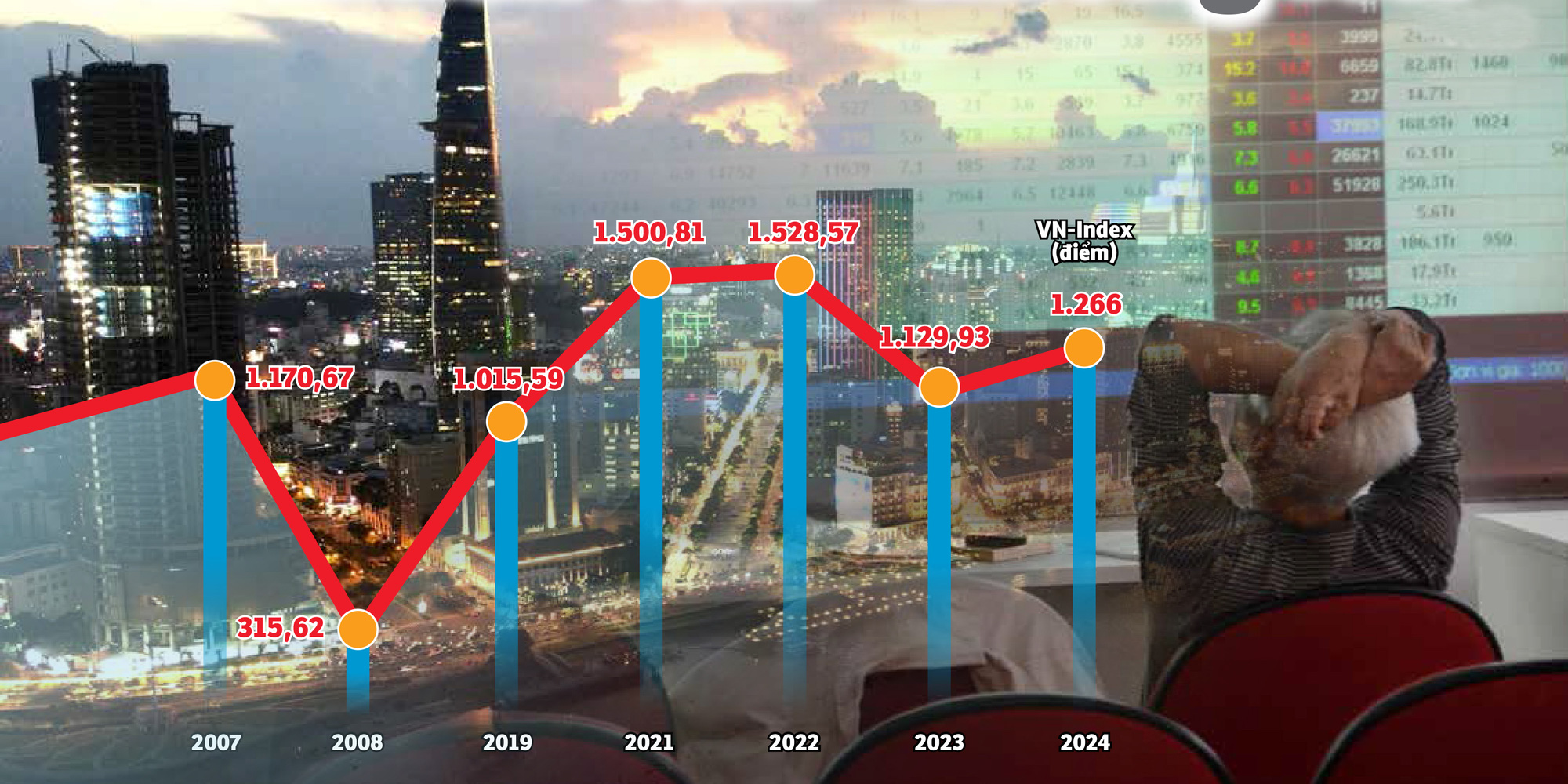

Vietnam is an economy with impressive growth rates in the world, but for many years the stock market has been sluggish, the VN-Index has been hovering around 1,200 points, even missing opportunities to 'upgrade' (a measure to attract foreign capital).

The VN-Index has hovered around 1,200 points for nearly 20 years - Graphics: N.KH. - Photo: TTD

Speaking with Tuoi Tre, Mr. Dominic Scriven, chairman of Dragon Capital - the largest foreign fund in Vietnam, said that unlike many markets, Vietnamese stocks lack new, interesting, and convincing factors to attract the attention of foreign investors.

Domestic investors are looking at the VN-Index, the index representing the largest stock exchange in Vietnam, still "standing still" after nearly two decades, making many people "disgusted".

When the index "hovered"

Regarding the concern about why Vietnam's stock market is "slow to develop", Mr. Nguyen Quang Thuan, chairman of Fiingroup - a company providing financial information and credit rating services, mentioned the story of VN-Index "hovering" around 1,200 points.

