What is non-term savings?

Non-term savings is a method of saving money without being bound by a deposit term and amount, with a variable interest rate. Customers can flexibly withdraw money or close their accounts, without having to wait for maturity, while still ensuring safety and increasing profits.

Benefits of non-term savings

Saving without a term brings many benefits such as relatively high interest rates, flexibility, safety, and easy management. However, you need to consider carefully before deciding to deposit money and learn carefully about the conditions and interest rates of the corresponding bank or financial institution to make the smartest investment decision.

Customers can increase good profits by making non-term savings deposits. (Illustration photo)

Interest rates: Non-term savings usually have relatively good interest rates, but they will be lower than other savings accounts such as term savings or certificates of deposit.

Flexible: Demand savings allow customers to withdraw money at any time without having to pay fees or lose interest like other savings accounts.

Safety: Money is protected and guaranteed safe when deposited in a non-term savings account.

Easy to manage: Savings without a term is an easy way to manage finances. Customers can view their money and track the accumulated profits.

No deposit limit: Unlike term savings, non-term savings have no deposit limit. Customers can deposit any amount that suits their financial capacity.

Suitable for many customers: Non-term savings are suitable for many different customers, including individuals and businesses. This helps people to deposit money into their savings accounts to accumulate.

Interest rate on non-term savings

Interest rates on non-term savings are usually determined by banks and may vary from bank to bank. However, these interest rates are usually lower than term savings, due to the flexibility and convenience of the product.

The specific interest rate depends on the interest rate policy of each bank. Normally, banks will announce the interest rate of term savings periodically, and you need to follow up to get updated information. Checking and choosing a bank with attractive interest rates will help you maximize the benefits of non-term savings.

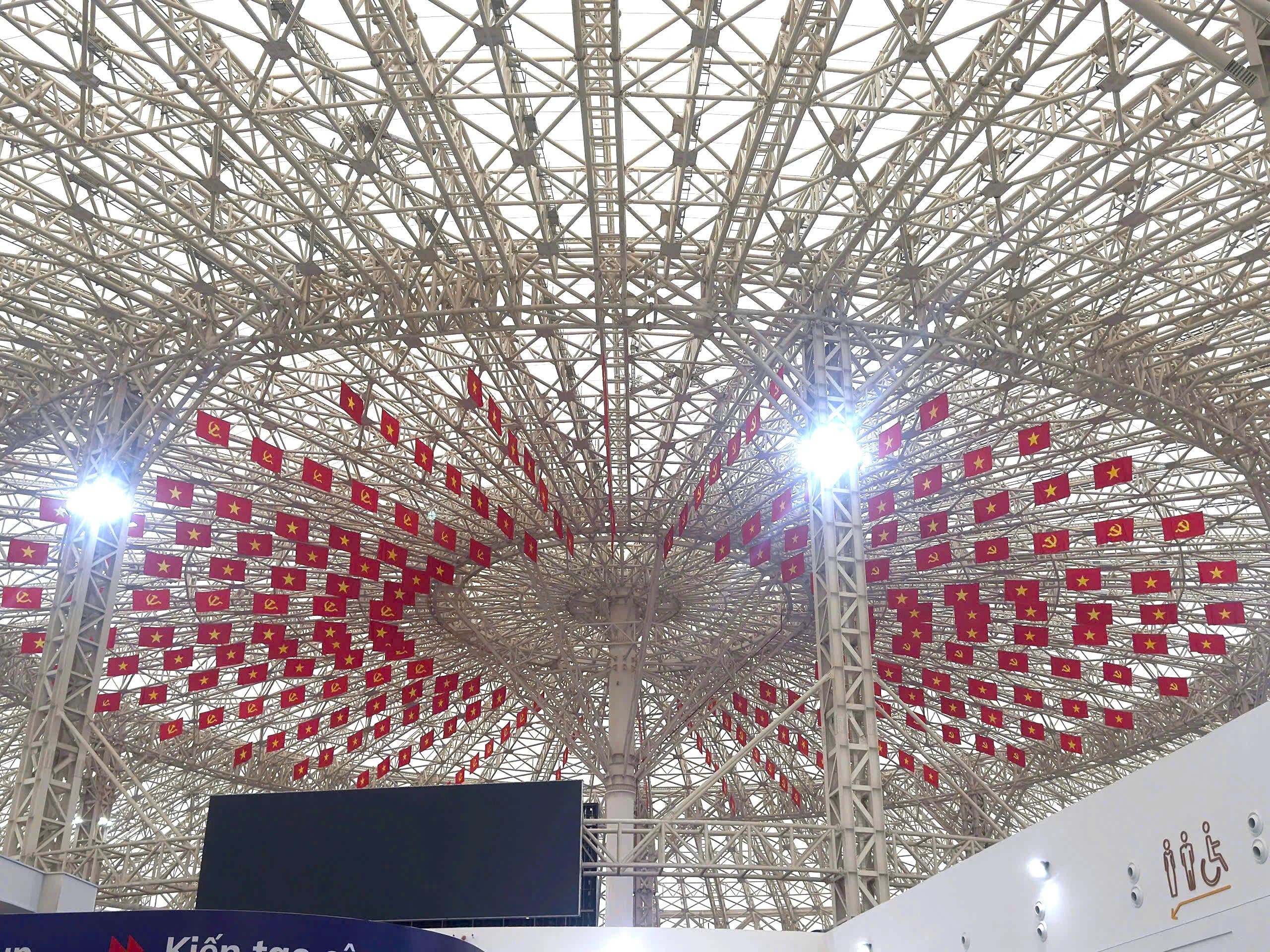

Non-term savings is a flexible form of savings.

The formula for calculating non-term interest depends on the interest calculation method of each bank or financial institution. However, the general calculation method is to use the formula:

Interest = Deposit amount x Interest rate x Number of deposit days/365

In which, the deposit amount is the amount that the customer deposits into the savings account. The interest rate is the interest rate applied according to the bank's regulations. The number of deposit days is the deposit period from the date the customer deposits to the date the customer withdraws or closes the account.

Each bank or financial institution may apply different interest calculation methods, so you should carefully refer to the information about interest rates and interest calculation methods of the bank or financial institution before depositing money.

Should I deposit savings without term?

Whether or not to deposit a savings account without a term depends on each person's financial situation and needs. However, below are some tips to help you decide whether or not to deposit a savings account without a term.

No specific spending plans in the near future: If you don't have specific spending plans in the near future, you may want to keep money in a demand account to use in case of emergency, such as home repairs, unexpected medical expenses, or simply to save for larger future spending plans.

Plan for a short-term purchase: Holding a portion of your money in a savings account can help you prepare for that expense without incurring the cost of borrowing money.

When the market is down: When the stock market or real estate market is down, the value of investments can decline. In this case, holding money in a demand deposit account can be a safer option to minimize risk and wait for investment opportunities.

Ganoderma (Synthesis)

Useful

Emotion

Creative

Unique

Wrath

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)