|

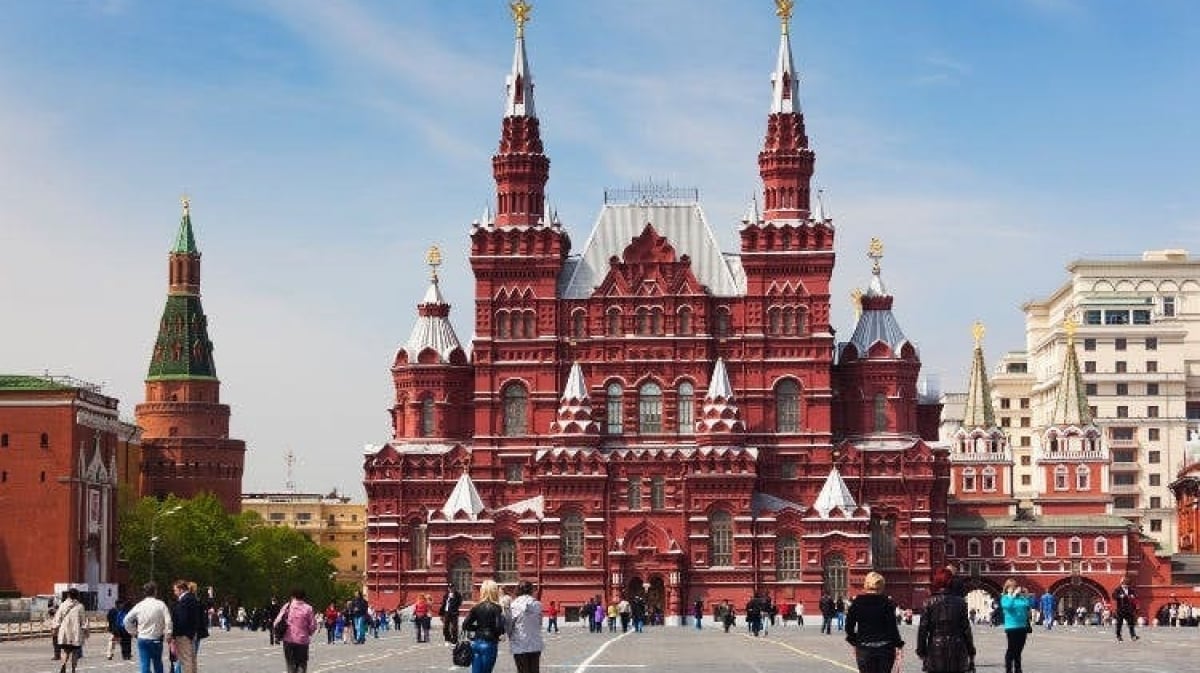

| Russia is considering banning oil exports to prevent fuel shortages in the country. (Source: Reuters) |

World economy

Global dividend value grows at record pace in Q1/2023

Companies around the world paid a record $326.7 billion in dividends to shareholders in the first quarter of 2023, led by banking, oil and auto giants, according to asset management firm Janus Henderson.

Janus Henderson’s report released on May 23 showed that global dividends in the first quarter of 2023 increased by 12% year-on-year, reaching a record high. Notably, one-time special dividends reached $28.8 billion, the second largest since the first quarter of 2014, of which US automaker Ford and German rival Volkswagen accounted for nearly a third of the total global special dividends.

The strong dividend growth in Q1/2023 is all the more impressive given that 2022 is shaping up to be a difficult year for the global economy, with high inflation, rising interest rates, geopolitical conflict and Covid-19 restrictions yet to be lifted, said Ben Lofthouse, head of global equity income at Janus Henderson.

Globally, 95% of companies increased or maintained their dividends in the first quarter of 2023, the report said, and companies are expected to pay out a total of $1.6 trillion in dividends this year. (AFP)

US economy

* Representatives of US President Joe Biden and Republican lawmakers in Congress on May 23 ended another round of negotiations on the public debt ceiling without any signs of progress , while the deadline to raise the public debt ceiling to avoid a default scenario (June 1) is approaching.

