On November 10, Vietcombank adjusted the online deposit interest rate for 1-2 month terms to a record low of only 2.6%/year. For 3-5 month terms, it also brought it down to 2.9%/year.

According to the online interest rate table just announced by Vietcombank, terms from 1 to 11 months decreased by 0.2 percentage points, terms from 12 to 24 months decreased by 0.1 percentage points.

It is known that the ceiling rate prescribed by the State Bank for term deposits from 1-5 months is 4.75%/year.

Currently, the highest deposit interest rate at Vietcombank is for 12-24 month terms, but it is only 5%/year.

Vietcombank has always been the leading name in reducing deposit interest rates in recent times. Meanwhile, deposit interest rates at other "big guys" such as Agribank , VietinBank and BIDV have not shown any signs of change.

According to statistics, the trend of decreasing savings interest rates started rapidly and rapidly from April 2023. The mobilization interest rate is even lower than the COVID-19 period, but the downward trend has not stopped.

Currently, most banks have lowered their highest listed interest rates to below 6% per year. Only a few banks still pay interest rates of 6% per year or higher, including BaoVietBank, VietABank, Oceanbank, CBBank and HDBank .

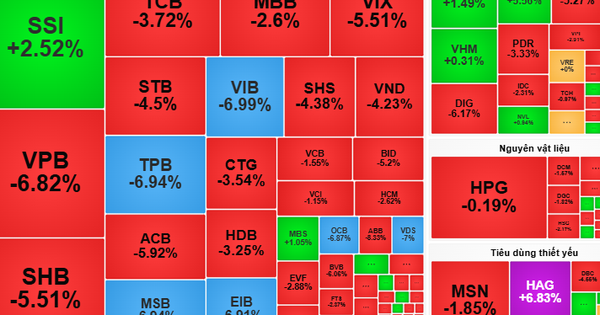

Since the beginning of November, 16 banks have reduced their deposit interest rates: Sacombank, NCB, VIB, BaoVietBank, Nam A Bank, VPBank, VietBank, SHB, Techcombank, Bac A Bank, KienLongBank, ACB, Dong A Bank, PG Bank, PVCombank, Vietcombank. Of which, VietBank has reduced interest rates twice this November.

The reduction in deposit interest rates is considered an effort by banks to create cheap capital sources. The reduction in deposit interest rates will help banks have a basis to further reduce lending interest rates to support the economy.

However, the funds mobilized with high interest rates since the end of last year have not yet matured, causing banks to still bear high average capital costs.

State Bank Governor Nguyen Thi Hong said at a recent meeting: According to banking industry data, the average lending interest rate in the 2017-2018 period was about 8.86 - 8.91% per year.

In fact, new loans at banks have also decreased by 1-3% compared to the beginning of the year, to around 7-10%, while old loans (floating interest rates) are anchored around 11-14% per year.

Source

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)