SJC gold price today has not stopped, setting a new record. surpassing the peak of 127 million

SJC, DOJI and PNJ gold prices increased to 127.1 million VND/tael

At the beginning of this afternoon's trading session, the gold price this afternoon, August 25, 2025, at Saigon Jewelry Company (SJC) recorded unexpected developments. After many consecutive increases, the SJC gold price in Hanoi remained unchanged in the buying direction, listed at 125.6 million VND/tael. However, in the selling direction, the SJC gold price jumped 500,000 VND/tael, reaching 127.1 million VND/tael.

Not out of the general trend, DOJI Group also witnessed a flat buying price of 125.6 million VND/tael, while the selling price increased by 500,000 VND/tael, to 127.1 million VND/tael.

Gold price at brands remains at 126.9 million

At Mi Hong, the latest gold price today, August 25, 2025, recorded an increase in both directions. Specifically, the buying price increased by 400,000 VND/tael to 126.4 million VND/tael, and the selling price increased by 300,000 VND/tael to 126.9 million VND/tael.

Meanwhile, Bao Tin Minh Chau also had notable price increases. Both buying and selling prices increased by VND300,000/tael, reaching VND125.9 million/tael and VND126.9 million/tael, respectively.

Phu Quy Gold and Gemstone Group recorded an increase of VND300,000/tael in both directions, with the buying price being VND124.9 million/tael and the selling price being VND126.9 million/tael.

As for Vietinbank Gold, the listed selling price increased by 500,000 VND/tael, to 127.1 million VND/tael.

The price of 9999 plain gold rings today, August 25, 2025, is stable.

At 3:00 p.m. on August 25, 2025, the price of DOJI's 9999 Hung Thinh Vuong round gold ring was listed at VND 118.8 million/tael (buy) and VND 121.8 million/tael (sell), unchanged in both buying and selling directions compared to the previous day, with a buying - selling difference of VND 3 million/tael.

Plain gold ring price today August 25, 2025 increased in Phu Quy

Bao Tin Minh Chau kept the price of gold rings at 119.0 million VND/tael (buy) and 122.0 million VND/tael (sell), unchanged in both directions compared to early this morning, with a difference of 3 million VND/tael.

Phu Quy Group also listed the price of gold rings at 118.7 million VND/tael (buy) and 121.7 million VND/tael (sell), a slight increase of 400 thousand VND/tael in both directions compared to yesterday, with a buy-sell difference of 3 million VND/tael.

Gold price list today 8/25/2025 in Vietnam in detail

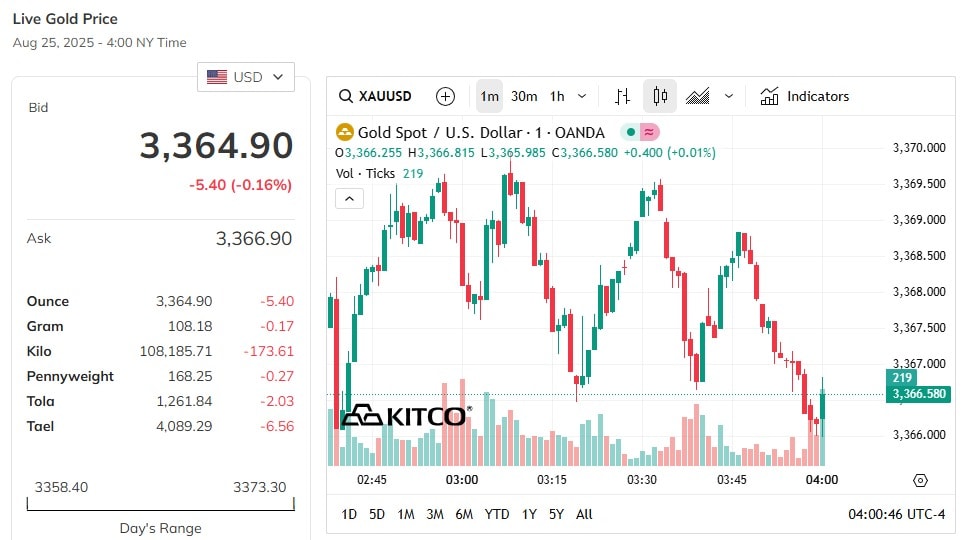

Update on world gold price this afternoon is still red

World gold price, at 3:00 p.m. on August 25, 2025 (Vietnam time), the world spot gold price was at 3,364.9 USD/ounce. Today's gold price decreased by 5.4 USD compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,480 VND/USD), the world gold price is about 111.65 million VND/tael (excluding taxes and fees). Compared to the domestic SJC gold bar price on the same day (125.6-127.1 million VND/tael), the current SJC gold price is about 15.45 million higher than the international gold price.

Gold prices slipped from a near two-week high on Monday as the dollar rebounded. However, growing expectations that the US Federal Reserve will cut interest rates, following Chairman Jerome Powell's "dovish" signal last week, provided support for the precious metal.

Spot gold fell 0.1% to $3,367.86 an ounce at 0632 GMT, after hitting its highest since Aug. 11 on Friday. Meanwhile, U.S. gold futures for December delivery also fell 0.2% to $3,412.50.

A 0.1% rebound in the dollar index against other major currencies, after hitting a four-week low, made gold less attractive to foreign buyers.

“There is good support for gold around $3,350 in the short term, as Powell’s dovish comments helped gold make a notable bottom on Friday,” said Matt Simpson, senior analyst at City Index. “A sustained rally would likely require weaker PCE and employment data in the future. But with inflation likely to remain elevated, gold’s upside could be limited after the initial bounce.”

Last week, Chairman Powell signaled the possibility of a rate cut at the Fed’s meeting next month, saying risks to the job market were rising even though inflation remained a threat. He stressed that a final decision had not yet been made.

According to the CME FedWatch tool, the market is currently betting on an 87% chance that the Fed will cut rates by 25 basis points at its September meeting, and a total of 48 basis points of cuts by the end of the year.

Gold tends to gain in a low-interest-rate environment, as it reduces the opportunity cost of holding the non-yielding metal. Meanwhile, Asian stock markets also rose on Monday as investors cheered the possibility of the Fed resuming its rate-cutting policy.

Investors are now awaiting US personal consumption expenditure (PCE) data on Friday, with forecasts that core inflation could edge up to its highest level since late 2023, reaching 2.9%.

In other precious metals markets, spot silver rose 0.3% to $38.94 an ounce, platinum fell 0.2% to $1,359.66, and palladium was flat at $1,126.41.

Source: https://baodanang.vn/gia-vang-chieu-nay-25-8-2025-gia-vang-sjc-can-ky-luc-moi-len-127-1-trieu-dong-luong-3300284.html

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)