Local economy has improved thanks to credit capital

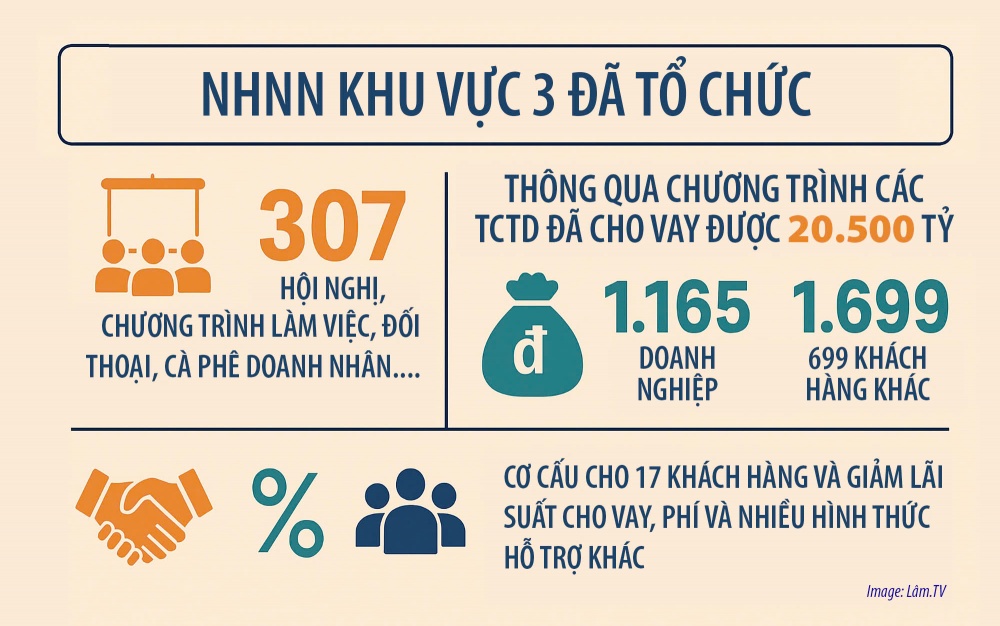

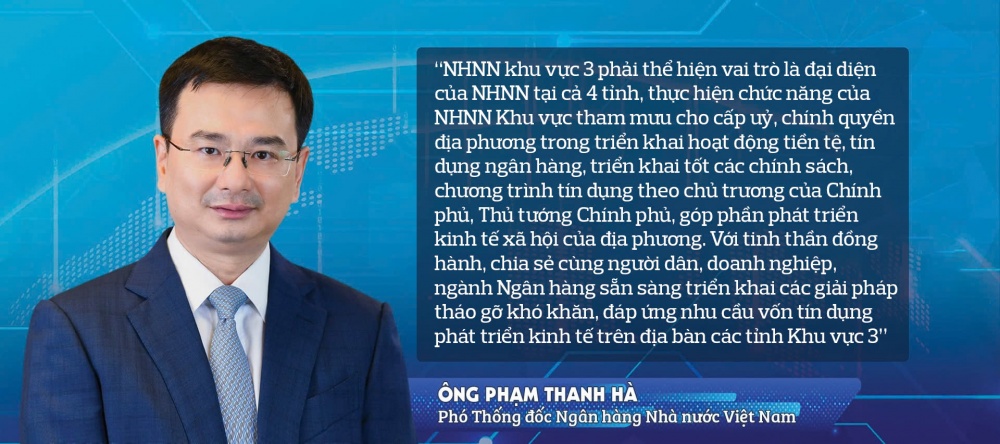

With consensus and high determination, the State Bank of Vietnam has completed the reorganization of 63 provincial and municipal branches into 15 regional banks, ensuring the implementation of state management, payment activities, monetary security, and treasury for the banking system. According to the leaders of the State Bank of Vietnam, the consolidation of the State Bank's organizational structure, including 15 regional banks, is the result of serious and drastic efforts of the State Bank's Board of Directors and Steering Committee, implementing the consistent directions of the Central Committee, the Politburo, and the Secretariat on implementing the "revolution" of streamlining the apparatus, which is a key, urgent task, of special significance to the country's development in the new era.

