duong Giang-VNA

However, after the COVID-19 pandemic broke out in early 2020, the world fell into a serious shortage of chips. This has negatively affected most industries, especially automobiles and electronics, as this is one of the indispensable inputs for these industries.

In that context, many countries in the world, especially the US, Japan, South Korea and China, have begun to realize the importance of self-sufficiency in semiconductor and chip supply, and have come up with their own strategies to develop this industry.

America pours money into semiconductors and chips

Despite being the birthplace of semiconductors, the United States today accounts for only about 10 percent of the world’s semiconductor supply and is not the place to manufacture the most advanced chips. Instead, the United States relies on East Asia for supplies.

Therefore, to reduce external dependence, in August 2022, President Joe Biden issued the CHIPS and Science Act, with the aim of returning the United States to its dominant position in chip manufacturing and addressing supply chain issues that have hindered research and production activities.

Under this act, the US government will spend 52.7 billion USD to support research, development, semiconductor manufacturing and human resource development, of which 39 billion USD is for manufacturing incentives, 13.2 billion USD is for R&D and human resource development activities, and 500 million USD is for funding activities for technology, information, communications and international semiconductor supply chain security.

Shortly after President Biden passed the Science and CHIPS Act, major U.S. corporations announced nearly $50 billion in additional investment in semiconductor manufacturing, bringing total investment in the sector to nearly $150 billion since President Biden took office:

Then, in mid-December 2023, the US Department of Commerce signed a non-binding preliminary agreement on the terms of a $35 million grant to BAE Systems Electronic Systems, a subsidiary of BAE Systems Corporation, to support the modernization of the New Hampshire Microelectronics Center in Nashua. This is the first grant to US companies under the CHIPS and Science Act.

Commerce Secretary Gina Raimondo said the grants reflect a national security-oriented semiconductor research and manufacturing subsidy program that aims to create a long-term, thriving domestic semiconductor industry. Raimondo said she expects to see more announcements about similar grants in the first half of next year.

Meanwhile, President Joe Biden also revealed that in the coming time, the US Department of Commerce will spend billions of dollars more to produce more semiconductor chips in the US, as well as increase research and development in this field.

For his part, White House Security Advisor Jake Sullivan stressed that Washington does not want to be in a difficult situation regarding the supply of semiconductor chips in case any other country can cut off this supply in a time of crisis.

Japan spends big to revive semiconductor industry

Japan was once the world’s largest semiconductor manufacturer and accounted for more than 50% of the world’s semiconductor chip supply. However, concerns about environmental impact and globalization have led many of the country’s semiconductor chipmakers to relocate production overseas. As a result, Japan’s share of the semiconductor market has steadily declined and is now around 10%.

By the early 2000s, the Japanese government and domestic semiconductor companies began to realize the seriousness of losing their position as the world’s largest manufacturer to foreign competitors. Over the past two decades, they have made numerous efforts to revive the industry. Notably, in 2020, the Japanese government announced a semiconductor strategy that aims to increase domestic semiconductor industry revenue to 5 trillion yen by 2030.

However, these efforts have so far had limited success, partly because semiconductor investment projects often take a long time to implement, and partly because Japan’s policies have not been attractive enough for the “big guys” in the industry. Therefore, in June 2023, Japan announced a revised strategy aimed at strengthening efforts to develop and produce advanced semiconductor chips that are important for economic security and advanced technologies such as artificial intelligence (AI).

Previously, Japan pledged 330 billion yen in financial support for Rapidus and 476 billion yen for a semiconductor factory invested by TSMC (Taiwan, China) in Kumamoto Prefecture. The Japanese government also provided 92.9 billion yen in subsidies to Kioxia Holdings Corp. to build a factory in Mie Prefecture.

South Korea invests in R&D

South Korea has long been known as one of the world's leading memory chip manufacturers, with Samsung Electronics Co. and SK Hynix Inc. being the two main manufacturers, accounting for 73.6% of South Korea's chip supply to the world.