Mr. Thuan said that during a conference on the stock market in Singapore, chaired by the leader of the Vietnamese securities management agency, many people asked: "Why has the VN-Index been hovering around 1,200 points for nearly 20 years?".

This question has also been a question of many people inside and outside the industry.

To reiterate, VN-Index once approached the 1,200 mark in 2007. After the global financial crisis, the score gradually "fell".

By the end of 2021, after the COVID-19 pandemic, the VN-Index surpassed the 1,500 point threshold for the first time, setting a new record.

At that time, everyone invested in stocks, everyone played and talked about stocks from coffee shops to family meals.

But a year later, the index fell sharply with many massive sell-off sessions. Up to now, VN-Index is still trading in the "1.2xx" zone despite high economic growth that has surprised foreign organizations.

If the stock market is considered a "thermometer" of the economy, but when GDP is booming, the largest stock exchange index in Vietnam still has difficulty trying to surpass the old peak, let alone set a new mark.

Over the past 20 years, the economy has grown impressively, GDP has increased dozens of times, but VN-Index is still struggling at 1,200 points - Synthesis: B.KHÁNH - Graphics: N.KH.

Many reasons

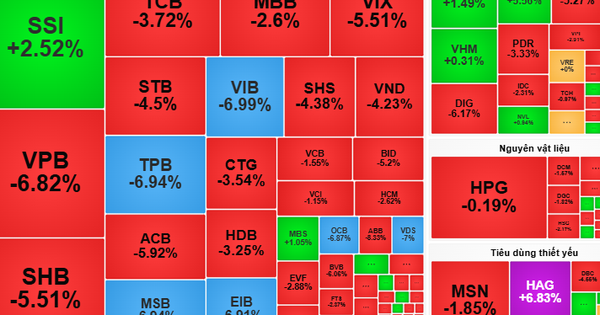

Experts pointed out that the VN-Index has not yet broken out due to strong fluctuations in the market when individual investors still dominate with more than 90% and this group is very susceptible to psychological impacts.

In addition, the unfinished upgrade story, the scarcity of new quality supply, and the lack of new financial products... are limitations that make it difficult for the market to make a sustainable breakthrough as expected.

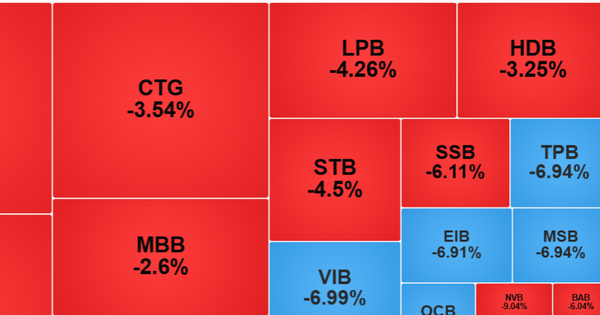

Mr. Nguyen Hoang Giang, chairman of DNSE Securities, pointed out that in the capitalization structure of VN-Index, the finance, banking, and real estate groups alone account for about 60%, and at times it was up to 70 - 80%.

This is also showing quite close to the market valuation of large-cap groups such as banks and real estate.

"If the stock basket had more stocks from FDI enterprises, I think the recent score story would be different," Mr. Giang said.

This comment may be related to the US market as their Index has many technology and semiconductor stocks.

Stocks of Nvidia, Apple, Meta, Alphabet... all surpassed all-time highs. When the potential of this industry is good, the US stock index surpasses one peak after another.

While the artificial intelligence (AI) "fever" reshapes the US stock market, Vietnam is still stuck in the same old industry group.

Mr. Vu Duy Khanh, director of analysis at Smart Invest Securities, said: "The market needs to have attractive dynamics, many quality goods, and new products to attract both domestic and foreign capital.

Meanwhile, we are lacking both: there are only a few old products around, the number of businesses listed in recent years can be counted on the fingers, good products are full of foreign "room", there are no new products to trade", Mr. Khanh analyzed and said that if the quality of goods and products cannot be improved, foreign capital flows into Vietnam will hardly be vibrant even when upgraded.

According to Mr. Huynh Hoang Phuong - asset management consultant of FIDT (a company specializing in asset management and investment consulting services), many large stocks in Vietnam have a phenomenon of "changing stars", in other words, there are stocks that increase very strongly and then "fade" and other stocks take their place.

The index not increasing is also a consequence of many "big guys" declining. For example, the case of Hoang Anh Gia Lai shares in the previous cycle, or recently the FLC and Novaland groups... This further shows that the quality of listed companies in Vietnam is uneven.

Attracting capital, especially capital from foreign investors, is an important factor for the economy to have more growth momentum - Photo: B.MAI

How to get the cash flow back?