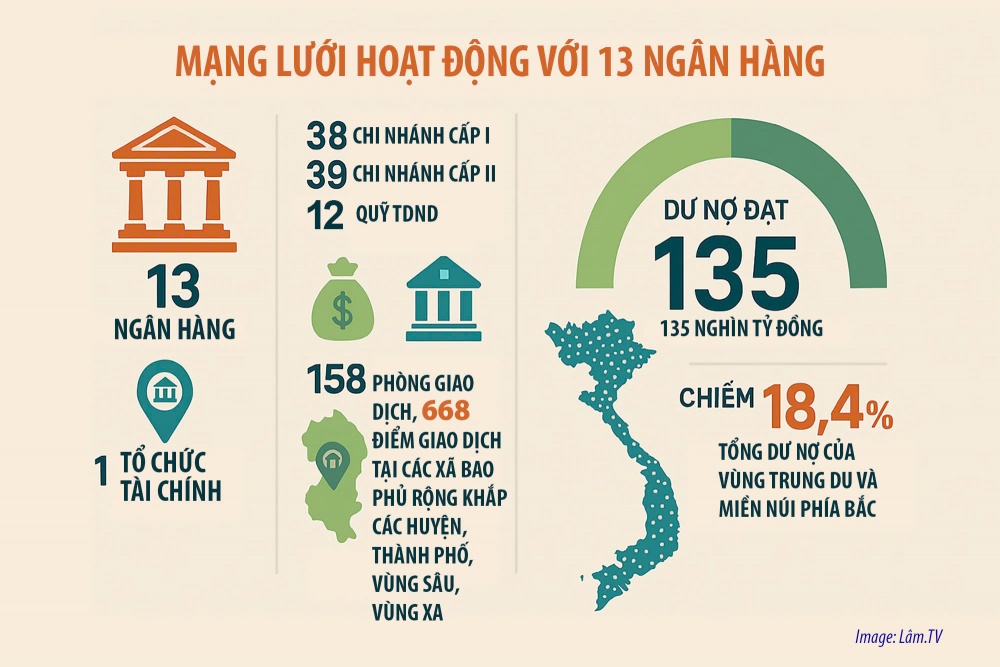

SBV Region 3 includes 4 provinces: Son La, Dien Bien, Lai Chau, Hoa Binh in the Northwest region, the western gateway of the country, bordering Laos and China, with great potential, many favorable conditions for the development of agricultural production, forestry, hydropower, eco-tourism and many rare mineral resources. The natural area is 37,309 km2, accounting for 11.3% of the country's area; population of 3.4 million people, the population structure in rural areas accounts for over 80%, urban areas about 20%.

In recent years, the overall economic picture of the Northwest region has improved. The overall economic growth rate of the region has increased over the years, the socio-economic infrastructure, especially electricity, roads, schools, and stations have been upgraded and expanded; many industrial parks and industrial clusters have been built and put into operation. Investment projects in the region have increased in both quantity and scale, especially in the hydropower sector, including many national key projects. Agriculture, forestry and fishery have initially developed in the direction of commodity production, forming a number of concentrated, specialized, and deeply processed production areas with high economic efficiency, with the second largest fruit growing area in the country; the largest area and output of coffee and tea in the country... In addition, eco-tourism has strongly developed, attracting many domestic and international visitors such as Dien Bien Phu; Pha Din Pass; O Quy Ho Pass; Mai Chau - Hoa Binh, Son La and Hoa Binh Hydropower Reservoir; Ta Xua; Ngo Chien; Moc Chau was honored as the World's Leading Natural Destination... contributing significantly to the stability and overall development of the country.

|

| Local economy has improved thanks to bank capital |

According to Mr. Trinh Cong Van, Acting Director of the State Bank of Vietnam Region 3, in recent years, credit institutions have promoted lending investment in local strengths such as hydropower, agriculture, tourism, etc. In addition, credit institutions prioritize lending capital to policy beneficiaries, etc. to contribute to promoting socio-economic development, hunger eradication, poverty reduction, and improving the lives of local people.

As a large agricultural processing enterprise in the province, Ms. Chu Thi Kim Oanh, Director of BHL Son La Agricultural Processing Company, emphasized that the companionship and support from the banking system plays an extremely important role in the operation of the enterprise. Ms. Oanh said that BHL Son La Agricultural Processing Company has signed a strategic agreement with VietinBank to provide comprehensive financial services such as online transactions, online foreign currency trading, etc. These services are not only convenient and simple but also suitable for the characteristics of the agricultural processing industry.

According to Ms. Oanh, by 2025, the company aims to expand its market, diversify its products, and increase value in the agricultural supply chain. To achieve these goals, it needs the support and companionship of the banking system.

|

Appreciating the results that the banking sector in the area has achieved, contributing significantly to the overall socio-economic development of the province, Mr. Nguyen Dinh Viet, Deputy Secretary of the Provincial Party Committee, Chairman of the People's Committee, Head of the National Assembly Delegation of the XVth term of Son La province, said that in the past time, the banking sector of Son La has proactively coordinated with the provincial Departments and Branches to monitor; promptly work to grasp, remove, and propose to remove difficulties and obstacles, especially regarding land, legal procedures, production connection and product consumption... creating favorable conditions for businesses, cooperatives, and people to access credit capital.

At the same time, deploy solutions to apply population data in lending activities for life and consumption; promote non-cash payments in pension and social insurance benefits on the basis of the National Population Database. In addition, direct the People's Credit Funds to strengthen measures to prevent and control violations and bad debt generation; strengthen state management in the field of e-commerce and business on digital platforms.