The two sides remain deeply divided over how to narrow the federal budget deficit, with Democrats arguing that high-income earners and businesses should pay more in taxes, while Republicans want to cut spending.

It is unclear whether a deal can be reached before June 1. President Biden has raised the possibility of using a constitutional provision that allows the president to raise the debt ceiling. (Reuters)

* On May 19, US Federal Reserve Chairman Jerome Powell said that tightening credit conditions due to tensions in the banking sector could help the Fed avoid having to raise interest rates too high .

Financial stability tools have helped ease bank stress, but developments in the sector are tightening credit conditions and could weigh on economic growth, employment and inflation, Mr. Powell said, so the Fed may not need to raise rates as high as expected to achieve its goals.

However, the head of the Fed also noted that this is uncertain. (TTXVN)

Chinese Economy

* China overtook Japan as the world's top auto exporter in the first quarter of 2023 , thanks to growing demand for electric vehicles and increased exports to Russia.

China's auto exports in the January-March period rose 58% from a year earlier to 1.07 million units, according to the China Association of Automobile Manufacturers.

Meanwhile, the Japan Automobile Manufacturers Association said the country exported 950,000 vehicles in the same quarter, up 6 percent from the same period last year. (Reuters)

* Chinese President Xi Jinping on May 19 announced a grand plan for Central Asia's development, from building infrastructure to boosting trade.

Speaking at the China-Central Asia Summit in Xi'an, Shaanxi Province, China, Xi Jinping said that China is willing to coordinate development strategies with Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan, and promote modernization.

Beijing will upgrade bilateral investment treaties and increase cross-border cargo volumes with Central Asia, providing these countries with 26 billion yuan ($3.8 billion) in financial support. (Reuters)

European Economy

* Reuters news agency, on May 23, quoted government and industry sources as saying that Russia is considering issuing a ban on gasoline exports , to prevent domestic fuel shortages.

The measure is expected to help curb price increases after the Russian Finance Ministry decided to reduce fuel subsidies for refineries. The government may also increase the minimum volume of gasoline required to be sold on the commodity exchange, according to sources.

The ministry plans to halve subsidies for oil refineries from July to supplement the national treasury. (TTXVN)

* International Energy Agency (IEA) Executive Director Fatih Birol said that the IEA does not expect the moves of the Group of Seven (G7) leading industrialized countries to oppose Russia's avoidance of a price ceiling (60 USD/barrel) on energy products to change the supply situation of crude oil and petroleum products.

The G7 will step up efforts to combat price-cap circumvention, while avoiding spillover effects and maintaining global energy supplies. However, the group did not provide details of the action plan.

"Any significant changes in the market will be reflected in our analysis reports but I do not see any reason to make changes in our analysis at this time," Birol said. (Reuters)

* On May 23, the National Bank of Hungary (NBH) cut its deposit rate by 100 basis points to 17%. The move marked a rate cut as inflation slowed and kicked off the first monetary policy easing cycle in Europe.

The NBH has introduced an emergency deposit rate of 18%, the highest in the EU, in October 2022 to support the Forint amid rising inflation.

The NBH is targeting inflation, which is the highest in the EU at 24%. Other central banks in central Europe, which have lower interest rates than Hungary and lower inflation, have so far kept rates steady, after a sharp increase since June 2021. (Reuters)

* According to a survey by the Ifo Institute, business confidence in Germany in May 2023 fell more than expected , raising further concerns about the risk of recession in Europe's largest economy.

A survey of 9,000 businesses showed that the business confidence index decreased from 93.4 points in April to 91.7 points in May.

Ifo President Clemens Fuest said it was the first time the index had fallen after six consecutive months of gains. Analysts polled by FactSet had expected the index to rise to 93 in May.

The Ifo survey showed managers are now more pessimistic about the current business situation and expectations for the next six months, especially in the manufacturing and trade sectors. (AFP)

* According to the latest forecast for the British economy released by the International Monetary Fund (IMF) on May 23, the country's economy could grow by about 0.4% in 2023 , partly due to "cooling" energy prices. In April 2023, the IMF predicted that the British economy would shrink by about 0.3%.

