The number of businesses withdrawing from the market in the past 10 months continues to be high. A series of difficulties for businesses are still waiting to be resolved. The need to remove bottlenecks for businesses is not only urgent in terms of time, but also in terms of thinking.

Removing bottlenecks for businesses: Requires a mindset that promotes development

The number of businesses withdrawing from the market in the past 10 months continues to be high. A series of difficulties for businesses are still waiting to be resolved. The need to remove bottlenecks for businesses is not only urgent in terms of time, but also in terms of thinking.

The number contains many bottlenecks

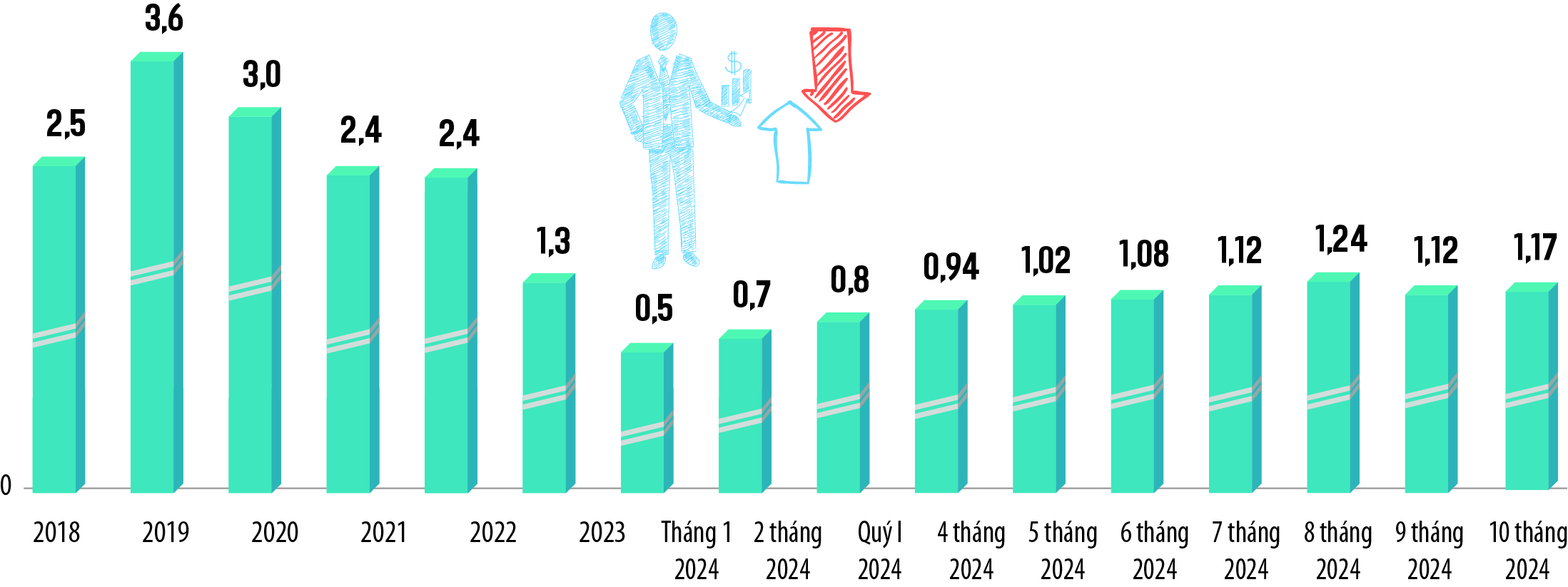

More than 173,000 businesses have withdrawn from the market in the past 10 months, worrying Dr. Nguyen Dinh Cung, former Director of the Central Institute for Economic Management. In his table of the ratio of businesses entering the market compared to businesses withdrawing, the trend is gradually decreasing (see table).

|

| Rate of enterprises entering the market/enterprises withdrawing from the market. Source: Dr. Nguyen Dinh Cung |

“Private sector investment growth is also low, at around 7.1%, although it has recovered each quarter, it is still too low compared to the growth needs of the economy, as well as the capacity of this sector,” Mr. Cung added to the issues of concern from the statistics.

Compared to the pre-pandemic period, specifically 2014-2019, the growth of this sector has always been above 10%. 2017 recorded a record growth rate of 17%. “The continuous high growth rate in those 5 years has contributed greatly to Vietnam's GDP growth rate in 2017-2019. Without promoting private investment and creating a new atmosphere in development investment, GDP cannot have a breakthrough growth rate in the next period,” Dr. Cung affirmed.

However, what Mr. Cung is most concerned about is that the difficulties of businesses seem to be too numerous and take too long to be resolved. “I don’t understand why the recommendations of businesses are being resolved so slowly. In summary, there are still issues of tax refunds, access to credit, land, removal of inappropriate business conditions... Many problems have been resolved, but they are still not completely resolved,” Mr. Cung raised the issue when continuously receiving recommendations from business associations.

|

| Aluminum export businesses are facing many difficulties, but petitions have not been resolved for many years. Photo: Duc Thanh |

Business community uncertainty

Ms. Ly Thi Ngan, Chief of Office of the Vietnam Aluminum Profile Association (VAA), could not say enough about the difficulties of businesses in the industry. “Exporting businesses are facing a lot of difficulties, but the petitions have not been resolved for many years. We continue to petition to adjust the tax framework and reduce the export tax on aluminum products in the form of bars, rods, and profiles with HS code 7604 from 5% to 0%...”, Ms. Ngan said.

