The US labor market lost momentum, even as inflationary pressures remained, leaving most analysts optimistic about gold's prospects next week.

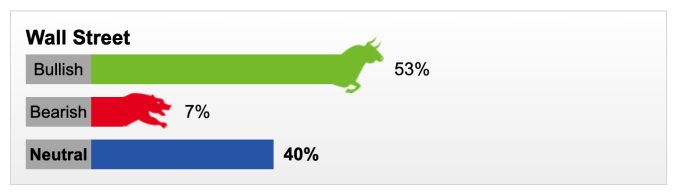

Fifteen Wall Street analysts participated in Kitco’s gold survey, with eight (53%) expecting gold prices to remain in the green next week. Six (40%) were neutral, with only one analyst predicting a decline in the precious metal over the next seven days.

Wall Street experts' gold price forecast for the week of August 7-11. Photo: Kitco News

"The US jobs market is cooling and that's exactly what the Fed wants to see," said Adam Button, chief currency analyst at Forexlive.com. "The market is getting more and more comfortable that interest rates are at their peak. Once that's confirmed, the only way rates can go is down, which should support gold."

However, the expert also believes that gold is already at a fairly high price despite the "strong winds" from the Fed. "Gold is at $ 1,940 per ounce, so how high can gold go in the interest rate cutting cycle?", Button said, adding that investors should observe the market before making a decision. The Fed may have to wait until early next year. "That's when I expect gold to take off."

Marc Chandler, CEO at Bannockburn Global Forex, also has a positive view on gold in the short term.

"I think the recent pullback, supported by rising interest rates and a stronger greenback, has run its course. A potentially significant reversal is in the works after the jobs data and gold fell to a near four-week low below $1,926," Chandler said, adding that a move back above $1,950 suggests the potential for gold to return to $1,965-$1,970 in the short term.

Colin Cieszynski, chief market strategist at SIA Wealth Management, also expects gold to rise in the coming days. "Technically, it looks like the recent rally in the US dollar and the correction in gold are coming to an end. If gold holds its gains today, we will have a real bullish candlestick pattern," Cieszynski said.

On a more cautious note, James Stanley, senior market strategist at Forex.com, said gold prices will maintain a sideways pattern, although next week's inflation data will be a risk event.

Stanley said gold is not ready for a bigger crash. "The dollar is really strong and there is a big window for the bears, but they haven't broken through it so I have to think the reversal is not there yet," Stanley said, citing $1,980 as a resistance level to watch.

The only bearish forecaster for next week is Kitco’s Jim Wyckoff, who said he “sees enough evidence” to predict lower prices next week. “Lower levels will be a level of stability as prices are in a downtrend on the daily chart,” Wyckoff said.

Minh Son ( according to Kitco )

Source link

![[Photo] President Luong Cuong receives delegation of the Youth Committee of the Liberal Democratic Party of Japan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2632d7f5cf4f4a8e90ce5f5e1989194a)

Comment (0)