Right from the beginning of the session on August 11, shares of Masan Group (stock code MSN) of billionaire Nguyen Dang Quang increased to the ceiling price of VND82,000/share. This purple color continued to maintain until the end of the session with a trading volume of more than 29.7 million shares and no sellers. Masan shares were purple in the first session of the week when the VN-Index hit a new peak at 1,596.86 points after increasing by 11.91 points. At one point in the session, the VN-Index even reached the threshold of 1,600 points despite the profit-taking selling volume sometimes overwhelming the buying volume.

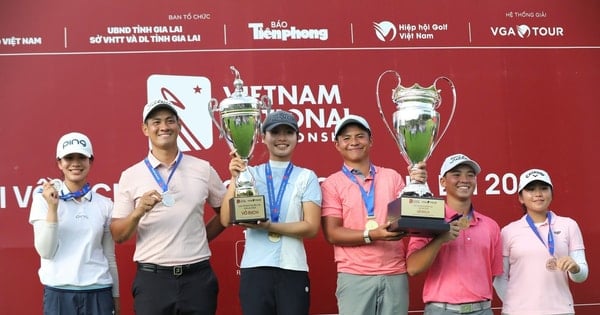

Billionaire Nguyen Dang Quang's MSN shares turned purple in the session when VN-Index set a new record.

PHOTO: MSN

Masan is also the only stock in the VN30 basket on the HOSE that increased by the full margin. In addition to Masan, in the VN30 basket, the code GVR of the Vietnam Rubber Industry Group also increased to the ceiling price at the end of the session. Meanwhile, the banking group was differentiated when many stocks such as ACB, BID, MBB,SHB , VCB... still increased, while other stocks such as TCB, STB, CTG, HDB... turned down. Industry groups were also differentiated, such as the oil and gas, fertilizer and chemical groups with BSR, PLX, DPM, DCM, DGC... closing in red. However, green still dominated.

In this session, many codes in the public investment and construction sectors increased such as CII, CTD, DID, HHV, G36, HTI... Cash flow from the end of last week until now has shown signs of focusing on midcap stocks such as VIX, PDR, CII, GEX, VND, DIG, NVL... These codes all have high liquidity and continuously increase prices.

On the Hanoi Stock Exchange, the HNX-Index also closed up 4 points to 276.46 points. Liquidity of many stocks also increased. The total market value reached more than 51,000 billion VND, down more than 8% compared to the last session of last week.

Stock investor sentiment remains positive as most listed companies recorded profit growth in the second quarter of 2025. According to statistics from SSI Research, total revenue in the second quarter of 2025 recorded a modest growth of 6.9% over the same period while profit after tax attributable to parent company shareholders increased sharply by 31.5% - far exceeding the 20.9% increase in the first quarter of 2025. Sectors with results exceeding expectations include retail, fertilizer, utilities, banking and industrial parks. In contrast, some sectors such as food and beverage (F&B) and some housing real estate stocks recorded lower-than-expected results. Seven stocks VIC, NVL, VGI, HHS, HVN, PGV and VIX - accounting for 6.7% of total market profit and 14.4% of capitalization - contributed to about 50% of the absolute profit growth in Q2/2025. Excluding the impact from this group of stocks, the profit growth of the whole market in Q2/2025 would be 14.8%. Banks continued to be the main growth driver, contributing 44% of total market profit after tax and 28% to the growth in market profit after tax. This was followed by real estate (8%, contributing 20% of growth) and utilities (7%, contributing 12% of growth).

Source: https://thanhnien.vn/co-phieu-ti-phu-nguyen-dang-quang-tim-lim-gop-phan-dua-vn-index-lan-dau-cham-1600diem-185250811153845189.htm

![[Photo] Prime Minister Pham Minh Chinh chairs the conference to review the 2024-2025 school year and deploy tasks for the 2025-2026 school year.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2ca5ed79ce6a46a1ac7706a42cefafae)

![[Photo] President Luong Cuong receives delegation of the Youth Committee of the Liberal Democratic Party of Japan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/2632d7f5cf4f4a8e90ce5f5e1989194a)

Comment (0)