|

| The British economy is in trouble. (Source: BBC) |

Inflation in this country is at 8.7% in May 2023. The increase in wages is expected to push up interest rates.

Wages have risen 7.2% over the past year to support consumers, according to the UK Office for National Statistics. However, prices have also risen as a result.

Mr. Max Mosley, economist at the UK's National Institute of Economic and Social Research, said that prolonged inflation also erodes the amount of money households spend on assets, putting downward pressure on house prices in the long term.

In June, the Bank of England (BoE) decided to increase the base interest rate by 0.5%, to 5%.

The UK National Institute of Economic and Social Research estimates that the rate hike will cause 1.2 million UK households (4% of households nationwide) to deplete their savings by the end of the year due to higher mortgage repayments.

According to the study, the rate of households with mortgages will default on their loans up to nearly 30% (about 7.8 million households), with the biggest impact occurring in Wales and the North East of England.

“A 5% interest rate hike would push millions of households with mortgages into default,” explains Max Mosley.

Source

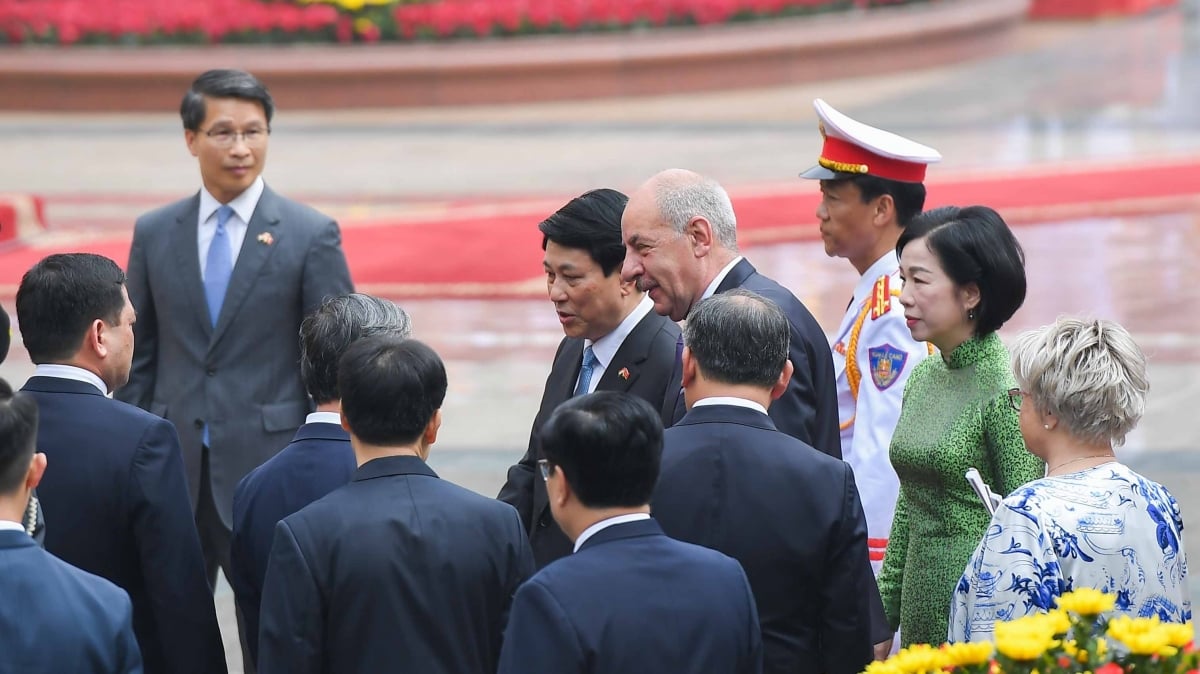

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)