The price of SJC gold bars has continuously increased sharply in recent days, at nearly 124 million VND/tael for sale. Compared to the beginning of the year, the price has increased by about 50%.

The increase in gold prices may make many people holding gold happy, but on the contrary, it may make those who owe gold "impatient". Among them, there is a notable enterprise with a debt of 5,833 taels of SJC gold, borrowed at the time of gold at 17.7 million VND/tael, up to now, if calculated according to market price, the debt has increased nearly 10 times.

That is Saigon Seafood Trading Joint Stock Company, established in 1976, specializing in the production, processing and trading of seafood and agricultural products for export and domestic consumption.

Seafood enterprises owe 5,833 taels of SJC gold from the time the price was 17.7 million VND/tael

Sai Gon Seafood used to be a prominent business unit in the southern seafood industry, receiving many titles and awards. According to the introduction, the company still produces and processes 20,000-30,000 tons of various types of seafood every year, of which 60% is for export.

Since 2008, the company's bad debts have increased dramatically, mainly due to advances to factories and households implementing fish farming models, but which were later unable to be recovered. Faced with this situation, the company had to borrow from Phuong Nam Bank (merged into Sacombank since 2015) to maintain operations.

In January 2009, Saigon Seafood borrowed 5,833 taels of SJC gold from Phuong Nam Bank, with a unit price of 17.66 million VND/tael, equivalent to more than 103 billion VND. At the same time, this company also signed a cash loan contract with this bank, also worth 103 billion VND.

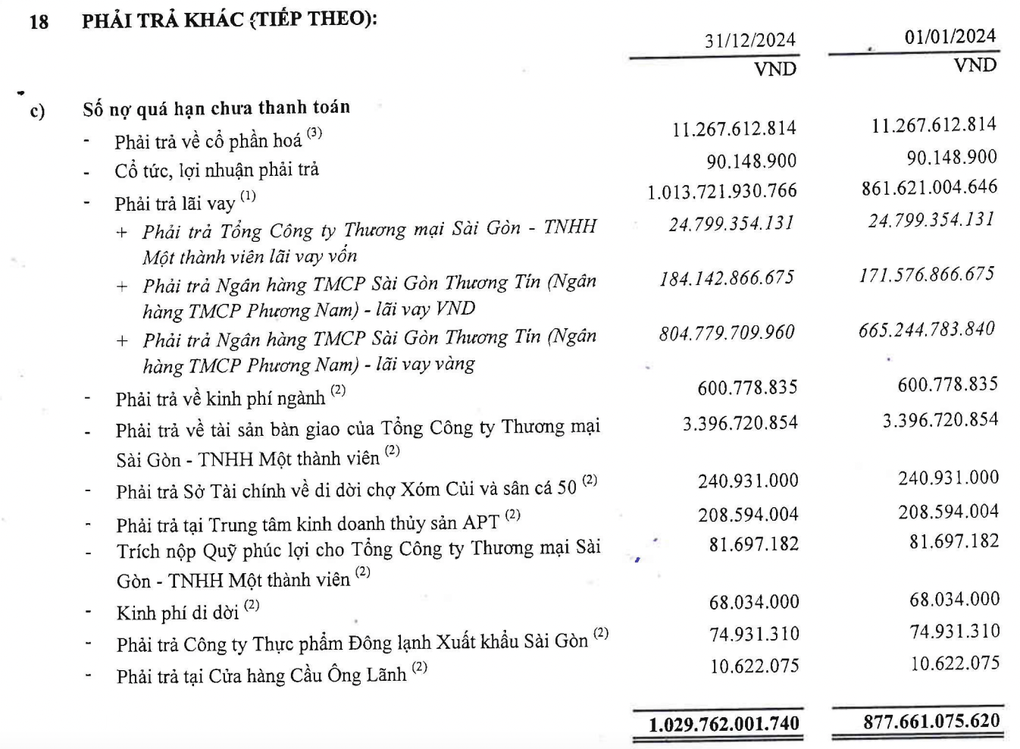

By the end of 2024, these two loans had increased to more than VND 1,583 billion (VND 594.1 billion was the principal after revaluation of the SJC gold loan debt, and nearly VND 989 billion in interest), more than 7.5 times the original outstanding debt.

Cost pressure has caused the company to continuously incur losses, although Saigon Seafood's annual revenue remains stable at around VND250-300 billion.

Cost pressure causes continuous losses, negative equity

In 2024, the company continued to lose another VND 201 billion, mainly due to financial expenses. Accordingly, the total accumulated loss by the end of the year increased to VND 1,556 billion, the current accumulated loss is 17.68 times higher than the charter capital (VND 88 billion).

As of December 31, 2024, Saigon Seafood's total assets were VND 176 billion, with negative equity of more than VND 1,466 billion. Liabilities were more than VND 1,642 billion, mainly principal and interest at Sacombank.

In 2024, the company revalued the loan of 5,833 taels of SJC gold at the listed price of the lending bank. The principal balance of the gold loan was converted to VND491 billion, equivalent to VND84.2 million/tael.

The amount of unpaid interest from Sacombank is nearly 989 billion VND, of which the interest on gold loans is 805 billion VND. The gold debt accounts for 70% of the company's total debt.

The amount of unpaid interest on Sacombank loans is nearly 989 billion VND, of which the gold loan interest is 805 billion VND.

In the 2024 audit report of the company, the auditor stated that these events indicate the existence of a material uncertainty that casts significant doubt on the company's ability to continue as a going concern. The auditor has performed the necessary audit procedures but still does not have sufficient basis to evaluate the company's financial statements prepared on the basis of the going concern assumption.

In 2025, Saigon Seafood sets a business target of 7 million USD in export turnover, 257.4 billion VND in net revenue and 6.8 billion VND in net profit (excluding losses incurred in previous years and interest payable to Sacombank).

Over the years, Sacombank has auctioned APT’s debt many times, but no investors have shown interest, even though the starting price has dropped sharply. Most recently, on April 15, 2025, Sacombank only offered a starting price of VND317 billion for all of APT’s debt - equivalent to about 1/5 of the nominal debt value.

Source: https://dantri.com.vn/kinh-doanh/doanh-nghiep-no-5833-luong-vang-sjc-tu-luc-gia-hon-17-trieu-dongluong-20250813152953863.htm

![[Photo] President Luong Cuong attends special political-artistic television show "Golden Opportunity"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/44ca13c28fa7476796f9aa3618ff74c4)

Comment (0)