The above petition has been sent by VAA to the Ministry of Finance many times, requesting a report to the Government and the National Assembly, starting from 2018, when it discovered shortcomings in the implementation of the Law on Export Tax and Import Tax in 2016. Since then, VAA and its members have repeatedly mentioned it, but have not received any response so far.

The reason is that the group of aluminum profile products - HS code 7604 - is a processed product on the production line, requiring investment of hundreds of billions of VND per factory and research and development to transform from raw aluminum into aluminum profiles, and is subject to an export tax rate of 5%. Meanwhile, products with HS code 7610 are simply processed such as cutting, trimming, punching pads... with low investment costs from aluminum profile products but have a tax rate of 0%. "This is unfair to Vietnamese aluminum profile manufacturers", Ms. Ngan shared VAA's opinion.

In particular, she said, this group of products is subject to export tax ranging from 5% to 40%, making it very difficult for businesses to penetrate foreign markets, especially the US market - the largest partner of the aluminum industry today.

VAA is not the most weary association with its years-long petition.

On November 5, 5 associations and industries jointly signed an official dispatch to Deputy Minister of Health Do Xuan Tuyen and the Drafting Committee of the Decree amending Decree 09/2016/ND-CP on fortifying micronutrients in food. The 5 associations are the Vietnam Association of Seafood Processors and Exporters (VASEP), the Ho Chi Minh City Food and Foodstuff Association, the Transparent Food Association, the Phu Quoc City Fish Sauce Production Association and the Association of High-Quality Vietnamese Goods Enterprises. This petition was sent after the meeting on October 30 of the Ministry of Health to collect comments on the draft Decree.

“We see that the meeting results do not fully and accurately reflect our concerns about the difficulties and obstacles in implementing regulations on salt used in food processing must be fortified with iodine and wheat flour used in food processing must be fortified with iron and zinc,” Mr. Nguyen Hoai Nam, Deputy Secretary General of Vasep, clarified the reason for the above document.

According to Mr. Nam, businesses always fully support the policy of supplementing micronutrients to improve people's health, including the mandatory iodine solution for salt and solid spices used in households and food service establishments.

“The only thing we are concerned about and recommend is the regulation on the use of iodized salt and iron and zinc-fortified wheat flour in food processing, because many of Vietnam's export markets require not to use iodized salt, such as Japan and Australia, and require a certificate of commitment that the product does not use this type of salt. This puts great pressure on Vietnamese export enterprises,” Mr. Nam explained in detail.

In the above document, the associations proposed to exclude exported food products from the scope of the Decree amending Decree 09/2016/ND-CP. The addition of micronutrients in salt and wheat flour in food processing is recommended as encouraged. In addition, the associations proposed to allow the production and import of salt without added iodine to meet specific needs.

Requires a mindset of promoting development, rather than management

The recommendations of the five associations regarding Decree 09/2016/ND-CP are not new, and have even been included by the Government in the tasks to be done in Resolution 19/2018/NQ-CP on continuing to implement key tasks and solutions to improve the business environment and enhance national competitiveness.

Specifically, the Government has assigned the Ministry of Health to study, amend and supplement Decree No. 09/2016/ND-CP in the direction of: abolishing the regulation "salt used in food processing must be fortified with iodine" at Point a, Clause 1, Article 6; abolishing the regulation "wheat flour used in food processing must be fortified with iron and zinc" at Point b, Clause 1, Article 6. Instead, only food processing enterprises should be encouraged to use it.

“These solutions all come from the reasonable demands of business people. Perhaps the success of the business environment reform period from 2014 to 2019 is due to policy makers having the mindset of development promoters, instead of state managers,” Dr. Cung acknowledged.

It is not by chance that Mr. Cung mentioned this time. Looking back, the years 2014-2019 were the time when Vietnam's business investment environment made a breakthrough. Since 2014, the first year the Government issued Resolution 19/2014/NQ-CP on the main tasks and solutions to improve the business environment and enhance national competitiveness, efforts to improve Vietnam's business environment have been officially measured by the ranking compared to regional economies, as well as global competitiveness rankings.

It is worth noting that reform is not only to improve rankings on global rankings, but more importantly, to substantially remove obstacles and barriers to business activities, making the business environment truly open and favorable.

The abolition and simplification of regulations on business conditions is an inheritance of previous reforms, but the scale, extent and determination of this reform are much greater than before. Thanks to that, thousands of business conditions have been abolished; thousands of other conditions have been supplemented and amended to make business operations more favorable.

“I think that the mood of the business environment and the policy environment at that time created a turning point, thereby creating a leap in growth. This time is also in need of such a leap and there is a basis to achieve it when General Secretary To Lam said that we must definitely abandon the mindset of banning if we cannot manage it, we must remove institutional bottlenecks...”, Mr. Cung emphasized.

However, these mindset shifts are not only in the general public, but need to start from many leadership positions...

Source: https://baodautu.vn/go-diem-nghen-cho-doanh-nghiep-doi-hoi-tu-duy-thuc-day-phat-trien-d229450.html

![[Photo] Prime Minister Pham Minh Chinh chairs the conference to review the 2024-2025 school year and deploy tasks for the 2025-2026 school year.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2ca5ed79ce6a46a1ac7706a42cefafae)

![[Photo] President Luong Cuong receives delegation of the Youth Committee of the Liberal Democratic Party of Japan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2632d7f5cf4f4a8e90ce5f5e1989194a)

Comment (0)