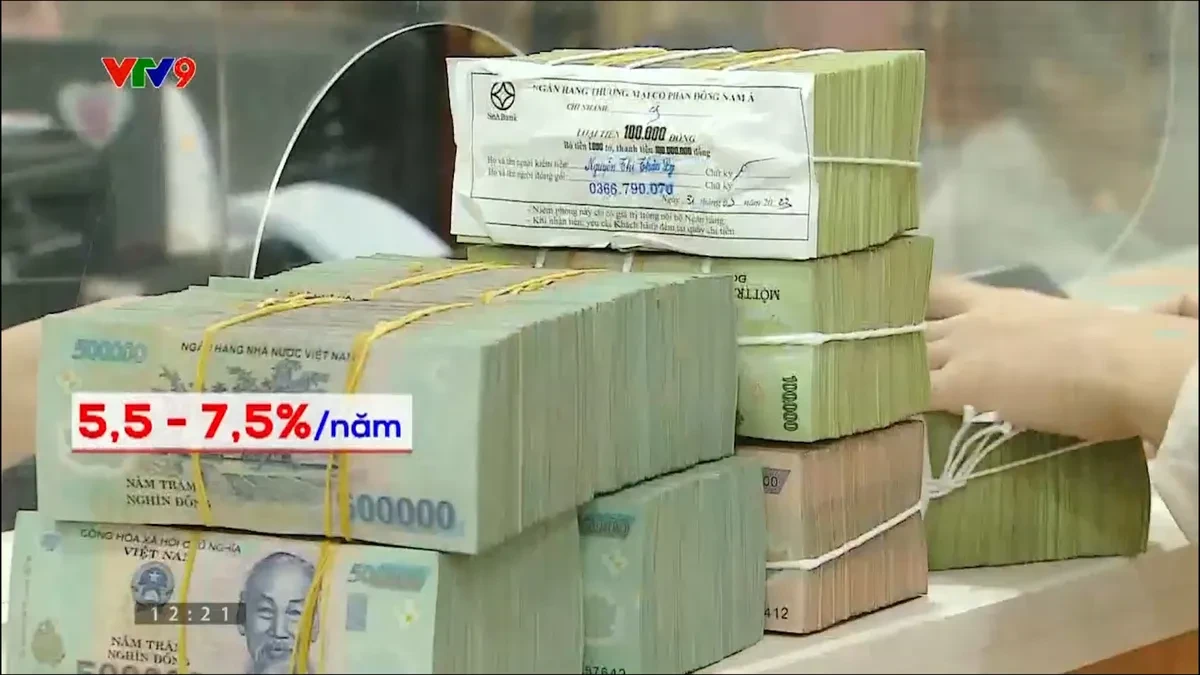

There have been 10 banks that have increased deposit interest rates in the past 2 months, the increase is from 0.1-0.7% depending on the term and the bank. For a 12-month term, deposit interest rates range from 4.6%-5.95%/year.

In the past 2 months, deposit interest rate at commercial banks have started to increase again, this creates great pressure on lending interest rates. Especially in the context that banks have to keep lending interest rates low to support economic growth, under the direction of the Government and the Prime Minister.

There have been more than 10 banks increasing deposit interest rates in the past 2 months, the deposit interest rate level is quite clearly differentiated between banks. With an increase of 0.1-0.7% depending on the term, and depending on each bank. Surveyed at a term of 12 months, deposit interest rates fluctuated from 4.6% - 5.95% / year. There is a quite clear differentiation between small joint stock banks and large banks. Particularly with terms of 13 months or more, some banks have pushed interest rates beyond 6% / year, up to 6.5% / year for long-term deposits, 24 or 36 months.

There are banks that offer the highest rate of up to 9.5%/year, but they will have their own criteria, such as only for large deposits, over 2,000 billion VND, usually for economic organizations. The premises interest rate increased, explained by many banks that they need to mobilize capital to serve the increasing demand for loans at the end of the year.

The bank's deposit interest rate has been adjusted up twice. To attract depositors, they also add interest when people online savings on digital banking.

"We have a program to add 0.6% for new customers who are transacting with the bank for the first time. All banks' common ground is increasing and to serve the whole, the capital demand of the whole system and the whole industry must also increase," Mr. Dang Quang Anh - Director of BVBank Hanoi branch shared.