Find every solution to push credit from the " lowlands "

Despite many positive results, credit promotion in the Northwestern provinces still faces many difficulties. Statistics show that credit growth in the region has been on a downward trend, is unstable and low compared to the national average. As evidence, credit growth in 2021 is 7.96%; in 2022 is 7.20%; in 2023 is 9.63%; in 2024 is 7.62% and in the first months of 2025, growth is negative.

According to bank representatives, capital absorption in the area is facing many difficulties because the provincial economy in general is growing slowly and unstable. In addition, the economies of the provinces in the region are heavily dependent on natural conditions; some investment lending sectors have reached their potential such as hydropower, agriculture, etc.; transportation is difficult, leading to not attracting large investors, etc. Not to mention that there are not many large economic projects that create momentum to promote the local economy and are slow to implement; enterprises in the area are mainly small and medium-sized, with limited financial capacity; e-commerce is developing strongly, etc.

|

| Find every solution to promote credit for local economic development |

Meanwhile, the capital mobilized in the area only meets 83% of the total outstanding debt of credit institutions in the area; if calculated on the outstanding debt of the banking sector lending in the area (including credit institutions in and outside the province), it only meets 52% of the total outstanding debt. Therefore, credit institutions in the area are passive in terms of lending capital, having to depend on loan capital, regulated from the head office to lend to people and businesses in the area. Besides, credit institutions also face many difficulties in handling bad debt and debt with potential risks.

“This year, the Government sets a growth target of at least 10% for localities so that the whole country can reach 8%. So, how can the mountainous provinces such as Dien Bien, Lai Chau, Son La, which are considered credit and financial depressions, achieve this target?”, Mr. Pham Duc Toan, Vice Chairman of Dien Bien People's Committee, wondered.

Mr. Toan estimated that in Dien Bien, with an ICOR coefficient (investment capital ratio compared to growth rate) of 5.5, investment capital of about 9 trillion VND is needed, of which the province's private investment accounts for only 50%, equivalent to 4,500 billion. In 2024, Dien Bien's outstanding credit balance will be about 22 trillion VND, including outstanding debt from the Social Policy Bank. In 2025, the industry's credit growth target is 16%, but for Dien Bien, this figure must also be 20% to meet capital sources for the private sector here.

Regarding Lai Chau, Mr. Giang A Tinh, Vice Chairman of the Provincial People's Committee, added that this province has great hydropower potential. In addition to the current capacity of 3,000 MW, according to the Power Plan VIII, Lai Chau is allocated an additional 900 MW. In addition, the province is assigned by the Government to invest in solar power, with an investment rate of 12 billion VND per MW.

To exploit this potential, Mr. Tinh suggested that banks proactively seek information on businesses and project planning at local departments and branches to identify feasible projects and business reputations to promptly consider businesses/projects eligible for loans...

|

Mr. Nguyen Ngoc Son, Permanent Vice President of Son La Business Association and Director of Quynh Ngoc Joint Stock Company, representing the business community, said that although the economy is recovering and developing, businesses, especially in Son La province, still face many difficulties and limitations. The majority of businesses in the province are small and micro-sized (accounting for nearly 97%), have low production and business capital, the proportion of businesses in industry groups is still unbalanced, mainly operating in the construction and service sectors, so they face many difficulties in accessing loans. Many businesses do not meet the requirements for collateral or are not eligible for loans, leading to limitations in expanding production and investment.

“The provincial business association and businesses hope that the banking sector will continue to promote its pioneering role, creating more suitable mechanisms and policies to help businesses overcome capital difficulties, especially cooperatives and small and medium enterprises,” said a representative of the Son La Business Association.

In addition, Mr. Nguyen Ngoc Son also recommended that the State Bank encourage credit institutions to expand the form of mortgage loans based on future assets because currently very few banks apply this form of loan.

|

In response to the expectations of local leaders and businesses, a representative of Vietcombank said that, implementing the direction of the State Bank, Vietcombank affirmed that Region 3 is one of the key areas, with an expected credit growth rate of 31%, higher than the average. To achieve this, Vietcombank proposed a number of recommendations to the State Bank such as paying attention to supporting Vietcombank branches, especially young branches in Region 3; at the same time, creating favorable conditions for the bank to implement incentive programs and policies to support businesses.

Leaders of Agribank, VietinBank and BIDV also pledged to continue promoting lending to local strengths such as hydropower, agriculture, tourism, etc., prioritizing lending capital to policy beneficiaries to contribute to promoting socio-economic development, hunger eradication, poverty reduction, and improving the lives of local people.

Source: https://thoibaonganhang.vn/dua-dong-von-ngan-hang-phat-trien-vung-phen-dau-cua-to-quoc-162368.html

![[Photo] President Luong Cuong and Sri Lankan President Anura Kumara Dissanayaka visit President Ho Chi Minh relic site](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/0ff75a6ffec545cf8f9538e2c1f7f87a)

Comment (0)