- What do you think about the phone call between General Secretary To Lam and US President Donald Trump in the context of the US Government's policy of imposing a tax of up to 46% on goods imported from Vietnam?

It must be said that General Secretary To Lam had a very timely and valuable phone call, demonstrating the General Secretary's clear vision.

Firstly, the phone call demonstrates Vietnam's goodwill in investment cooperation as well as in bilateral trade between the two countries.

Second, and especially important, it contributes to creating opportunities to resolve current trade conflicts and difficulties between Vietnam and the US, and contributes to changing the new tax policy intended to be applied to Vietnam.

Before the General Secretary’s phone call, there were many opinions that Vietnam should quickly take advantage of the “golden” week to negotiate and exchange with the US so that the two sides can better understand each other in trade relations. This period of time is certainly also an opportunity that President Trump has intentionally left open to negotiate with other countries.

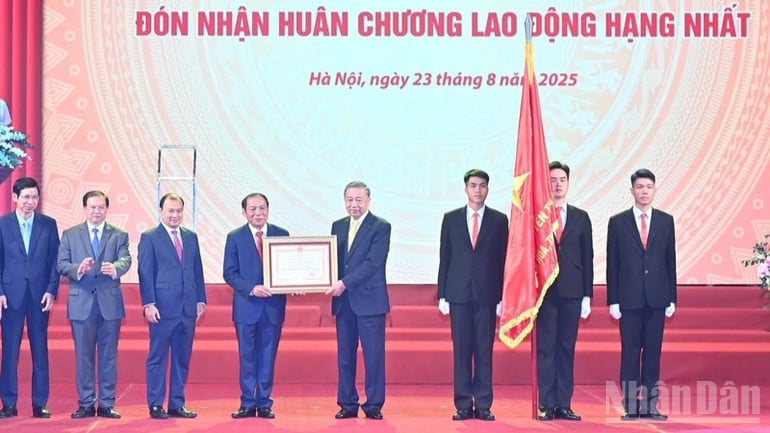

General Secretary To Lam had a phone call with President Donald Trump on the evening of April 4. (Photo: VNA)

I think that after the phone call with General Secretary To Lam, Mr. Donald Trump clearly saw the goodwill in the cooperative relationship between the two countries as a comprehensive strategic partnership and also realized that trade will help both sides develop together, not just one side. Therefore, it will be easier for both sides to sit down and negotiate with each other, thereby achieving the best results between the two countries.

- After this phone call, do you think our upcoming tariff negotiations with you will achieve better results?

I believe and expect that with Vietnam's goodwill, the US will certainly adjust the most reasonable tax policy so that the two countries can develop trade relations together.

I think the two countries will negotiate to the point where Vietnam will try to reduce import tariffs on US goods to the maximum possible level, even to zero, and the US will apply the same tax rate on imported goods from Vietnam. That way, both countries will benefit.

In addition, as we can see, the trade relationship between Vietnam and the US has developed very well over the past 30 years since the US lifted the embargo on Vietnam. In 1995, right after the US lifted the embargo, trade between Vietnam and the US was only about 450 million USD, but by 2014, this figure had reached 130 billion USD, many times higher.

Vietnam can absolutely negotiate for the US to apply a more suitable tax rate. (Illustration photo)

That proves that trade relations have brought many benefits to the two countries.

Another factor to consider is that Americans are accustomed to consuming goods from other countries in the world. If the US imposes high tariffs as planned, the prices of goods imported into the US will increase and affect American consumption, affecting the lives of people, thereby reducing spending and affecting the US economy .

It could even have a ripple effect on the global economy. This is the issue we are most concerned about, leading to a global economic slowdown and recession. And that is something that even US President Donald Trump does not want.

Therefore, in my opinion, all of the above factors combined will open a door for countries to sit down and negotiate with the US as Mr. Trump did in his first term from 2017 to 2021. Thus, Vietnam can completely negotiate for the US to apply a more appropriate tax rate.

National Assembly Delegate, Associate Professor, Dr. Tran Hoang Ngan.

- What should Vietnam do to deal with unfavorable tax situations that may occur in the near future, sir?

Up to now, I still do not believe that the US will apply this tax rate. However, we also need to quickly develop a scenario to deal with a very difficult situation.

One thing that needs to be emphasized is that the 46% tax rate expected to be imposed on Vietnam will not be a big “shock” if direct competitors are also subject to the same or higher rate.