More innovatively, many banks have introduced automatic interest-generating programs with idle money left in users' payment accounts. For example, at MSB Bank, they accept to pay interest for very short terms, from 3 days.

Ms. Nguyen Thi My Hanh - Deputy General Director of MSB said: "When the account balance is at a certain level, it will immediately help customers make a profit in the account and can make a profit with a term of 1 week, 2 weeks, or monthly, depending on the customer's cash flow, this helps optimize the money and the period that customers leave money in the bank".

According to statistics from the State Bank, there were about 14 million billion VND in deposits from residents and economic organizations in the banking system as of the end of September.

Banks strive to keep lending rates low

With the increasing trend of cashless payments, demand deposits (also known as CASA) are considered a huge resource if banks know how to exploit them. Banks share that their goal of paying interest on short-term deposits is to optimize benefits for users, but an equally important goal is that they can attract more people to the bank and leave their money there.

The interest rate on non-term deposits is only about 0.1% - 0.5%/year, very small compared to term deposits. Therefore, the more CASA is attracted, the more banks can reduce the cost of capital mobilized.

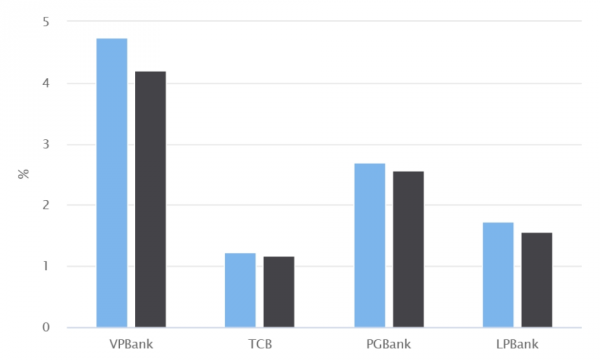

Looking at the Q3 business results, the CASA ratio at many banks is quite high, up to nearly 37%. If banks can mobilize more cheap input capital, this is also the way for banks to find a solution to the problem of how to keep lending interest rates low, without increasing deposit interest rates.

Mr. Tran Van Luan - Permanent Deputy General Director of PGBank said: "The high amount of non-term deposits helps reduce capital mobilization costs, thereby reducing interest costs for customers, increasing competitiveness for the bank. This is also the goal we are aiming for in the coming time to be able to provide products and services, especially pricing policies for customers".

Seeking to reduce input capital costs and cut operating costs, banks have offered many preferential loan packages to meet year-end capital needs.

Ms. Nguyen Anh Van - Deputy General Director of LPBank said: "We have a preferential short-term loan interest rate package worth 3,000 billion VND, with a minimum interest rate of 6% or more, and we have increased the limit of this preferential package to 6,000 billion. For individual customers, we provide loans for consumption purposes and loans to restore production and business with a loan interest rate of only 6.5%".

According to analysts, under the pressure of increasing deposit interest rates and interbank interest rates, lending interest rates are unlikely to decrease further, but at least they will not increase. Because banks will have to offer competitive lending rates to retain good borrowers.

"If we look at the movement of deposit interest rates, they have started to increase again by about 59 points compared to April, so there is not much room for a decrease. However, with the pressure to promote economic growth, we assess that lending interest rates will still maintain a low level," said Ms. Hoang Thi Minh Huyen - Senior Macroeconomics Expert, Bao Viet Securities Joint Stock Company.

The State Bank's report shows that the average lending interest rate of domestic commercial banks for new and old loans with outstanding debt is fluctuating at 6.7-9.1%/year, down about 1% compared to the beginning of the year.

With the Government 's direction to provide capital to support economic growth, banks will also have to maintain lending interest rates at appropriate levels, balancing input sources and businesses' resilience. Because only when businesses are strong enough to recover will they have capital to pay interest on bank loans. At the end of November, the State Bank also issued a document requesting commercial banks to maintain a stable and reasonable deposit interest rate level, consistent with the ability to balance capital, the ability to expand healthy credit and the ability to manage risks, contributing to stabilizing the monetary market and interest rates.

Source

![[Photo] Impressive image of 31 planes taking flight in the sky of Hanoi during their first joint training](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/24/2f52b7105aa4469e9bdad9c60008c2a0)

![[Photo] The ceremonial artillery is ready to "fire" for the second parade rehearsal at My Dinh National Stadium.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/24/883ec3bbdf6d4fba83aee5c950955c7c)

Comment (0)