Mr. Dominic Scriven, chairman of Dragon Capital - a foreign fund managing about 5.5 billion USD and having invested in about 100 listed Vietnamese enterprises, told Tuoi Tre that to increase the attractiveness of the Vietnamese market, the important thing to do is to increase new goods, new products and upgrade the market.

At the same time, he hopes that the transfer of technology to new information technology systems and the application of central clearing mechanisms will be promoted.

Agreeing, domestic experts also said that being upgraded to a market status is just like a "ticket" to enter the market, whether or not trading is possible depends on the products and goods.

From there, Mr. Nguyen Quang Thuan proposed to promote the reduction of state ownership in companies and industries where the state does not need to own or control.

Observing in recent years, equitization has "stagnated", the number of newly listed enterprises in the private sector can be "counted on the fingers", the market increasingly lacks the motivation to surpass new milestones in terms of scores.

In addition, Mr. Thuan said that it is necessary to encourage businesses on UPCoM to move to a listed floor and improve or review listing standards or for companies to strengthen corporate governance and transparency.

In addition to bringing in new products from state divestment sources, Mr. Phan Dung Khanh, investment consulting director of Maybank Securities Company, added the need to promote the development of technology companies.

As the technology industry with the theme of AI and semiconductors becomes a trend attracting capital flows from investors around the world, the shortage of stocks of this group of businesses makes the Vietnamese stock market less attractive.

However, the addition of this industry group is considered quite "deadlocked", because the number of Vietnamese AI and semiconductor enterprises is already absent, and there are no companies to "list".

Same score but different liquidity and capitalization

Mr. Huynh Hoang Phuong, FIDT's asset management consultant, noted: We need to look at it more fairly. Although the index is adjusted to the same 1,200-point mark when more stocks are listed, the total market capitalization is much larger, dozens of times larger, at the same point mark.

In addition, the current period has seen the number of securities investor accounts increase more than 20 times, and liquidity increase more than 20 times compared to the period in 2007. In fact, many Vietnamese stocks have grown very well in recent times, only the index has been held back by some "big guys" who have expired.

"Can't increase anymore"!

Looking back at 2017 data, foreign investors made a record net purchase in the history of the Vietnamese stock market with a value of more than 2 billion USD in stocks, bonds, and fund certificates, 8 times higher than the net purchase value in 2016.

Net purchases with large values continued in 2018 and 2019. The explosion in net foreign purchase value is the result of simplifying documents and promoting state capital divestment in enterprises with potential and good business results such as Sabeco, Vinamilk...

The leader of a securities company in Ho Chi Minh City commented that the recent stock market "waves" are mainly speculative in nature following monetary policy, with the main driving force being record low deposit interest rates, the cheap money effect, and recently signals of monetary policy easing from the Fed. These factors have been fully reflected in the market price, so now "it cannot increase anymore" due to the lack of story and motivation.

"What the market needs most is goods. But the roadmap to list Agribank, MobiFone, TKV, VNPT... is still "quiet". For example, VNPT also planned to IPO at the end of 2019 with 35% of shares offered to investors, but this plan has not seen any progress so far," the leader wondered.

The names that are still waiting for you

Around the middle of this year, SCIC also announced the sale of capital with many notable names listed on the stock exchange such as FPT, Thieu Nien Tien Phong Plastic Joint Stock Company (NTP)...

Many investors had high expectations for this news because for a long time there had not been any notable state divestment deals.

However, the securities company leader said: As scheduled, there have been similar announcements in recent years, and up to now, state capital is still in many enterprises that the State should no longer need to hold...

There are also some other names on SCIC's divestment list, but they are less attractive because of ineffective business, small scale, and old industry groups. Meanwhile, in the private group, big names are not listed on the stock exchange or there are corporations that only list a few subsidiaries.

However, when asked about solutions to promote equitization and divestment, the company leader acknowledged that it was "very difficult" because there was a fear of pressure and responsibility when implementing, especially for businesses with land funds.

Not to mention that in many state-owned enterprises, issues such as documents and records for capital contribution using land use rights and capital contribution using assets on land also encounter many difficulties.

"The issue of slow equitization and divestment of enterprises has been raised many times and has lasted for many years but it remains the same. Now there is no way but determination and drastic action is needed," the leader emphasized.

Consultant for customers at SSI Securities Corporation (HCMC) - Photo: TTD

The rate of individual investors is too high, lacking financial products

According to data from Fiingroup, banking, securities and real estate groups are in the top 3 groups of stocks traded the most by individual investors due to their high liquidity and short-term "wave-making" ability.

However, according to Mr. Bui Van Huy - Director of Ho Chi Minh City branch of DSC Securities Company, with the group of banking stocks, the market is focusing on the expiration date of Circular 02 at the end of this year.

