The Military Commercial Joint Stock Bank (MB) has just announced information on the results of its private bond offering. Accordingly, the bank has successfully issued the MBBL2431011 bond lot with a total value of VND 200 billion, issued on May 27, 2024, with a term of 7 years, expected to mature on May 27, 2031. The bond lot was issued in the domestic market, with an issuance interest rate of 6.18%/year.

According to data from the Hanoi Stock Exchange (HNX), this is the first batch of bonds mobilized by MB in May and the 11th batch issued by MB since the beginning of the year.

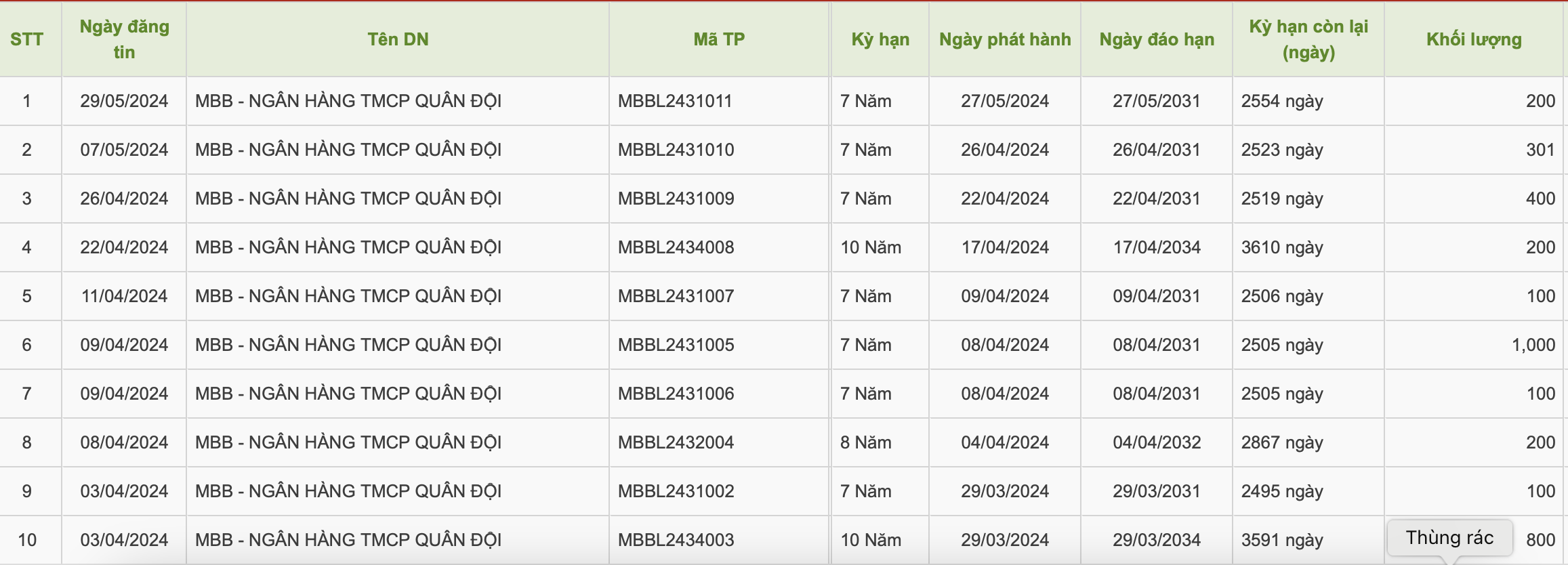

Previously, the bank issued 10 lots of bonds with the code MBBL2431005 with the highest value of 1,000 billion VND. The total value of 11 lots of bonds is 3,551 billion VND.

MB bond lots issued in 2024.

On the other hand, this year, MB spent about VND5,743 billion to buy back 9 bond lots before maturity. In May, the bank bought back 2 bond lots, MBBL2229009 and MBBL2229010.

Both bonds were issued in May 2022, with a term of 7 years and are expected to mature in 2029. Of which, bond code MBBL2229010 is worth VND 1,010 billion and bond lot MBBL2229009 is worth VND 100 billion.

On the same day, May 27, Shinhan Bank Vietnam Limited successfully mobilized bond code SBVCL2427001 with a total value of VND 1,000 billion, with an issuance interest rate of 5.2%/year. The bond lot has a term of 3 years, expected to mature in 2027.

This is the first bond lot mobilized by the bank this year and the fourth bond lot issued by Shinhan Vietnam to the market. The previous 3 bond lots were issued by the bank consecutively in 2022, with a term of 2 years and matured in April and May 2024. In 2023, the bank spent a total of VND 2,912 billion to pay interest and principal for these bond lots .

Source: https://www.nguoiduatin.vn/mb-huy-dong-gan-3-600-ty-dong-trai-phieu-trong-5-thang-dau-nam-2024-a665832.html

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/9f771126e94049ff97692935fa5533ec)

Comment (0)