According to the IMF, the forecast change is due to falling energy prices, stable demand, concerns about the consequences of Brexit have been somewhat eased, while the financial sector has gradually stabilized after political instability and US bank failures. (Reuters)

Japanese and Korean Economy

* The Japanese government is considering increasing a portion of social insurance revenue to "advance" financial resources for solutions to cope with the current alarming decline in birth rates.

According to Japanese government officials, the additional revenue is equivalent to 500 Yen/person/month (about 3.6 USD) and will be implemented from fiscal year 2026.

A Japanese government official said that with the additional revenue included in the above social insurance, along with health insurance premiums and contributions from businesses, the government will collect about 1,000 billion Yen (about more than 7 billion USD) per year, enough to offset the "advance" funding to implement the "Plan to accelerate child care and nurturing support for the 2024-2026 period". (VNA)

|

| South Korea's expected inflation rate fell to 3.5% this May, down 0.2% from April. (Source: Flickr) |

* The Bank of Korea (BoK) said that the country's manufacturers' confidence in the economic situation increased in May 2022 due to expectations of economic recovery.

The BOK said the business survey index (BSI) for manufacturers stood at 73 in May 2023, up 3 points from the previous month. The reading reflects expectations of a recovery in earnings for major manufacturers later this year, offsetting concerns over lingering economic uncertainty.

The BSI index of non-manufacturing enterprises increased by 4 points compared to April 2023, to 78 in May 2023. Also in this month, the BSI index in all industries increased by 4 points to 76.

A reading below 100 indicates more pessimists than optimists. The survey was conducted among 1,675 manufacturers and 1,137 non-manufacturing businesses from May 9 to 16. (THX)

* On May 23, the BoK announced the results of its survey on consumer trends in May, saying that the expected inflation rate this month fell to 3.5%, down 0.2% compared to April.

According to the BoK, the reason for the decline in inflation expectations is that people still hope that domestic stagnation will ease as consumption recovers despite concerns about an economic recession. (TTXVN)

ASEAN Economy and Emerging Economies

* On May 22, Thai government spokesman Anucha Burapachaisri said that in the first four months of this year, the country exported 2.79 million tons of rice, worth 1.5 billion USD, up 23% over the same period last year.

Thailand expects rice exports to continue to increase due to growing demand in many countries, and the total rice export figure for the whole year could reach 8 million tons. Thailand is currently the world's second largest rice exporter after India. (VNA)

* On May 23, Indonesian Coordinating Minister for Economic Affairs Airlangga Hartarto held an online meeting with Australian Minister for Trade and Tourism, Senator the Hon Don Farrell , to discuss several key points on the issue of the Indo-Pacific supply chain .

This issue is currently being addressed by 14 countries within the framework of negotiations on the Indo-Pacific Economic Framework for Prosperity (IPEF) to ensure safe and resilient supply chains, minimizing disruptions and impacts on countries in the region.

At the meeting, the two ministers stressed the importance of cooperation for economic prosperity and stability in the region, and highlighted the progress made in recent rounds of IPEF negotiations. (VNA)

* Malaysia and the United Arab Emirates (UAE) have agreed to initiate negotiations on the Comprehensive Economic Partnership Agreement (Cepa) between the two countries.

Cepa is a comprehensive agreement covering trade in goods, services, investment, economic cooperation and many other areas. This agreement will contribute to promoting economic growth and creating more jobs for people in both countries.

Kuala Lumpur believes that the Malaysia-UAE Cepa agreement will enhance the special relationship between the two countries and bring great benefits to both people and businesses.

In 2022, the UAE was Malaysia's second largest trading partner in West Asia and its 17th largest trading partner, with total trade turnover reaching RM38.73 billion (US$8.79 billion). Meanwhile, Malaysia has an important geopolitical position for the UAE to participate in the Asia-Pacific market. (TTXVN)

Source

![[Photo] President Luong Cuong receives delegation of the Youth Committee of the Liberal Democratic Party of Japan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2632d7f5cf4f4a8e90ce5f5e1989194a)

![[Photo] Prime Minister Pham Minh Chinh chairs the conference to review the 2024-2025 school year and deploy tasks for the 2025-2026 school year.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2ca5ed79ce6a46a1ac7706a42cefafae)

Comment (0)