Although it is the leading country in chip production in Asia, Korea is facing many fierce challenges from major competitors, notably TSMC.

In an effort to maintain its position, in early April 2023, the Korean government announced the “R&D Strategy for Core Technologies”, in which Seoul decided to select semiconductors, displays, and next-generation batteries as the three technologies that will be prioritized for development and start with policy planning.

Under the strategy, South Korea will invest a total of 160 trillion won in public and private R&D funds by 2027, including 156 trillion won for corporate R&D spending and about 4.5 trillion won for tax support for businesses.

In addition, Seoul will establish a public-private research consultancy to seek and gather basic technologies, original technologies, applied technologies and research at the commercialization stage.

South Korea invests heavily in R&D activities. Illustration photo: Thu Hoai - VNA

On the other hand, to support the development of high-level human resources, the Korean Government plans to increase the number of research facilities and flexibly utilize human resources through various recruitment mechanisms.

Then, in mid-May, South Korea unveiled its first detailed plan for research and development (R&D) in the chip industry amid growing global competition in the sector. In this 10-year roadmap, the Ministry of Science, ICT and Information Technology outlined the goal of pursuing technological advancement in three areas: next-generation memory and logic chips and advanced packaging technology.

The ministry said it will support the semiconductor industry to produce faster, more energy-efficient and higher-capacity chips so that the industry can maintain global dominance in the fields it is leading and gain a competitive edge in advanced logic chips.

Then, in July, the South Korean government issued a decision to establish seven "specialized complexes" dedicated to the semiconductor, display, and secondary battery industries in major cities across the country, increasing incentives for private enterprises to set up factories or production facilities in these important areas, aiming to nurture advanced technology sectors and turn them into future economic growth engines.

Specifically, the Korean government will build two specialized complexes to serve the semiconductor (chip) industry. The first complex, located in Yongin-Pyeongtaek City in Gyeonggi Province, will serve the 56.2 billion won investment of Samsung Electronics Co., SK hynix Inc. and other chipmakers in the production of memory products and system chips until 2042.

The second complex, located in Gumi, North Gyeongsang Province, is expected to become a major facility for core semiconductor products, such as silicon wafers and substrates.

China rushes to build its own supply chain

China is one of the world’s leading suppliers of semiconductors, but it is not yet fully self-sufficient in semiconductor chip manufacturing technology and equipment, especially advanced chips. Its dependence on foreign technology and equipment makes China vulnerable to any geopolitical tensions. Meanwhile, the strategic competition between the US and China is still fierce. In particular, the US has taken steps to limit China’s access to advanced chip technology.

Against this backdrop, China is looking to build a domestic chip supply chain that can be “immune” to US restrictions. Chinese chip equipment and materials suppliers have earmarked 50 billion yuan ($7.26 billion) with state support to strengthen the domestic supply chain.

Speaking at a chip supply chain conference in Guangzhou, China, Chiu Tzu-Yin, chairman of the National Silicon Industry Group (NSIG), said: "We cannot avoid the separation of the semiconductor industry. This will be the biggest opportunity for Chinese enterprises to produce manufacturing machinery and materials."

As imports of foreign-made chipmaking machinery stall due to US restrictions, Chinese companies specializing in chipmaking equipment and materials have been in the spotlight thanks to government-sponsored subsidies and investment under the Made in China 2025 initiative.

About 35% of Chinese semiconductor factories will use domestic equipment in 2022, up from 21% in 2021, according to Chinese media.

“Global political conflicts may usher in a golden age for China’s semiconductor manufacturing machinery sector,” said David Wang, CEO of ACM Research, a company specializing in wafer cleaning equipment.

Khanh Linh

![[Photo] Bustling construction at key national traffic construction sites](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Podcast]. April in the heart](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/2/9d4d85d863d74637977909e5f6ad4148)

Comment (0)