However, the prices of countries that are direct competitors of Vietnamese goods in the US market are lower, such as Thailand 36%, Indonesia 32%, India 26%, Bangladesh 37% and Pakistan 29%. This will create disadvantages for our country's goods.

To continue to grow well in these difficult conditions, we must diversify our export markets. In addition to large markets such as the US and EU, Vietnam needs to pay attention to ASEAN, Middle East, Africa, India, etc. We must increase the use of 17 FTAs to export to those markets.

The next thing to do is to improve the quality of Vietnam's export goods, that is, increase added value, deep processing, develop supporting industries, connect foreign enterprises in the country for deep processing instead of raw exports...

At the same time, to limit external impacts, we also need to pay attention to the domestic market with more than 100 million people, because this is an attractive, active market, helping us have stability and sustainability.

In particular, we need to pay attention to e-commerce. We have seen goods from countries in the region, Chinese goods entering the market through e-commerce gateways. Why don’t we take advantage of exporting Vietnamese goods through e-commerce?

Therefore, it is necessary to have policies to support businesses, invest more in logistics, transport infrastructure, seaports, reduce transportation costs, and increase the competitiveness of Vietnamese goods in the international market.

- In your opinion, how should the Vietnamese economy change to ensure harmonious interests with other markets in the world in the future?

One of our country’s traditional growth drivers is consumer investment and exports. Therefore, if the US imposes such high tariffs, it will certainly affect Vietnam’s growth drivers.

I think that currently the items that account for a large proportion of exports to the US include: Computers, electronic products, machinery and equipment, textiles, phones, wood, footwear and even seafood... These will be the items that will be greatly affected and face competition with countries that have similar items exported to the US.

In addition, the textile, garment and footwear industries have a huge labor deficit. High tax rates will certainly affect workers and the problem of job creation and income for workers, leading to impacts on consumption and economic growth. Therefore, we need to solve this problem in the most harmonious way to realize the Prime Minister's direction of not changing the GDP growth target of 8% or more in 2025.

Thank you!

Vtcnews.vn

Source: https://vtcnews.vn/dien-dam-cua-tong-bi-thu-to-lam-voi-tong-thong-my-the-hien-tam-nhin-sang-suot-ar935959.html

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

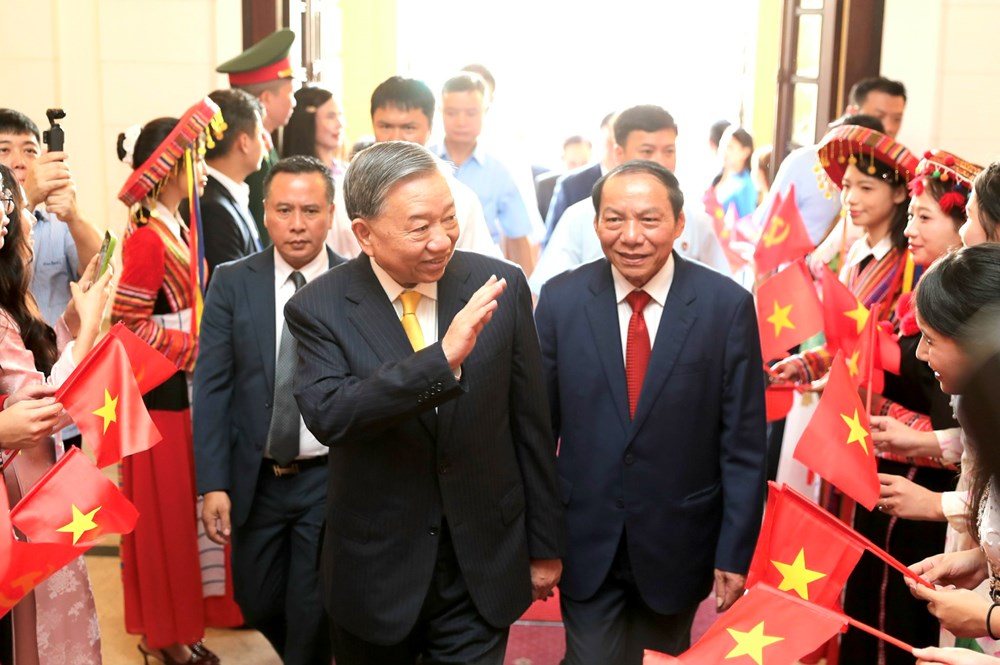

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)