It is possible that there will be attempts to "beautify" the books, but many items will not be able to be hidden, thereby affecting the bank's profits or bad debts in the fourth quarter of 2024 and the whole year of 2025.

As for real estate stocks, we cannot expect a rebound as the recovery rate of businesses in this industry is still a question.

Meanwhile, the high proportion of individual investors can be considered a characteristic of the Vietnamese market, accounting for nearly 90% of daily transactions.

"The obvious characteristic of this group is that they invest according to the crowd, are easily influenced by psychology, rumors and trends," said Mr. Huynh Hoang Phuong, asset management consultant of FIDT (a company specializing in asset management and investment consulting services), when talking about the reason for the sideways index.

In terms of long-term direction, this expert believes that the Vietnamese capital market is moving towards a structure with a larger proportion of investors and organizations, with openness in considering opening new fund management companies, developing new types of funds, new products...

Not only the lack of quality new products, the lack of financial products is also a bottleneck in the Vietnamese market. Derivative products up to now on the stock market only include VN30 futures contracts, "short selling" has not been applied.

Regarding this issue, at the recent summary conference, the Vietnam Stock Exchange said it has researched and improved stock index sets and developed VN100 index futures products.

Rectify the quality of existing goods

Expecting new products, but also not forgetting to rectify the quality of existing products. Mr. Nguyen Quang Thuan - Chairman of Fiingroup - also believes that it is necessary to continue improving the quality of existing products on the market by upgrading standards in the information disclosure stage. Mr. Thuan cited that in the past, many businesses explained the fluctuations in business results without getting to the core, or business leaders announced information to the public but kept it anonymous.

"Therefore, it is necessary to strengthen the control of transactions by the board of directors, for example, consider limiting the phenomenon of announcing information about buying/selling shares but not implementing it even though the market price is lower/higher than the expected purchase/sale price," Mr. Thuan proposed.

Missed many "upgrade trains", who is responsible?

Data shows that since the beginning of 2024, foreign investors have net sold nearly VND95,000 billion in the Vietnamese stock market, much higher than the VND22,000 billion last year. Looking back at the history of some markets, before being upgraded to emerging markets, they often increased in price and attracted foreign capital.

Mr. Bui Van Huy - Director of Ho Chi Minh City branch of DSC Securities - said that upgrading is still a big topic to stimulate cash flow into securities next year.

According to Mr. Huy, FTSE Russell has placed Vietnam on the watch list for upgrading from a frontier market to secondary emerging since September 2018.

Another stock expert said that after 7 years, the market and investors are "looking forward to" but are gradually getting used to the "disappointment". As in the assessment in September, Vietnam has not been added to the list of countries to be considered for upgrading from a frontier market to an emerging market.

However, this information does not reflect too negatively on the stock market in the following session, because there are still knots that have not been resolved or have been untied but are in the process of being experienced.

In a recent working session of the Securities Commission, FTSE Russell affirmed that Vietnam has met 7/9 criteria for upgrading. The two criteria that need to be improved are removing the requirement for foreign investors to deposit funds before trading (non-prefunding) and handling failed transactions (failed trade management).

Regarding the non-prefunding criteria, the Ministry of Finance has issued Circular 68 with the important content of removing the mandatory deposit requirement for foreign investors. Circular 68 takes effect from November 2, 2024.

With the criterion of failed trade management, the solution applies the central clearing mechanism (CPP). However, the CPP model is associated with the function of the new information technology system (KRX), but up to now, KRX is still "silent".

At the current pace, many parties agree that it will be September next year at the earliest before Vietnamese stocks can be listed on the secondary emerging market by FTSE Russell.

While the VN-Index hovers around 1,200 points, foreign investors have been "diligently" withdrawing capital from stocks, showing that there is still much work to be done to develop Vietnam's capital market - Photo: BM

New trading system: waiting forever for it to go live!

Regarding KRX, at the conference to summarize and deploy tasks for 2025 of the Vietnam Stock Exchange (VNX) that recently took place, the leaders of the State Securities Commission proposed that HoSE and related units put KRX into operation in 2025.

Speaking to Tuoi Tre, the deputy general director of a securities company said that the new securities trading system KRX has been repeatedly announced and then postponed, greatly affecting the confidence of the market and investors over the past years.

"The KRX project was signed by HoSE with the Korean Stock Exchange in 2012. It has been 12 years and still has not been launched.

In the most recent time, the management agency completed the final testing in March 2024 to be ready for deployment in early May 2024, but it was eventually postponed," the leader complained.

According to this person, the new trading system has "missed its deadline" many times. "If it continues to be delayed, many investors will worry about the quality, safety and ability to respond to this system after being behind schedule for a decade," the deputy general director emphasized.

Source: https://tuoitre.vn/chung-khoan-viet-nam-can-them-hang-moi-chat-luong-cho-dong-luc-tu-nang-hang-20241219092514505.htm

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)