The stock market session on March 13 was likened to a 'roller coaster'. At one point, the VN-Index surpassed the 1,340-point mark, but the gradually increasing selling pressure caused the index to lose more than 8 points at the close of the session.

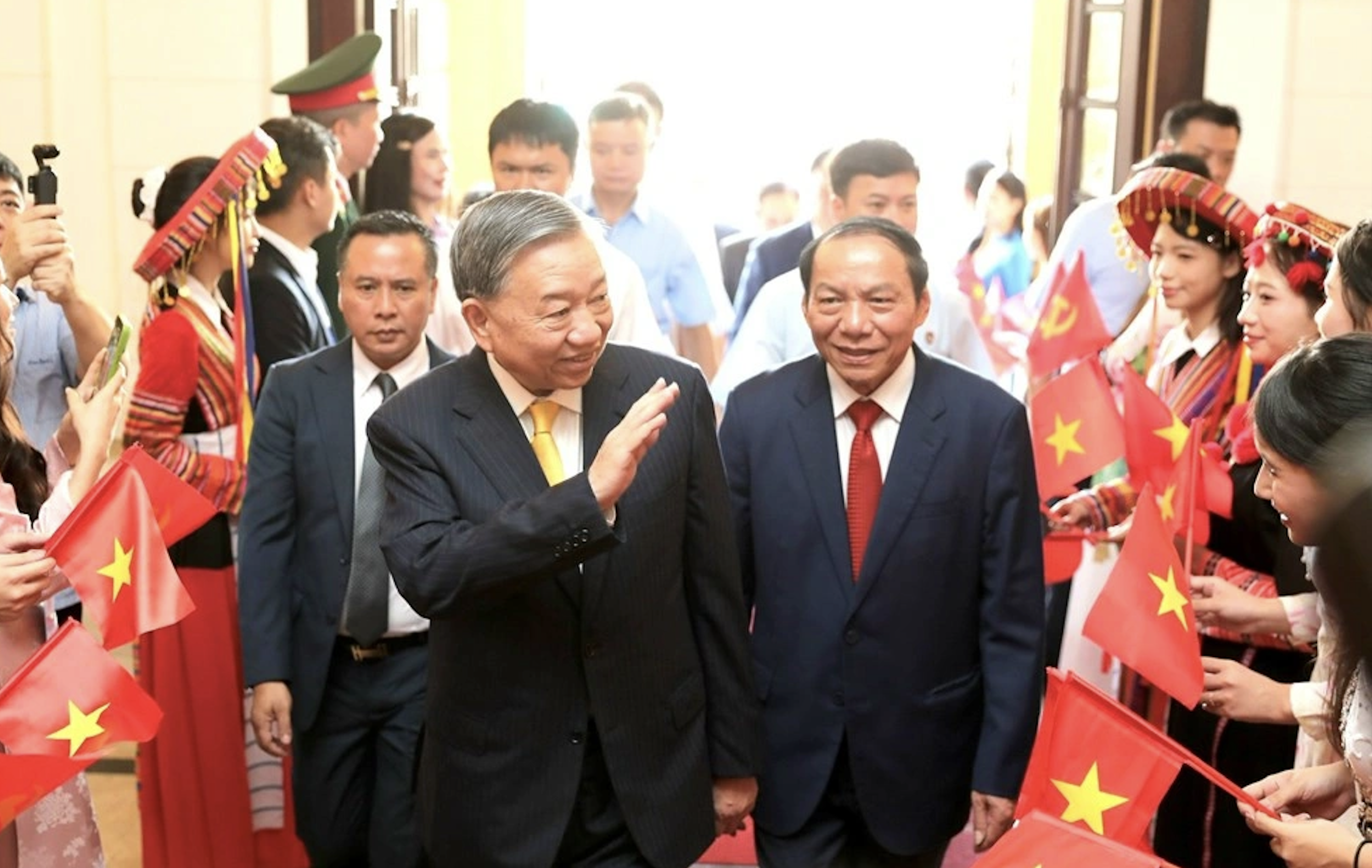

The stock market is under strong correction pressure, despite positive information from the KRX system - Photo: QUANG DINH

The index representing the Ho Chi Minh City Stock Exchange fluctuated continuously in today's session, March 13, although the strong increase in Vingroup stocks created market traction.

The main factor causing the VN-Index to decline is the decline in performance from the banking, securities, steel, and construction groups... The active selling force of this group is dominant.

In the banking group, STB decreased by 1.89%, MBB (-1.22%), TCB (-1.97%), EIB (-2.86%), BID (-1.7%), MSB (-2.15%),VIB (-0.98%), VPB (-1.79%), HDB (-2.1%), CTG (-0.8%)...

In particular, Vietcombank 's VCB also decreased by 1.8% and became the stock that pulled the VN-Index down the most.

In the securities group, a series of stocks were also under pressure to adjust by over 1% such as HCM (-1.09%), VIX (-2.01%), SHS (-2%), VCI (-1.02%)... While VND of VNDirect was one of the few cases that increased in price in the morning session, the remaining half of the session also decreased by 0.99%.

In addition, the construction group, which has long been expected to lead from the public investment sector, has just witnessed a strong correction session, in which VCG lost nearly 5.5%, CTD (-4.6%), HHV (-3.5%)...

On the contrary, the real estate group supported the index from falling deeply, notably the trio of Vingroup "family" with VIC increasing by 6.9%, VHM increasing by 1.81%, VRE increasing by 2.73%.

The group of stocks related to Mr. Pham Nhat Vuong was supported by large net buying power from foreign investors. Specifically, foreign investors net bought nearly 250 billion VND in VIC, 75 billion VND in VHM, and 68 billion VND in VRE.

Some other real estate stocks increased in price in the same direction such as NLG (+1.2%), KHG (+3.86%)... In addition, the essential consumer group (MSN, MCH, DBC, VLC) also attracted attention with strong increases in price, liquidity and active purchases.

Although green color crept into some groups, statistics on the whole market showed that 537 stocks decreased in price, while only more than 220 stocks increased in price.

Facing the strong selling momentum, the absorption demand was not "inferior". If this morning's liquidity only increased slightly compared to the same time yesterday, in the afternoon session, the market recorded a total transaction value of nearly VND 24,500 billion on HoSE. In total, the liquidity of all three floors exceeded VND 26,600 billion (more than 1 billion USD), this is the highest level in the past 5 months.

Notably, the market decline occurred despite positive information about the KRX system's operational timing as well as the market upgrade process.

In a related development, the Vietnam Securities Depository and Clearing Corporation (VSDC) has announced plans to test and deploy a new system.

Accordingly, the system testing will take place from March 17 to April 11, 2025. The official deployment will be from April 30 to May 4, and the "Go-live" day will be on May 5.

Source: https://tuoitre.vn/co-phieu-vingroup-tang-tran-la-liet-ma-khac-giam-gia-thanh-khoan-vuot-1-ti-usd-20250313152742063.htm

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)