Years ago, Taiwan, South Korea, Japan and elsewhere in East Asia typically handled front-end processes in the global semiconductor industry, while Southeast Asian nations and India hosted back-end factories. Now, chip giants are starting to adjust amid tensions between the US and China.

Building a successful stepping stone model

In 2021, India approved a 760 billion rupee ($9.14 billion) program to support domestic semiconductor and display manufacturing.

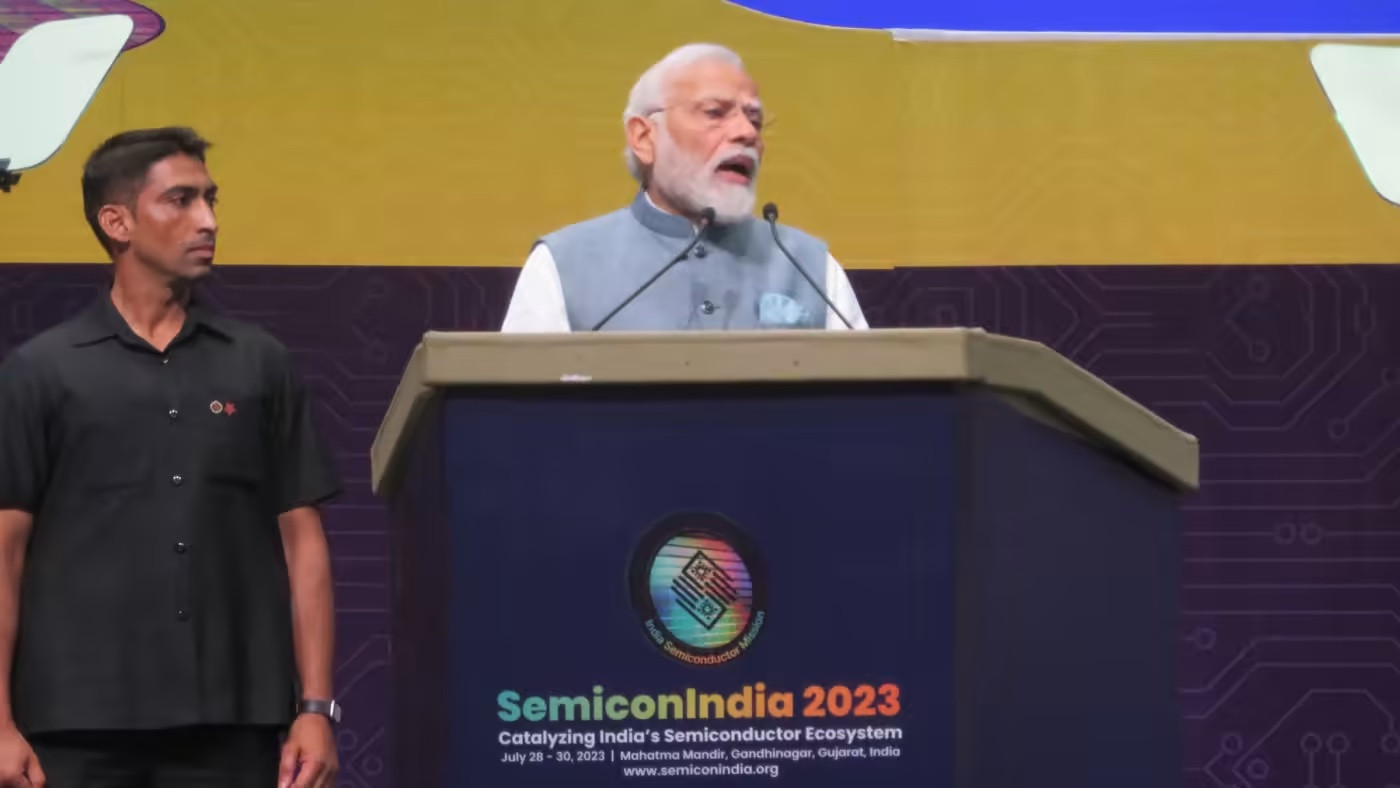

At the opening ceremony of the SemiconIndia 2023 industry event, Prime Minister Narendra Modi vowed to leverage the country's strengths to "contribute" to the global chip industry.

In June 2023, US chipmaker Micron Technology announced it was building a manufacturing plant in the Indian state of Gujarat, expected to be operational by 2024. Meanwhile, Taiwan's Hon Hai Precision Industry, or Foxconn, is reportedly partnering with US chip equipment maker Applied Materials to manufacture semiconductor machinery in the state of Karnataka.

Noboru Yoshinaga, executive vice president of Disco, a Japanese semiconductor equipment maker, said that despite concerns about the South Asian country’s infrastructure, such as its power grid, the fact that American companies are rushing to set up shop here shows that “the wind has changed direction.”

Ashwini Vaishnaw, India’s minister for electronics and information technology, said the country is planning to attract semiconductor investment and develop a local supply chain. “It is important that we have some initial successes that can be used for subsequent projects,” he said.

New Delhi has also announced a strengthening of its partnership with Tokyo, calling on companies strong in end-to-end processes and foundry equipment to invest. In July 2023, the two governments signed a memorandum of understanding to promote cooperation in the semiconductor supply chain.

Antoine Huchez, senior manager of growth strategy at US consultancy Frost & Sullivan, said that India has strong ambitions in attracting chip projects and the country has great advantages for growth.

Increase preferential tax reduction period

In Thailand, Narit Therdsteerasukdi, who oversees foreign investment policy as secretary-general of the Board of Investment, has called semiconductors one of the most important commodities today. At the same time, the government has adopted a neutral foreign policy to avoid being caught up in US-China tensions.

Bangkok has eased corporate tax breaks for chip companies. Specifically, a supply chain company entering Thailand will be exempt from corporate tax for up to 13 years, compared to the previous eight years.

Thailand is focusing heavily on attracting companies involved in back-end processes such as semiconductor design and wafer etching, which are considered more technically advanced than back-end processes such as chip cutting and packaging.

The country is also developing a local industry, bringing together electric vehicle assembly plants and component suppliers, because electric vehicles typically contain more semiconductors than gasoline-powered cars.

The "melee" to attract investment

Singapore and Malaysia are leading the way in attracting manufacturing facilities. Singapore, which has had a semiconductor industry since the 1960s, will open a $4 billion foundry by U.S. semiconductor maker GlobalFoundries in September.

The Singapore government has helped GlobalFoundries buy land and clear the site. In addition, Applied Materials and Soitec of France have also decided to expand their operating capacity in the island nation.

Looking to Malaysia, German giant Infineon Technologies announced plans to spend €5 billion ($5.45 billion) to expand its existing facilities. The investment is geared towards manufacturing next-generation silicon carbide power semiconductors. Technology giant Intel has pledged to invest $6.49 billion over 10 years through 2031 in its back-end processes in the country.

Elsewhere, Vietnam has manufacturing and research facilities for leading companies such as Samsung Electronics and Intel. In July 2023, during a working visit to Hanoi , US Treasury Secretary Janet Yellen conveyed the message that Washington wanted to cooperate closely with Vietnam in semiconductor manufacturing.

“Asia is currently witnessing a chaotic battle” to attract semiconductor businesses, said Daisuke Yokoyama, consulting director at KPMG.

(According to Nikkei Asia)

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)